This post was originally published on this site

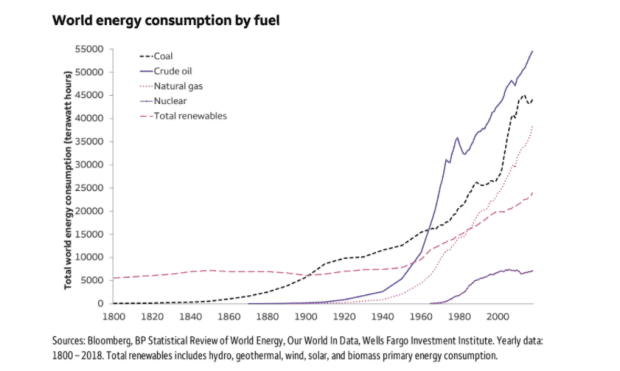

The world’s addiction to fossil fuels has gotten stronger despite all the clamor for more renewable sources of energy as yet another Earth Day approaches, says the head of real asset strategy at the Wells Fargo Investment Institute.

For investors, playing the transition from fossil fuels to renewables could be slow-going, and nuanced, says John LaForge, of WFII.

Fossil fuels are now a bigger portion of global energy use than decades ago, rising to 86% today from 81% in 1970, in large part because of oil

CL00,

gas

NG00,

and coal’s falling costs historically and as an expanding global population consumes more.

For its part, the U.S. soaks up 20% of daily oil barrels globally.

“It’s crazy,” LaForge said in a Monday phone interview with MarketWatch ahead of April 22’s Earth Day. The springtime commemoration began in 1970 as part of the rising environmental movement, according to the U.S. Senate’s website.

A half century later, the push for renewables to displace fossil fuels remains a “herculean task,” LaForge noted in a recent Wells Fargo report.

Still, it is that high-stakes, global-wide task that is driving a historic shift for politicians —and investors.

At President Joe Biden’s Earth Day summit, to be held virtually April 22-23, the White House plans to galvanize efforts by major economies “to reduce emissions during this critical decade to keep a limit to warming of 1.5 degree Celsius (2.7 degrees F) within reach,” MarketWatch reported.

European nations are already leading in the government-supported shift to greater renewables use and the pressure is on for the U.S. and major Asian economies to catch up, not to mention for industrial giants to return to their previous pledges to help developing nations.

‘A lot more gain to be had’

It’s only recently that wind

ICLN,

and solar

TAN,

have become economically competitive sources of clean energy, LaForge said, and that leaves for room for fossil fuels and renewables to co-exist on the energy markets, especially absent more aggressive public-policy support toward fighting climate change.

“There’s a constant pull when you have global economies growing all the time,” said LaForge. “For renewables to overtake fossil fuels, they basically have to do double-time.”

But while pockets of investment opportunities will exist for traditional fuels over the next five to 10 years, LaForge said, some investors won’t want anything to do with them.

With wind and solar becoming cheaper alternatives, and heightened awareness surrounding climate change, he remains optimistic about clean energy, if for the sake of Earth and the bottom line.

“We have to try,” LaForge said. “From an investor perspective, there’s a lot more gain to be had.”

LaForge said public policy is needed globally to combat climate change tied to energy sources such as coal and oil.

Biden’s conference and other major leadership gatherings in coming months are seen as precursors to the U.N.-hosted COP26 climate talks in Glasgow in November. Biden will need to restore the world’s confidence in the U.S. as he aims for net-zero emissions for the nation by 2050.

Consider the components behind renewables

Within real assets today, LaForge says investors have been diverting money away from fossil fuels and into metals used in the electric car industry, such as copper

HGK21,

silver

SIK21,

lithium, and cobalt.

Copper prices HGK21 were up about 1.6% Monday afternoon, with the May contract at about $4.23 a pound. That compares with a close of $2.39 on Friday, April 17.

Investors have bet on metals partly on the belief that electric cars will take off under Biden’s massive proposed infrastructure plan, which calls for charging stations throughout the nation, according to LaForge.

“Metals is the future,” LaForge said, stressing that copper prices have about doubled over the past year.