This post was originally published on this site

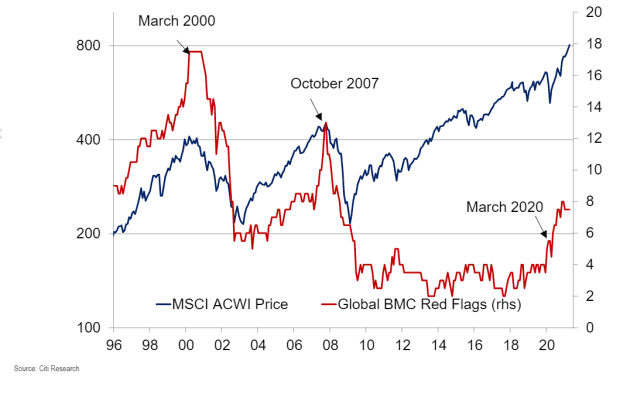

Citi maintains a grouping of 18 different indicators meant to flag a bear market — and the latest update isn’t suggesting it is time to sell.

The checklist, notably, didn’t predict the 2020 COVID-19 pandemic-induced drawdown, but it did rise ahead of the 2000 dot-com bursting of the bubble, and the 2008-09 financial crisis.

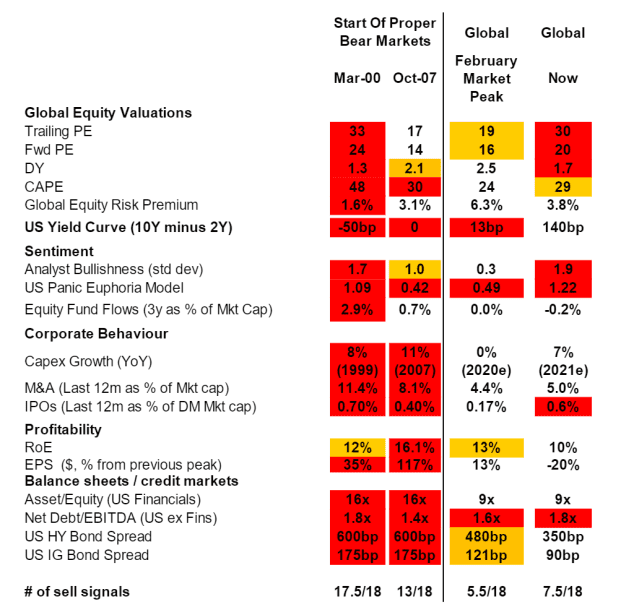

The Citi team led by Mert Genc found that stock-market focused indicators — like valuations and initial public offering activity — are showing signs of late-cycle excess. “It’s not hard to find signs of excess in global equity markets right now,” said Genc.

But other measures on the checklist, including corporate profitability and the yield curve, are consistent with an early cycle.

The overall index registers a 7.5 out of 18 — and the bank recommends buying dips when the index is below 10.

The team found bear-market checklists in emerging markets (seven out of 18) and Europe (six out of 18) also were far from indicating an imminent downturn.

The S&P 500

SPX,

on Monday recorded its 24th record high of the year, and has climbed 87% from the March 2020 lows.