This post was originally published on this site

U.S. stocks are set for another day on the back of the bull market, with futures pointing up amid a corporate earnings season that keeps wowing investors.

But another day of the S&P 500 rising isn’t new: The index is up a staggering 42% over the last year and more than 11% in 2021 alone.

Our call of the day, from strategist Vincent Deluard at broker StoneX, takes a close look at the big question hovering above these recent market gains. Are we seeing a new roaring economic cycle that started in March 2020, or “the spectacular apotheosis of a decade plus-long expansion and overvalued bull market”?

The strategist uses “the duck test” — which follows from the saying, “if it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck.” His conclusion isn’t good news for stocks.

Deluard points out that the level of stock gains we are seeing now is unprecedented, with one exception: the Great Depression. After passing 4,000 points for the first time this month, the S&P 500 is on track to soon double its COVID-19 pandemic low of 2,237 points 14 months ago.

There have been 12 major bear markets in the last century, according to Deluard, and stock prices never doubled in the ensuing rally after five of them. In the seven cases where stock prices in the post-bear market doubled, it took an average of four years.

“There is only one precedent in history for such a rapid doubling, when U.S. stocks doubled between June and September 1932,” Deluard says. “A 40% correction quickly followed, and then another 100% + rally in a confusing sequence of brutal bear markets and dazzling rebounds which lasted until the battle of Stalingrad turned the fate of World War II.”

Another troubling sign is that the recent, spectacular rebound in corporate earnings amid the wider economic recovery from the pandemic hasn’t led to a rise in share buybacks, which are still 30% below pre-pandemic levels, according to Deluard. “As a result, the total shareholder yield (buybacks & dividend divided by market cap) of U.S. large-caps is at its lowest level in a generation,” Deluard says.

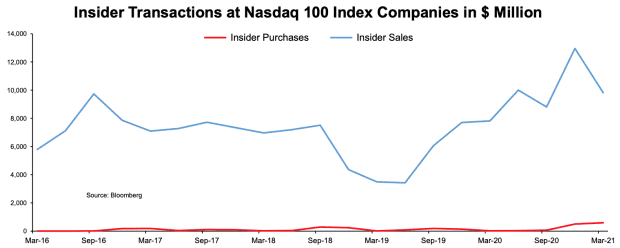

Further to that, individual investors have been throwing money at the market while insiders are getting out. An unprecedented $105 billion flowed into U.S. equity exchange-traded funds in the last eight weeks, Deluard says. Meanwhile, the strategist says equity offerings raised a record $262 billion in the first quarter and Nasdaq insiders sold $41.5 billion in the past three quarters.

Chart via StoneX.

The strategist also points to inflation as a worrying sign. He believes the argument that COVID-19 is distorting inflation is flawed, and that the current level of inflation, such as in commodity prices, represents more than normalization from the pandemic shock.

The last point Deluard makes is that banks’ loan-to-deposit ratio has collapsed to 50%, which is half of its pre-2007 levels. This is a red flag for “trapped kinetic energy” that will be unleashed by steeper yield curves, stronger demand for loans, and other factors, according to the strategist. Deluard notes that the big four banks would need to issue an additional $2.1 trillion in loans to return to the pre-pandemic loan-to-deposit ratio average.

“Inflation is the 800-pound gorilla that will kill this aging bull,” Deluard says.

The chart

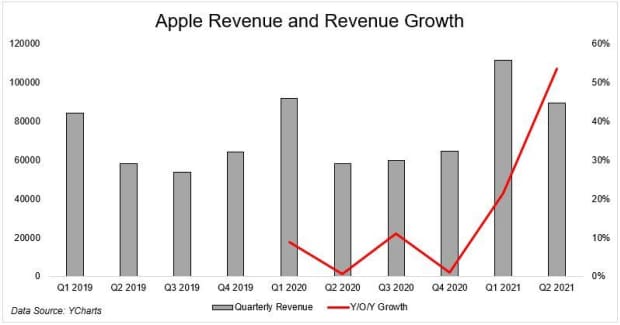

Chart via Irrelevant Investor blog.

Apple is smashing it. The world’s largest company by market capitalization reported earnings on Wednesday, revealing a whopping $89 billion-plus in quarterly revenue — the most ever in the quarter and 54% more than in the same period last year.

Our chart of the day, courtesy of Michael Batnick of the Irrelevant Investor blog, shows just how astonishing the recent revenue growth is.

The buzz

Shares in Finnish telecom Nokia

NOKIA,

— an individual investor favorite — jumped 9% on Thursday, after the group reported a “strong start” to the year in first-quarter earnings that smashed analyst predictions.

On the U.S. economic front, advance estimates of gross domestic product in the first quarter of 2021 shows the U.S. economy grew 6.4%. Meanwhile, 553,000 Americans filed for unemployment last week, less than the 566,000 in the week prior but more than the 528,000 expected. There were 3.66 million continuing jobless claims in the week of April 17.

In case you missed it, Federal Reserve Chair Jerome Powell said the central bank will stick to its strategy of boosting the economy with ultralow interest rates until the economy strengthens even further and COVID-19 cases fall sharply.

Canadian chip maker Alphawave confirmed plans to raise $500 million next month through an initial public offering in London with a targeted valuation of $4.5 billion. The group builds chips that facilitate high-speed and high-volume data connectivity, and is an unusual example of a North American company crossing the Atlantic to float.

Automobile giant Ford

F,

rounded out a busy day of earnings on Wednesday — jockeying for attention against device maker Apple

AAPL,

social-media platform Facebook

FB,

and music streamer Spotify

SPOT,

— by reporting one of its best quarters on record. But the stock fell in extended trading, as Ford warned the global chip shortage could bring a $2.5 billion hit to its bottom line this year.

The markets

U.S. stocks were pushing ahead

DJIA,

SPX,

with the exception of the tech-heavy Nasdaq

COMP,

amid strong corporate earnings and an upbeat mood on the economy.

European equities finished the day strong

UKX,

DAX,

as investors reacted to strong earnings from Nokia, Unilever

ULVR,

and Royal Dutch Shell

RDSA,

among others, while Asian stocks

NIK,

SHCOMP,

ended the day in the green.

Random reads

Thin Mints, fast: A Google

GOOGL,

affiliate is using drones to deliver Girl Scout cookies to some Virginia doorsteps.

Buyer’s remorse for the ages: Teen accidentally moves into retirement village after signing lease after only viewing property online

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.