This post was originally published on this site

Economists at Guggenheim Investments, like the Federal Reserve, think today’s skyrocketing lumber prices and shortages of essential parts, materials and labor likely won’t last long enough to spark runaway inflation.

“Supply chain disruptions are widespread in everything from semiconductors to lumber, contributing to fears that higher inflation is on the way,” wrote economists Brian Smedley and Matt Bush in a Monday note.

“These disruptions are being exacerbated by surging demand as the economy reopens and fiscal policy provides a strong tailwind for consumption,” they said.

But the economists also expect soaring prices for some key materials, including the lurch in lumber prices

LBK21,

LB00,

to more than $1,200 per 1,000 board feet from less than $200 a few months ago, to ease once capacity begins to pick up at sawmills, factories and manufacturers later this year.

“While these supply issues may be a near-term challenge, investors need to realize that these types of price pressures, typical in an economic rebound, are more like one-off adjustments than the kind of sustained inflation that would prompt the Federal Reserve (Fed) to react,” they said.

See: Lumber and steel markets look to Biden’s infrastructure plan for their next big boost

That echoes Federal Reserve Chairman Jerome Powell, who last week dismissed signs of inflation pressures in some parts of the economy as largely the result of “transitory factors,” such as supply bottlenecks and a surge in pent-up spending.

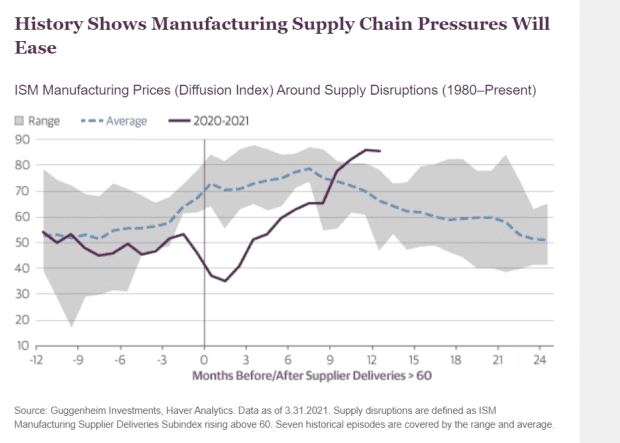

To underscore their point, the Guggenhiem economists examined how short-lived the effects of supply-chain disruptions have been since the 1980s.

Supply-chain bottlenecks haven’t lasted in the past

Guggenheim Investments

Referring to the chart above, they noted that “higher prices from supply bottlenecks in the manufacturing sector are typically short-lived,” the team wrote, adding the inflation pressures also likely will be dampened by high prices and an improvement in the COVID situation by year end.

All that likely means the Fed might struggle to overshoot its 2% inflation target as part of its recovery strategy, without “sustained inflationary pressure” coming from the large services sector,” the team wrote.

Read: Copper prices post highest finish in more than 9 years

U.S. stocks, including the Dow Jones Industrial Average

DJIA,

and S&P 500 index

SPX,

traded higher Monday, despite a gauge of manufacturing activity that rose, but came in short of analysts’ expectations, amid supply-chain logjams and soaring prices.