This post was originally published on this site

President Joe Biden unveiled the American Families Plan on Wednesday, a $1.8 trillion proposal that calls for spending on education initiatives, childcare and tax cuts and credits aimed at middle and low-income Americans.

To help pay for it, Biden proposed increasing taxes on wealthy Americans and boosting funding to the Internal Revenue Service to help the agency collect the upwards of $1 trillion taxes the IRS commissioner estimates go unpaid every year.

The proposal will dedicate $80 billion over ten years for this purpose, or $8 billion per year to an agency that spent $11.5 billion last year. The White House expects this investment will raise $700 billion over ten years, nearly half the entire price tag of the American Families Plan.

Read more: Here’s what’s in Biden’s $1.8 trillion ‘American Families Plan’

While this may sound like the perennial pledges politicians make to pay for proposals by cutting “waste, fraud and abuse,” many observers of the U.S. tax system argue that the IRS has been underfunded for years and that spending more on enforcement can yield significant returns on investment.

“Our analysis of IRS data show the enormous impact of budget cuts at the agency,” wrote Susan Long, director of the Transactional Records Access Clearinghouse at Syracuse University, in an email. “The IRS is recovering only a fraction of the unpaid taxes it recovered less than a decade ago, even though there are more millionaires than ever.”

According to the Congressional Budget Office, appropriations to the IRS have fallen by about 20% between 2010 and 2020, when adjusting for inflation, and that has led to the number of IRS revenue agents being cut from 14,749 in in 2010 to 8,350 last year.

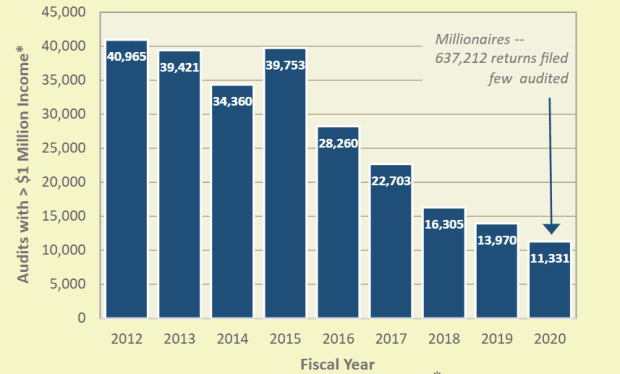

These cuts have led to the number of millionaires being audited by the IRS to fall 72% during that time, according to an analysis published Tuesday by TRAC.

In 2012, audits of millionaires led to $4.8 billion in new revenue for the federal government, but that number fell to $1.2 billion in 2020, according to TRAC data.

“With 98 percent of millionaires escaping any scrutiny, fewer audits in all likelihood means many millionaires escape paying billions of dollars owed the U.S. Treasury,” the report reads.

Some would even argue that the White House is being conservative in its estimates of the revenue the proposal would generate. Larry Summers, the economist and former treasury secretary, penned a study with Natasha Sarin of the University of Pennsylvania Law School that estimated that “with feasible changes to policy,” the IRS could expect to generate $1.1 trillion more in new revenue over ten years. Summers and Sarin derived the figure by estimating a compliance rate derived from data on past audits and applying that to unaudited returns.

Garrett Watson, senior policy analyst at the Tax Foundation, told MarketWatch that the Biden administration’s success in collecting owed revenue will come down to execution. “There are many ways you could not use the money effectively,” he said, but noted that its plan to require banks to provide more information about their customers’ account flows would likely yield valuable information, while costing the federal government little.

Watson also warned that increased tax enforcement without an effort to simplify the tax code could lead to inefficient spending. “Some of this gap is due to evasion, but a lot is due to misunderstanding of the tax code because it’s so complicated, especially for independent contractors,” he said. Simplifying the code would be “complimentary to the effort — it lets the IRS focus on the people who are deliberately evading taxes.”

The Congressional Budget Office is less optimistic about the potential of new investments in the IRS, estimating in 2020 that a $40 billion increase in the IRS’ budget would yield just $103 billion in new revenue, or $63 billion net of new expenses. The CBO’s more conservative estimate is derived by factoring in things like “taxpayers learning,” and the difficulty the agency could have in finding qualified employees to hire for additional audits.

“After the third year of an initiative, CBO judges that taxpayers will have adapted to a new enforcement activity and developed ways to evade that enforcement,” according to a July 2020 report from the office. “Enough qualified new enforcement employees each year would become more difficult, and training less-qualified employees might involve more time and spending.”

Larry Kudlow, who served as director of former President Donald Trump’s National Economic Council, was also skeptical of the Biden administration’s estimates in an article published Wednesday in the New York Sun. “Team Biden expects to raise $780 billion dollars in new tax revenues,” he wrote. “Believe me, folks, they won’t get half of that. They might not even get a third.”

Meanwhile, John Koskinen, former head of the IRS under President Obama told the New York Times that the $80 billion proposal is unnecessarily generous. “I’m not sure you’d be able to efficiently use that much money,” he said. “That’s a lot of money.”