This post was originally published on this site

How many ways can you say “holding pattern.”

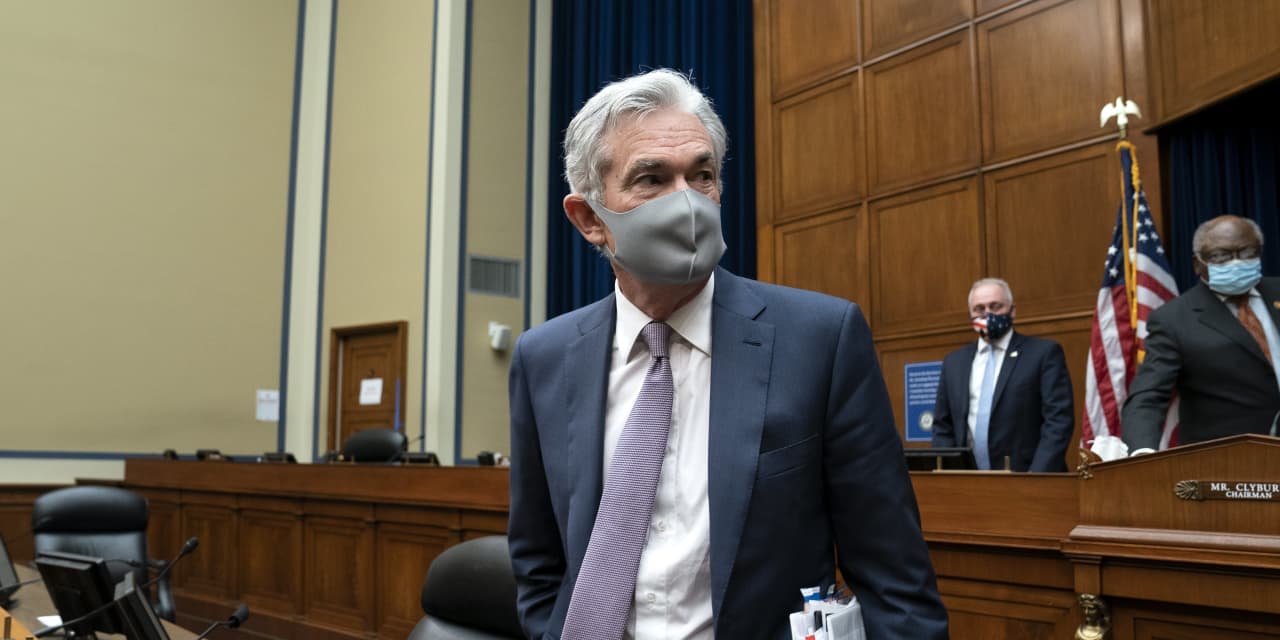

Federal Reserve officials are expected to stay the course at the end of their two-day policy meeting on Wednesday.

In the words of Fed Chairman Jerome Powell, the central bank is still “not thinking about thinking about” pulling back from its easy monetary policy stance even though there are signs the economy is booming.

The Fed has made clear it wants to react to hard data rather than to these “signs” of a boom.

The Fed’s policy interest rate remains close to zero. In addition, the Fed is buying $120 billion of assets per month to support the economy. The first step to remove this accommodation will be for the Fed to “taper” these purchases.

Economists think a decision to taper is months away although a minority think the Fed might start discussing the issue in June. Fed officials have said they want to see “substantial further progress” in meeting their goals of full employment and 2% inflation before tapering.

Fed officials want to see inflation move above their 2% target for some time and don’t think the economy will overheat. They think spikes in consumer prices during the recovery in the economy will be transitory.

“The Fed put a lot of effort after the March FOMC meeting into convincing bond investors that it was not thinking about changing its views of low inflation and low policy rates through 2023,” said Steve Englander, head of North America macro strategy at Standard Chartered Bank.

The persistent messaging has worked, some analysts said.

Read: Debt markets getting the memo on the path of likely Fed rate hikes

Kathy Bostjancic, chief U.S. financial economist at Oxford Economics, thinks long-term interest rates will resume their ascent in coming weeks. She forecasts a gradual rise in 10-year Treasury yields

BX:TMUBMUSD10Y

to 1.9% by year-end.

Fed officials will release a policy statement at 2 p.m. Eastern, followed by a press conference by Powell at 2:30 p.m. Eastern.

Here’s a look at what economists and investors will be watching for when the Fed meeting ends.

Optimism

Economists think Powell will have to be more optimistic about the outlook. After all, economists see strong GDP growth in the next two quarters and expect the April unemployment report next week will show another strong gain in jobs.

“Powell is likely to continue his subtle shift in tone about the outlook in a more optimistic direction,” building on his comment on “60 Minutes” that the economy seems to be at an inflection point, said Matthew Luzzetti, chief U.S. economist at Deutsche Bank.

But Powell is likely to stress caution about the ongoing health crisis and that the economy is still about 8.5 million jobs short of pre-COVID levels.

Inflation

Powell is likely to face many questions about inflation and former Treasury Secretary Larry Summers’ argument that fiscal stimulus is pushing the economy to grow too fast. “There has been a few hints here or there from Fed officials saying that they are aware inflation could start heating up earlier and they are prepared to address that if that happens, but its not part of the central message yet,” said Avery Shenfeld, chief economist of CIBC World Markets.

Economists think that the Fed is also holding policy steady because it is concerned the coronavirus pandemic is not over and think Powell may stress this point more clearly.

Pandemic risks

“We think that Powell will validate our view that there is defacto a pandemic test as well as the declared macro test for taking the next steps in policy and policy communication,” said Krishna Guha, vice chairman of Evercore ISI.

“Powell is likely to stress that while vaccination progress is encouraging, adverse global virus developments and vaccine hesitancy means the U.S. is not out of the woods yet in terms of pandemic risks,” Guha added.

U.S. stocks

DJIA,

SPX,

were set to open slightly lower as investors awaited the conclusion of the Fed policy meeting.