This post was originally published on this site

(Updates story with closing prices through April 30, President Biden’s 100th day in office.)

Joe Biden has had a spectacular run — especially in the stock market. Friday was his his 100th day in office.

During the new president’s first 100 days in office, the Dow Jones Industrial Average

DJIA,

rose 8.6% and the S&P 500 Index

SPX,

advanced 8.5%.

Best performers in the S&P 500

Here are the 20 stocks among the S&P 500 that have had the highest total returns (with dividends reinvested) since Biden took office Jan. 20. There’s a second column showing returns since Election Day (Nov. 3, 2020):

Those are excellent returns. From the close Nov. 3, the S&P 500 was up 24.1% through April 30.

At the close on Election Day, the S&P 500 had bounced back 51% from its coronavirus pandemic closing low on March 23, 2020. But it was up only 4% for 2020.

So some of the companies on this list have to be considered recovery plays, especially retailers such as Gap Inc.

GPS,

and L Brands Inc.

LB,

Nasdaq-100

The Nasdaq Composite Index

COMP,

rose 3.8% during Biden’s first 100 days in office. The Nasdaq-100 Index

NDX,

which includes the largest 100 non-financial companies in the full Nasdaq, was up 4.2%. This index is tracked by the Invesco QQQ Trust ETF

QQQ,

Here are the 20 best performers among the Nasdaq-100 during Biden’s first 100 days in office:

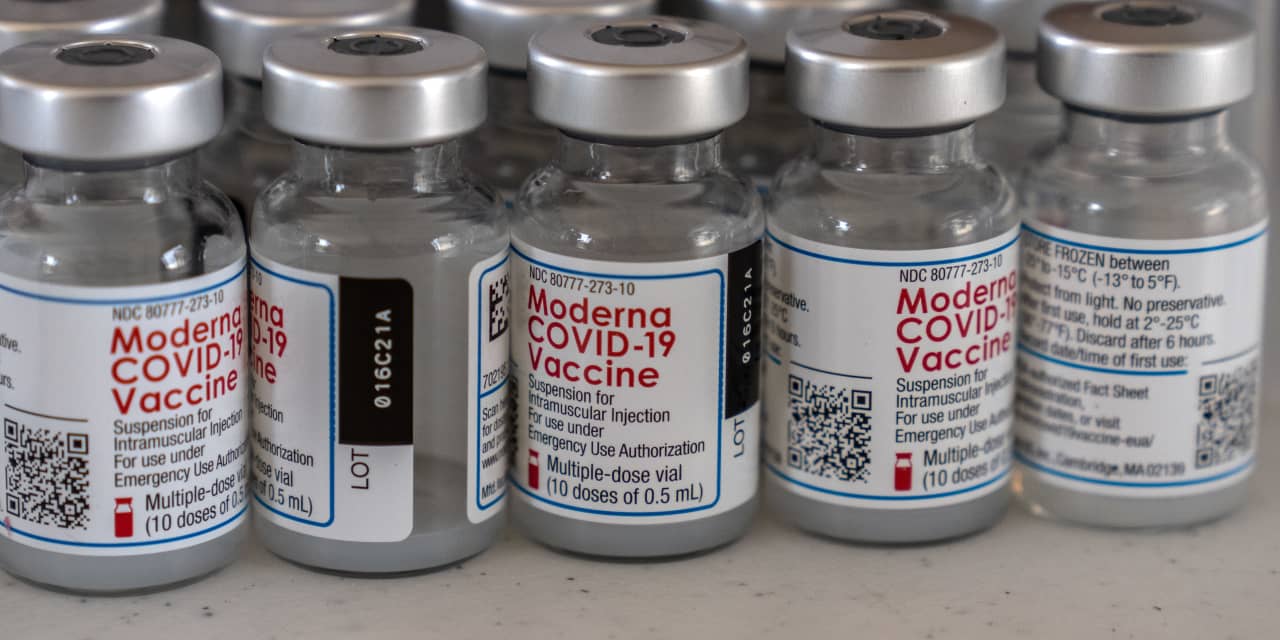

So Moderna Inc.

MRNA,

takes the Nasdaq-100 prize for Biden’s first 100 days. The Covid-19 vaccine developer’s stock is up 159% since Election Day.

In case you are wondering, shares of Tesla Inc.

TSLA,

fell 17% during Biden’s first 100 days in office, for the fifth-worst performance in the Nasdaq-100. The worst performer in the Nasdaq-100 during Biden’s first 100 days was Peloton Interactive Inc.

PTON,

which was down 37%.

Don’t miss: Have you held any of these 20 stocks long term? Your current dividend yield might surprise you