This post was originally published on this site

EU countries may finally be making progress towards controlling the COVID-19 pandemic, raising hopes the bloc’s economic recovery may be on its way to catching up with the U.S.

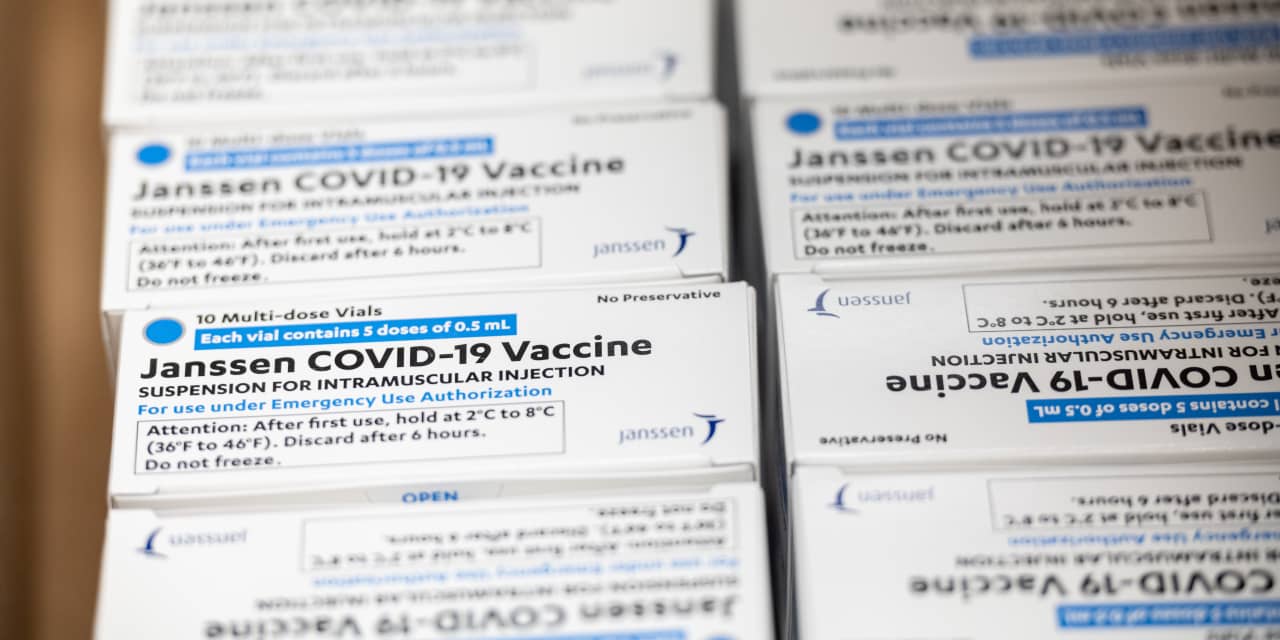

A series of well-publicized stumbles in vaccine purchasing and distribution, with some rollout programs suspended and restarted, plagued EU countries, but the selloff in European and German debt shows investors may be taking a more optimistic view on the eurozone’s efforts to soften the pandemic’s spread.

The 10-year yield for German government bonds

BX:TMBMKDE-10Y,

or bunds, was at negative 0.24% on Monday, matching its highest levels since last January, and up from negative 0.61% at the start of the year. Debt prices move in the opposite direction of yields.

At last check on Wednesday, the German benchmark maturity was at negative 0.26%, leaving the spread between the elevated 10-year U.S. yield

BX:TMUBMUSD10Y

and its equivalent German counterpart to 1.84 percentage points.

Two weeks ago, that gap stood at over 2 percentage points amid concerns the U.S. vaccine distribution was handily outpacing the EU’s own efforts to inoculate the continent’s population.

The dollar

DXY,

also took a hit on Monday as the prospects for the eurozone to catch up with the U.S.’s vaccination program buoyed the euro

USDEUR,

strengthening 0.2% against the greenback this week.

The narrowing yield gap between the U.S. and Germany comes as the pace of vaccinations in Germany and France has picked up, with about 20% of Germans having received a vaccine so far, and 18% of the EU population vaccinated, while about 40% of Americans have received a dose.

“The vaccination campaign is gaining speed significantly during the second quarter,” said Germany health minister Jens Spahn, after vaccine makers BioNTech and Moderna would increase the doses they would deliver to the EU.

“EU authorities are increasingly confident they have cracked the problem of forward vaccine supply,” said Krishna Guha of Evercore’s ISI.

Some of this broader confidence has also bolstered businesses and consumers expectations of the recovery, raising speculation the ECB may start to dial back its pandemic asset-purchasing program at the second half of 2021.

But it’s unclear if the improvement in economic sentiment will be reflected in the European Central Bank’s meeting on Thursday, with analysts pointing to the June meeting as the likely date for directions on its future bond-buying.

“The risk is that even the ECB later this week could acknowledge [the vaccine rollout] during its press conference, although we think the central bank’s aim should rather be to bridge the time until the June meeting, when the pace of its asset purchases is up for reassessment, without causing too much of a hiccup,” said Antoine Bouvet, senior rates strategist at ING, in a Tuesday note.