This post was originally published on this site

Investors frantic over the bill left by the pandemic may not have much to fear if this one indicator is anything to go by.

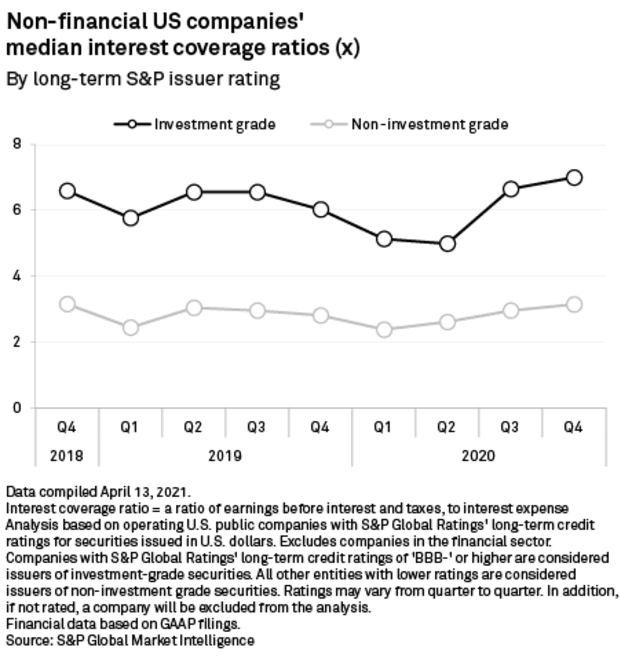

The ability of U.S. companies to shoulder their interest payments rose to its highest level in two years in the fourth quarter of 2020 based on a key metric, according to a report out Monday from S&P Global Market Intelligence.

Questions about sustainability of high debt loads come amid concerns how corporate America will pay the bills incurred by the COVID-19 pandemic.

S&P’s analysis tracked the interest coverage ratio, a measure of how many times over a business’ earnings, before interest and tax, can cover their cost of debt. Investment-grade companies’ interest coverage ratio recovered to 7 times their pretax earnings, up from a low of 5 times in the second half of last year, even as investment-grade rated companies issued a record $1.687 trillion of bonds in 2020.

And company balance sheets may continue to stay on the mend as earnings improve this year. Profits have grown around 34% in the first-quarter of 2021 for the S&P 500 companies which have reported so far.

Large U.S. corporations took advantage of the Federal Reserve’s extraordinary response to backstop capital markets last year, tapping credit lines and borrowing as much as they could to see through the sudden shriveling of cash flows and revenues caused by countrywide lockdowns and safety concerns around the coronavirus.

Investment-grade companies, in particular, benefited from the easy lending conditions last year, locking down borrowing costs at ultra-low rates.

The sharp rebound in earnings have helped power equities to new heights this year, with the S&P 500

SPX,

on track to end at an all-time high on Monday. The broad-based equity benchmark was up 11.5% for the year to date, at last check.

See: U.S. mounting debt load caps room for Fed interest rate rises, says analyst