This post was originally published on this site

Earnings season kicks off in earnest on Wednesday with reports from some of the largest banks in the U.S.

Besides looking at earnings per share, revenue and forward guidance, investors might just want to check out weather reports.

That is the conclusion of a research paper, which finds that weather conditions near a company’s major institutional investors affect stock market reaction to that news.

Researchers led by Danling Jiang, a professor at Stony Brook University, say unpleasant weather may trigger physiological and psychological reactions in these investors, which leads to delayed information processing, resulting in more sluggish price reactions to earnings announcements. They examined weather in the two weeks before earnings announcements, for a company’s top 10 largest institutional investors.

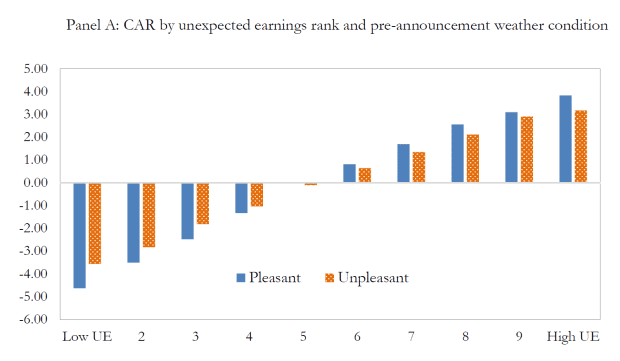

Looking at data from 1990 to 2016, they found a one-standard-deviation increase in pre-announcement unpleasant weather leads to a 45 basis point, or 10%, smaller spread between top and bottom surprises. They also found reduced trading activity during unpleasant weather.

That isn’t to overstate the impact. As the chart on average cumulative abnormal returns shows, it is far better for investors to get bad weather and the earnings news to be good, than vice versa. Also, it doesn’t seem to matter what the weather is at the company reporting the earnings — just that of the company’s major investors.

Jiang and her co-authors aren’t the first to study the impact of weather on the stock market. One study from 1993 found that market returns are significantly lower on cloudy days in New York City than sunny days. A 2003 study of 26 major stock markets across the globe found sunny weather induces optimism and more risk taking, while cloudy weather does the opposite.

For what it’s worth — the weather across the U.S. was 13% warmer than normal in March, according to the American Gas Association.

Something else to note is what day of the week it is. Previous research has found that investors are less attentive to earnings announcements occurring on a Friday.

Want a crash course in the future of crypto? Register for MarketWatch’s free live event: Sign up here!

Coinbase listing

The direct listing of Coinbase is set, with Nasdaq

COMP,

giving it a reference price of $250, which would value the cryptocurrency exchange at $65 billion. Bitcoin

BTCUSD,

which surged 5% on Tuesday, extended gains and broke through $64,000.

Earnings are due from heavyweight banks JPMorgan Chase

JPM,

Goldman Sachs

GS,

and Wells Fargo

WFC,

Software giant SAP

SAP,

SAP,

rose in Frankfurt after lifting its cloud revenue guidance for the year.

Mass media company Discovery

DISCA,

and Chinese online video platform iQiyi

IQ,

may see pressure after Bloomberg News reported Credit Suisse sold $2.3 billion worth of shares, as the bank continues to unwind positions held by Archegos Capital Management.

There are a number of Federal Reserve officials speaking, including Chair Jerome Powell, at noon Eastern, and Vice Chair Richard Clarida, at 3:45 p.m., with Clarida’s possibly more important given the topic, “The Federal Reserve’s New Framework and Outcome-Based Forward Guidance.”

European Central Bank President Christine Lagarde is speaking at a “fireside chat” event at 10 a.m. Eastern. The Fed’s Beige Book of economic anecdotes also is due for release.

Markets in holding pattern

Even the Johnson & Johnson

JNJ,

COVID-19 vaccine delay couldn’t prevent the 21st record close of the year for the S&P 500

SPX,

on Tuesday. Stock futures

ES00,

NQ00,

in the early hours edged higher.

The yield on the 10-year Treasury

TMUBMUSD10Y,

was 1.64%, as the bond market largely brushed off the stronger-than-expected consumer price data.

Oil futures

CL.1,

rose after the International Energy Association lifted its oil-demand forecast.

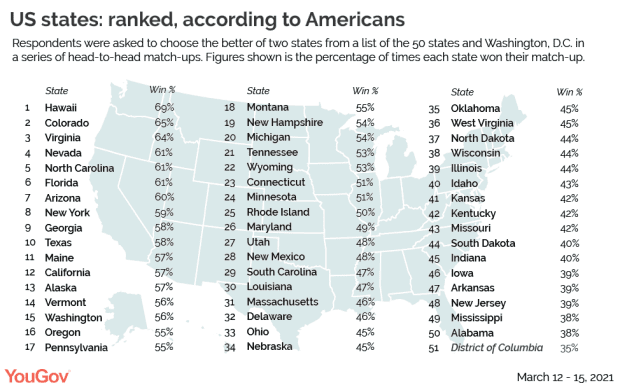

Ranking the U.S. states

YouGov

YOU,

asked 1,211 American adults to choose the better of two states (and the District of Columbia) in a series of head-to-head matchups. Not better at anything in particular, mind you, just “better.” Hawaii scored the highest, while Alabama and Washington, D.C., brought up the rear, in what seem like pretty fair rankings.

Random reads

France is offering the opportunity to exchange old cars for electric bicycles.

Alex Rodriguez, the former New York Yankees legend who played as recently as 2016, and ex-partner of singer Jennifer Lopez, is a “who?” to Anthony Edwards, the young star on the Minnesota Timberwolves basketball team that Rodriguez is buying.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers