This post was originally published on this site

General Electric Co. is scheduled to report first-quarter results before Tuesday’s opening bell, and there may be some concern that investors are set up to be disappointed, given that the industrial conglomerate’s stock has been rising even as analyst expectations have been falling.

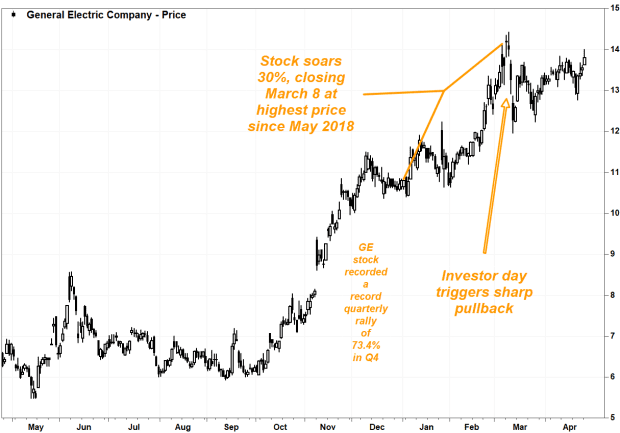

A similar dynamic had occurred ahead of GE’s much-anticipated investors day on March 10, as the stock

GE,

tumbled 12.4% in two days despite the company announcing a $30 billion deal to combine its aircraft leasing business with AerCap Holdings NV

AER,

and provided guidance that was mostly in line with expectations. Some analysts suggested the post-investor day selloff was a result of investors being too bullish, as the stock had run up 30% in the year to date ahead of the meeting, and closed at a near 3-year high two days before the meeting.

Since the industrial conglomerate reported fourth-quarter results on Jan. 26, the FactSet consensus for earnings per share (EPS) has dropped 67% and for revenue has fallen 5.1%, with estimates for three of GE’s four business units declining. Meanwhile, the outlook for industrial free cash flow (FCF) is now more than four-times more negative than it was three months ago.

And yet GE’s stock, which rose 1.9% in midday trading Monday, has climbed 22.2% since the end of January. In comparison, the SPDR Industrial Select Sector exchange-traded fund

XLI,

has advanced 16.7% since the end of January and the S&P 500 index

SPX,

has gained 8.7%.

FactSet, MarketWatch

As an example of the difference in the outlook for earnings and the stock, UBS analyst Markus Mittermaier recently raised his stock price target to $17 from $15, citing an acceleration of the transformation into a “simpler” company, but trimmed his first-quarter EPS estimate to 2 cents from 3 cents, and cut his 2021 outlook to 26 cents from 29 cents.

The numbers

Earnings: The average estimate of the 17 analysts surveyed by FactSet is for adjusted first-quarter EPS of a penny per share, down from 5 cents a year ago. On Jan. 29, the FactSet EPS consensus was 3 cents.

Estimize, a crowdsourcing platform that gathers estimates from buy-side analysts, hedge-fund managers, company executives, academics and others, has a much higher consensus EPS estimate of 4 cents.

Revenue: The FactSet consensus for revenue is $17.59 billion, down from $20.52 billion a year ago. The consensus has fallen by nearly $1 billion, from an $18.54 billion estimate as of Jan. 29. The Estimize revenue consensus is at $17.91 billion.

For GE’s business segments, the FactSet revenue consensus for Aviation has fallen to $5.28 billion from $5.39 billion on Jan. 29, has declined for Power to $4.00 billion from $4.16 billion and has slipped for Healthcare to $4.09 billion from $4.10 billion. The estimate has increased for Renewable Energy to $3.26 billion from $3.22 billion.

Industrial free cash flow: The average FCF estimate, of the two analysts who provided estimates to FactSet, is now negative $1.21 billion, with a range of negative $870.0 million to negative $1.55 billion. On Jan. 29, the range was negative $747.0 million to positive $216.0 million.

Stock movements

GE shares have rallied the after the past two earnings reports, by an average of 3.6%, after falling by an average of 3.8% after the previous two earnings reports. Over the past 10 earnings reports, the stock has gained six times, for an average gain of 7.5%, and fallen by an average 4.3% after the other four reports.

Since the end of January, the percentage of Wall Street analysts surveyed by FactSet with the equivalent of buy ratings has declined to 60% from 68%, while the percentage of analysts with hold ratings increased to 40% from 32%. No analysts have the equivalent of sell ratings on GE’s stock.

Baker Hughes Co.’s stock

BKR,

closed out the first quarter at $21.61, or up $11.11, or 105.8%, from where it closed out the same quarter a year ago. GE said in its fourth-quarter earnings report that it owned a 30.1% stake in Baker Hughes. As of April 16, Baker Hughes said it had a total of 1.04 billion Class A and Class B shares outstanding, which means GE’s held about 313.5 million Baker Hughes shares as of the end of January. A $11.11 price gain on that number of shares would equate to roughly $3.5 billion. Last year, GE recorded a $4.6 billion loss on its Baker Hughes stake.