This post was originally published on this site

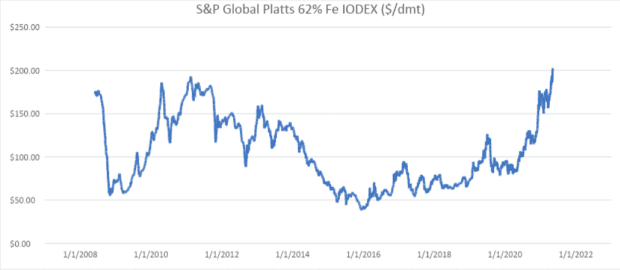

Iron ore logged its highest price on record Thursday, buoyed by insatiable demand for steel in China.

The benchmark S&P Global Platts IODEX, the spot price of 62% iron- fines delivered to China, was assessed at a record high of $202.65 per dry metric ton on Thursday. It trades up by about 27% from the Dec. 31 price, according to data from S&P Global Platts.

“Appetite for steel has been far beyond expectations as China returned to work [Thursday], helping iron ore fly past this historic milestone,” said Julien Hall, director of Asia metals price reporting at S&P Global Platts, in emailed commentary. The Chinese market was on holiday for Labor Day from May 1 through 5.

“May is considered peak construction season,” and with steelmakers’ profit margins now between $150 to $200 per metric ton, “they’re keen to produce as much as they can, regardless of the price of ore,” said Hall.

On the CME, the most-active May futures contract for 62% iron-ore fines delivered to China

TIOK21,

also settled at record $190.41 per metric ton on Wednesday to trade up over 22% year to date, according to Dow Jones Market Data. Prices were on track to notch a fresh high Thursday.

Prices for iron ore have been rallying over the past year, said John Kartsonas, a managing partner at Breakwave Advisors, the adviser for the Breakwave Dry Bulk Shipping exchange-traded fund

BDRY,

the best-performing ETF so far this year with a rise of 206%, according to Dow Jones Market Data.

Brazil, which is a major producer and exporter of iron ore, has been slow in ramping up production following a deadly accident in 2019, he said, in an email interview. That’s led to the world “running tight on iron ore.”

He also said China’s steel demand rose considerably last year as infrastructure spending increased. “With steel prices at all-time highs boosting the margins of steel mills, iron ore has been very strong.”

June U.S. Midwest domestic hot-rolled coil steel, meanwhile, settled at an all-time high of $1,573 per short ton Wednesday to trade over 63% higher this year. It was headed for a fresh record Thursday.

“Iron is experiencing a perfect storm at the moment, Beijing’s environmental constraints are having a two-pronged impact on prices,” Stuart Burns, editor at large for metals-analysis provider MetalMiner, told MarketWatch.

S&P Global Platts

On the one hand, emissions controls are favoring the use of high purity iron ore, of which there is constrained or limited supply,” he said. “On the other, perceptions of restrictions is boosting prices and hence steel output — up 16% so far this year —resulting in increased imports of iron ore.”

“Steel mill margins are strong so there is little incentive to push back on miners’ price levels, even if steel mills had the leverage to do so,” said Burns.

Looking ahead, there may be “some resistance to ever rising steel prices, particularly as Beijing’s efforts to bear down on debt growth begin to bear fruit,” he said.

Read: Here’s why the global reflation trade can survive China’s credit slowdown

In the second half of the year, “softer demand should see some easing in steel prices and hence downward pressure on iron ore prices…but we doubt it will be dramatic, ” Burns said. “Elevated iron ore prices appear set to be maintained for the rest of this year.”