This post was originally published on this site

The rapid consumer shift to online shopping due to COVID-19 pandemic-induced lockdowns helped a clutch of U.K.-listed companies report a surge in sales on Thursday. Some analysts are starting to ask how long that can last.

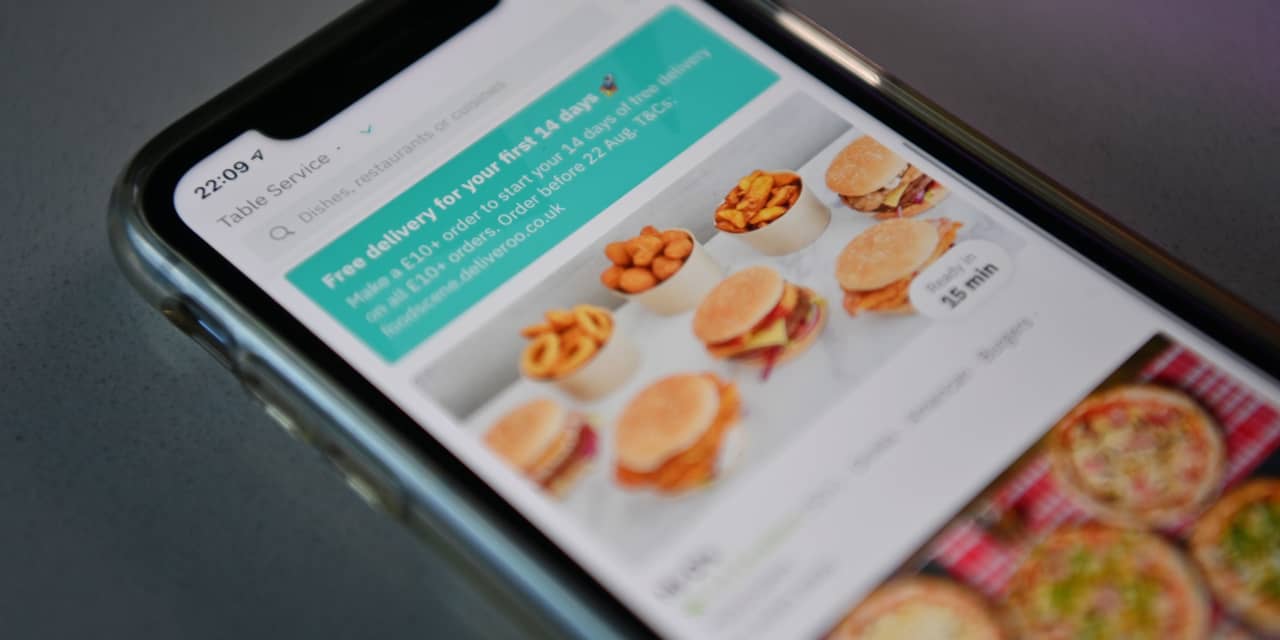

Deliveroo

DROOF,

ROO,

said that it doubled order numbers during the first three months of the year, as restaurants were forced to shut to stem the spread of the coronavirus that causes COVID-19. But the company warned that it expects growth to decelerate as restrictions ease.

Read: Amazon-backed Deliveroo’s shares slump 30% on London stock market debut

In its first set of results since its disappointing stock market debut on the London Stock Exchange in March, Deliveroo said group orders grew 114% year-over-year to 71 million and gross transaction value (GTV) was up 130% year-over-year to £1.65 billion ($2.27 billion).

Deliveroo kept its guidance unchanged for full-year annual GTV growth of between 30% to 40%, and gross profit margins of 7.5% to 8%.

“This is our fourth consecutive quarter of accelerating growth, but we are mindful of the uncertain impact of the lifting of COVID-19 restrictions,” said Will Chu, Deliveroo’s founder and chief executive, in a statement.

“So while we are confident that our value proposition will continue to attract consumers, restaurants, grocers and riders throughout 2021, we are taking a prudent approach to our full-year guidance,” he added.

Shares in Deliveroo fell 1.79% to 265.35 pence in London on Thursday, around 32% below their flotation price of 390 pence.

Uncertainty about Deliveroo’s growth prospects had been one of the concerns raised by analysts and investors ahead of the company’s initial public offering, who cited competition from Just Eat Takeway.com

TKWY,

and Uber Technologies’

UBER,

Uber Eats, coupled with progress from the COVID-19 vaccine rollout in the U.K. — the company’s largest market — which is expected to lead to a decline in at-home dining.

“Chief Executive Will Shu has thrown cold water over earnings expectations, taking a cautious view because the company doesn’t know how easing of lockdown restrictions will affect trading,” said Russ Mould, investment director at AJ Bell, in a research note on Thursday.

“There are two ways of looking at this situation. First, Deliveroo could see a drop in demand as more people are able to get out and about, particularly going out for meals rather than sitting at home waiting for the food delivery driver to arrive,” Mould said.

“Second, the company has no doubt been told by its advisers that it is better to under-promise and over-deliver in the first year as a listed company. Deliveroo’s reputation has already been shattered because of the big share price drop straight after listing. It doesn’t want to risk another slump by being too aggressive with earnings guidance and failing to meet it,” he added.

Stuck-at-home shoppers in search of beauty and sports nutrition products also helped The Hut Group

THG,

report a strong start to the year.

Read: Hut Group shares soar more than 30% on market debut in London’s biggest ever tech IPO

In its first set of maiden results since its IPO in September, THG, which helps sell retail brands, including Lookfantastic, skin care group ESPA, and sports nutrition player MyProtein.com., said group revenues rose 42% last year to £1.6 billion, sending adjusted profits up by 35%, fueled by strong demand for nutrition and beauty products.

However, it posted an operating loss of £481.8 million, largely due to noncash charges to cover share-based payments and asset value write-downs.

The company said first-quarter trading had been ahead of expectations, with revenue up 58%, as it left unchanged a recently upgraded target to increase revenue this year by between 30% and 35% percent.

“THG’s flagship platforms continue to enjoy impressive growth, with the 2020 new customers continuing to display high levels of stickiness,” wrote analysts at Jefferies in a research note. The company said it expects to spend up to £250 million on bolt-on deals this year, up from an earlier forecast of £150 million.

Shares in THG fell 2.4% to 687 pence in early London trading on Thursday. The stock is still trading more than 37% higher than its IPO price of 500 pence.

Another winner from the pandemic is Naked Wines

MJWNF,

WINE,

which on Thursday reported better-than-expected annual sales growth, driven by its direct-to-consumer wine subscription model and a strong performance in the U.S.

The online wine seller said group sales for the full year to the end of March, grew 68%, ahead of its growth forecast of 55%-65%. The company’s U.S. business grew by more than 75%, surpassing £150 million in annual sales, representing almost half of total group sales.

Shares in Naked Wines were down 0.96% in early London trading on Thursday. The stock is almost 20% up in the year to date, according to data from FactSet.

Analysts at Jefferies

JEF,

said they continued to view Naked Wines as a differentiated and advantaged model, particularly in the U.S., with a huge addressable market and clear momentum. “In our view, Naked has firmly capitalized on the favorable backdrop, and we continue to believe its advantaged proposition will support an extended growth runway,” they wrote in a research note on Thursday.