This post was originally published on this site

Nvidia Corp. is a well-known company to technology enthusiasts and investors alike. If you are considering buying the stock — or already own it — this quarterly review of the key metrics can help you with your own research and decisions about the company as an investment.

These updates will also include comparisons of results to other major players in the semiconductor space. Keep in mind that no two companies are alike — even rivals don’t compete in every segment. Any investor needs to do their own research to make informed long-term decisions.

Where Nvidia fits in

Nvidia

NVDA,

is the predominant designer of graphics processing units (GPUs), which are the critical components of graphics cards used for high-end PC gaming and other graphically intense applications. Its main competitor for GPUs is Advanced Micro Devices Inc.

AMD,

although Intel Corp.

INTC,

is working on new products to compete in the space.

The actual manufacturing of Nvidia’s GPUs is handled by Taiwan Semiconductor Co. Ltd.

TSM,

Nvidia has also been rapidly increasing its sales of CPUs for data-center processing and making moves to become more competitive in artificial intelligence-related (AI) areas as it waits for regulatory approval of its acquisition of Arm Holdings PLC. Jeremy Owens explains this complicated competition scenario.

Key dynamics

Nvidia’s fiscal 2021 ended Jan. 31. Here are some of the most important numbers that professional investors keep an eye on for the company and its rivals.

Sales growth

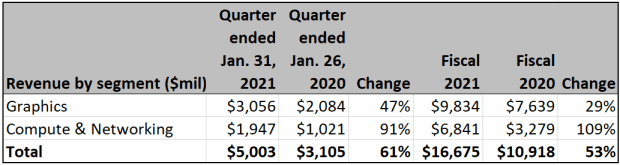

The company breaks down its sales in two ways — first, by reportable segment:

(Company filing)

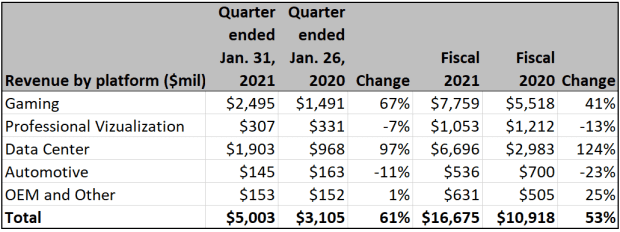

Here’s the sales breakdown by market platform:

Company filing.

With such incredible sales growth, it is probably not a surprise that Nvidia’s stock has outperformed benchmarks — it’s up 17% this year and soared 122% in 2020. Nvidia topped $5 billion in quarterly sales for the first time in the last quarter. In the three-month period before that — August through October 2020 — the company surpassed $4 billion in sales for the first time.

Pricing power and profitability

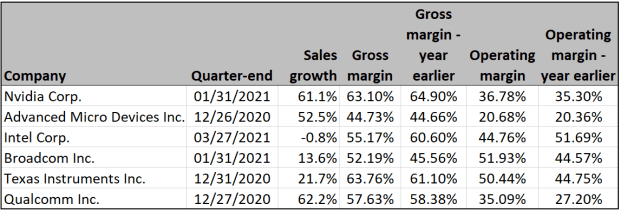

Here are year-over-year comparisons of sales growth, gross margins and operating margins for Nvidia and five other large semiconductor industry players held by the iShares PHLX Semiconductor ETF

SOXX,

The ETF holds shares of 30 semiconductor manufacturers, designers and equipment makers. Each company has a unique mix of business lines. This means a direct comparison may not be meaningful.

(FactSet)

The list includes AMD and INTC, which compete directly with Nvidia in some areas, but also Broadcom Inc.

AVGO,

Texas Instruments Inc.

TXN,

and Qualcomm Inc.

QCOM,

to round out the group that competes to make chips for various industries and platforms, including mobile devices and telecommunications.

A company’s gross margin is its sales, less the cost of goods sold, divided by sales. It is a measure of pricing power. An expanding gross margin with growing sales is a good sign. If the gross margin is contracting, it could mean a company is being forced to increase use of discounting to stave off competition. Comparing only two periods may not be especially meaningful, but it is important to understand if there is a trend.

A company’s operating margin is its earnings before interest, taxes and depreciation divided by net sales. It can be considered “return on sales.”

Nvidia’s gross margin narrowed during its fiscal fourth quarter. But its operating margin widened. The margin numbers were impressive for Broadcom, Texas Instruments and Qualcomm, while Intel’s numbers on the chart were weak across the board.

Read: Intel’s new CEO has another big problem to fix

Free cash flow

Many professional investors believe that valuation measures that are related to companies’ cash flows are more useful than traditional measures tied to profits, sales or book value. This is, in part, because intellectual property is so important in a service economy.

A company’s free cash flow (FCF) yield can be calculated by dividing its trailing 12 months’ FCF by the current share price.

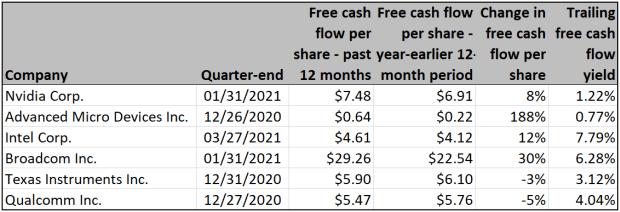

Here’s a comparison of the six companies’ changes in free cash flow per share for the past 12 reported months from the year-earlier 12-month period, along with trailing 12-month free cash flow yields, based on closing share prices April 23:

(FactSet)

Companies’ free cash flow can vary significantly, and a rapidly expanding company may not have a high FCF yield as it continually reinvests in its business. But the numbers can still be useful. For investors looking for value plays, Intel might be compelling with such a high FCF yield, provided you are also confident in CEO Patrick Gelsinger’s plans to turn the company around.

More on FCF yield: These stocks are ‘cash cows’ that give you a better way to play the value sector

Stock valuation and performance

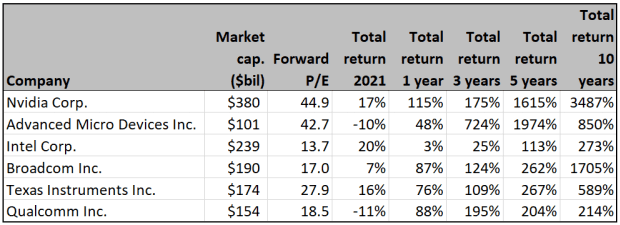

Here are price-to-earnings (P/E) valuations for the six stocks, based on consensus earnings estimates for the next 12 months among analysts polled by FactSet, along with total return figures through April 23:

(FactSet)

Nvidia is the 10-year total-return champion in this group, but AMD takes the prizes for five years and three years. Nvidia has the highest forward P/E valuation, a bit ahead of AMD. These are high valuations when compared to aggregate forward P/E ratios of 22.4 for the S&P 500

SPX,

and 30.6 for the Nasdaq-100 index. But the stock market places a premium on consistent high double-digit sales growth.

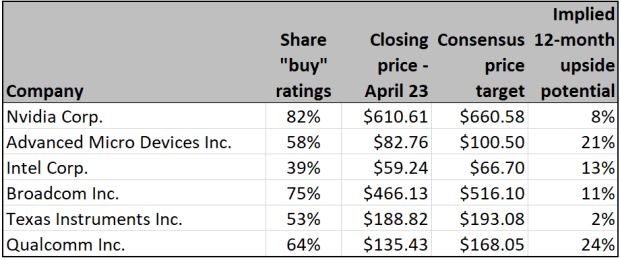

Wall Street’s opinion

Here’s a summary of opinion among Wall Street analysts polled by FactSet:

(FactSet)

Important dates

- May 26 — Nvidia is scheduled to announce results for its first quarter of fiscal 2022 at 5 p.m. ET.

Don’t miss: Want to increase your dividend income? The strategies of these funds can help you do it