This post was originally published on this site

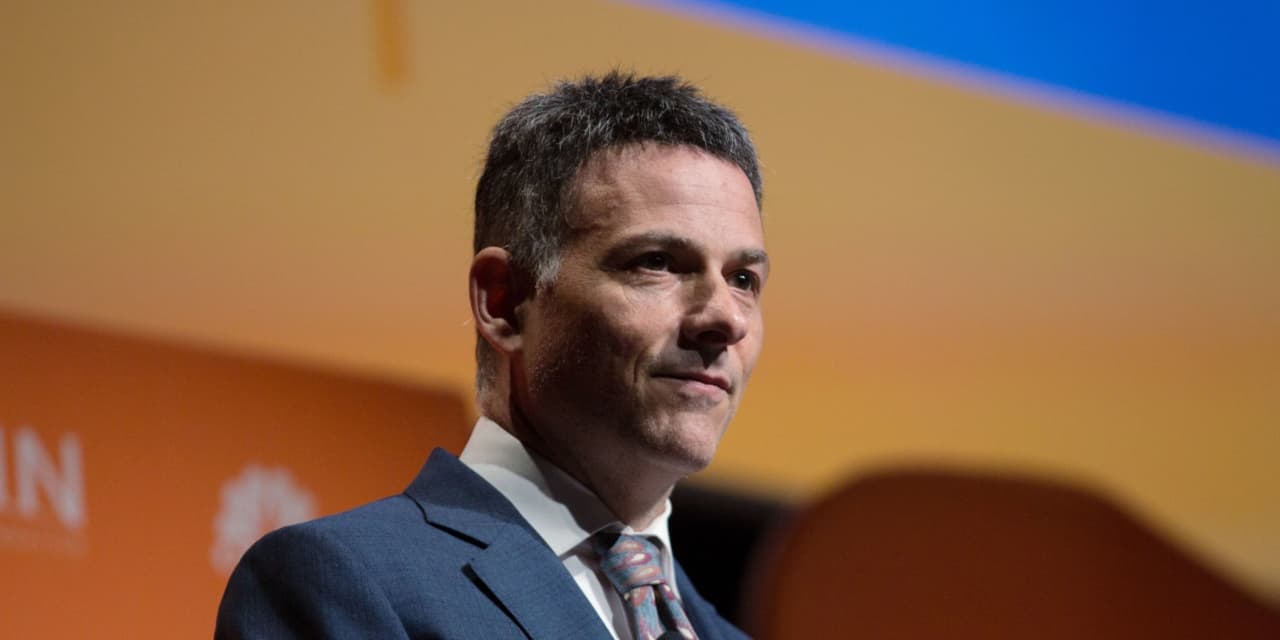

David Einhorn says that regulators are asleep on the Wall Street beat and that anomalies in the market are increasingly being ignored.

“From a traditional perspective, the market is fractured and possibly in the process of breaking completely,” wrote the head of Greenlight Capital Management in a quarterly letter dated Thursday.

Einhorn said that small investors are getting sucked into buying risky assets, accusing regulators “who are supposed to be protecting investors” of appearing “neither present nor curious.”

People “who would never support defunding the police have supported — and for all intents and purposes have succeeded in — almost completely defanging, if not defunding, the regulators,” the hedge-fund investor wrote.

Einhorn singled out Tesla Inc.

TSLA,

CEO Elon Musk and wealthy investor Chamath Palihapitiya for exacerbating some of the recent turbulence in markets, including Palihapitiya’s remarks about the GameStop Corp.

GME,

short squeeze, which Einhorn said inflamed the retail-fueled trading fracas.

“Finally, we note that the real jet fuel on the [GameStop] squeeze came from Chamath Palihapitiya and Elon Musk, whose appearances on TV and Twitter, respectively, at a critical moment further destabilized the situation,” Einhorn wrote.

For the most part, he wrote:

“

‘[Q]uasi-anarchy appears to rule in markets.’

”

Einhorn’s quarterly letter also revealed lackluster performance by the investment manager, who saw a 0.1% decline in the first three months of the year, even as the benchmark S&P 500

SPX,

notched a gain of around 6% and the Dow Jones Industrial Average

DJIA,

and the Nasdaq Composite Index

COMP,

also recorded solid returns.