This post was originally published on this site

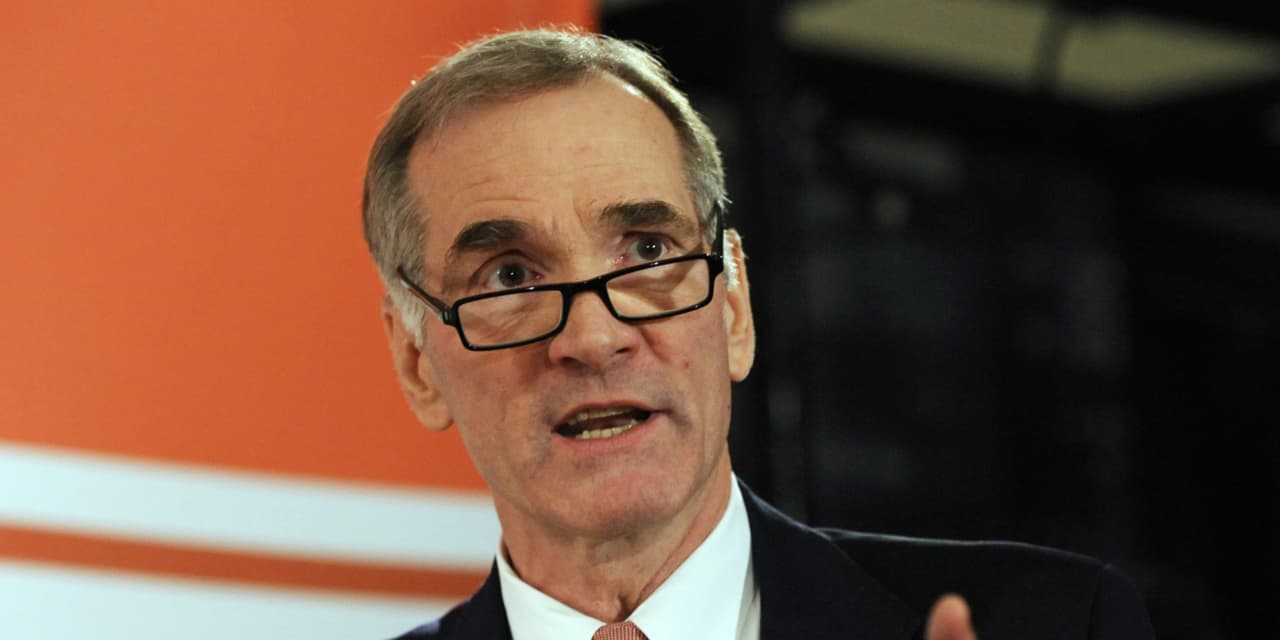

Yale University’s chief investment officer David Swensen, a legend in the world of institutional investing, has died after a long battle with cancer.

The Ivy League school’s president, Peter Salovey, announced Thursday that Swensen, 67, died Wednesday evening. “David’s ideas reverberated beyond Yale as he revolutionized the landscape of institutional investing,” Salovey said in his statement remembering the CIO’s innovative approach to managing the school’s endowment.

“He was a real inspiration to all of us,” Mark Yusko, chief executive and CIO of Morgan Creek Capital Management, said in a phone interview Thursday. Before founding Morgan Creek, Yusko was the CIO of the endowment investment office of the University of North Carolina at Chapel Hill, and a senior investment director for the University of Notre Dame.

Swensen’s contributions to his alma mater and investment management “really are immeasurable,” said Yusko. “He was an independent thinker,” with the courage to take unconventional risks in order to succeed when most of the crowd would rather fail conventionally than take such a chance, Yusko added, noting it’s a thread of thought that Swensen pulled from the economist John Maynard Keynes.

Swensen, who earned a Ph.D. in economics from Yale in 1980 and worked on Wall Street, is famous for developing what is known as the “Yale Model.” The investing approach embraced riskier alternative assets such as hedge funds, private equity and venture capital, and became a model used by many other university endowments and foundations.

“With his guidance, Yale’s endowment yielded returns that established him as a legend among institutional investors,” Salovey said.

While Swensen didn’t invent the endowment model, “he brought that model to the masses with his writing and leadership,” said Yusko. “He urged the people who worked with him to strike out and become CIOs at other universities. That impact will be felt for decades to come.”

Swensen was not his formal mentor, but Yusko said he read a lot about what he did and interacted with him while at Notre Dame as well as with his team many times over the years. “One of the things that I did take away from him,” said Yusko, is that “innovation is an asset class” that can separate great investors from the rest.

Swensen, who worked for Salomon Brothers and Lehman Brothers before returning to Yale in 1985 to lead its investments office, lectured over the years at Yale College and the School of Management, according to the university statement.

“He made the endowment billions,” said Edward Hirs, a Yale alum who teaches economics at the University of Houston, in a phone interview Thursday. “Yale was the home of portfolio diversification.”

Hirs, who studied economics at Yale’s School of Management, said he got to know Swensen in the mid-to-late 1980s. Swensen recognized that “endowments live on past the lifespan of the manager,” and was an early mover in making longer-term bets on alternative assets such as private equity, real estate and natural resources, all in pursuit of bigger gains, said Hirs.

But Swensen also brought his critical analysis to the stock market, willing to wade into precarious situations on the conviction of his financial models, he said.

In one anecdote that Hirs said he recalls Swensen recounting at an alumni gathering, the Yale investment chief spotted an investment opportunity in the stock market crash of 1987. Swensen approached the university president at the time about going long in a big way in the futures market. Swensen would get the green light to overload the endowment with equity exposure to benefit from a market rebound, which did follow, but left the office seeing evidence of his own perspiration on the floor, according to Hirs’s recollection of Swensen’s anecdote.

That spoke as much to his courage as his rigorous work. Hirs said he admired “his willingness to adhere to his investment plan” during such a tumultuous time, as well as his commitment to Yale when he could have earned much more on Wall Street.

Yusko also appreciated Swensen’s character.

“He was an individual of great integrity,” said Yusko. “He didn’t cut corners.”

In a Twitter post Thursday morning, Yale finance professor William Goetzmann said Swensen “left a remarkable legacy: a distinctive investment model anchored in humanism, and a commitment to sharing his knowledge.”