This post was originally published on this site

This article is reprinted by permission from NerdWallet.

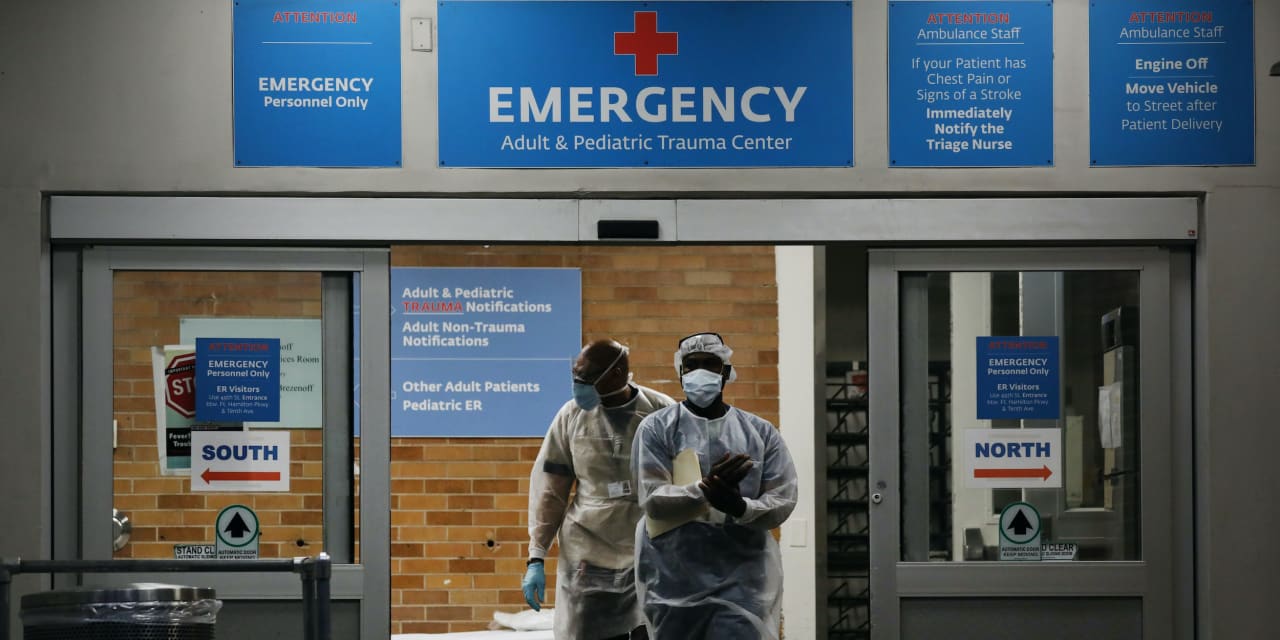

Testing and vaccination for the coronavirus are free thanks to laws passed last year. Treatment isn’t, however, and may be about to get more expensive.

A new vaccine is in production, millions of doses are being administered daily and President Joe Biden says there will be enough vaccines for all U.S. adults by the end of May. That’s great news. But there’s still a risk of getting COVID-19 and facing medical bills.

Here’s a primer to COVID-19 costs you could face, what insurers will pay for and how to deal with medical bills.

What’s covered under the law

COVID-19 tests and vaccinations are free for everyone under the Families First Coronavirus Response Act and the CARES Act.

- Private insurers cannot bill for vaccinations and generally aren’t supposed to bill for a COVID-19 test. The same holds true if you’re on Medicare or Medicaid. (There are some exceptions for testing, but vaccination is completely free.)

- If you don’t have insurance, the law provides funds to cover testing and vaccination costs for providers so they shouldn’t bill you.

Still, reports abound of people getting incorrectly billed for COVID-19 tests and related services. If you were billed for a free service, contact your provider to point out the mistake. You may have to follow up with your insurer.

Also read: Pfizer and BioNTech say COVID-19 vaccine was 100% effective in Phase 3 trial in adolescents

If you are in a position to buy insurance or want a cheaper premium, this is a good time to shop. The American Rescue Plan makes healthcare more affordable through reduced premiums for exchange plans and fully paid premiums for laid-off workers to adopt COBRA coverage.

Waivers also help but may not last

During the pandemic, many private insurers have voluntarily waived cost-sharing for COVID-19-related treatments, including copays, payments toward deductible and coinsurance (what you pay after the deductible). But that could change soon.

The national public health emergency period — an official government declaration — ends April 21, though it may be extended by 90 days given we’re not out of the woods yet. Insurers could resume normal cost-sharing when the emergency period ends.

Even if your insurer has a treatment waiver now, you may face some costs depending on your plan, the care received and how your insurer defines COVID-19-related treatment.

“Most of these waivers still only apply to COVID-19 treatment received from in-network providers or facilities, and consumers who are treated out-of-network may be forced to pay the entire cost of their treatment,” according to a Kaiser Family Foundation report published in November.

More: Breaking down this ‘miracle’ COVID-19 survivor’s $1.1 million hospital bill

People may have lingering symptoms or conditions needing treatment, says Adam Fox, deputy director at the Colorado Consumer Health Initiative, a nonprofit health advocacy organization.

“It’s not easy to distinguish what may be COVID-related or not after somebody initially recovers,” he says. “In most cases, insurance companies are not going to categorize follow-up care as COVID-related.”

To see what costs your insurer has waived, check its website. America’s Health Insurance Plans, a national association representing insurers, has a summary of waivers offered by major companies. For example, United HealthCare’s Medicare Advantage waivers apply until March 31, while Humana’s Medicare Advantage waivers apply throughout 2021.

Dealing with medical bills

Medical billing doesn’t go smoothly in the best of times. Expect more issues as the pandemic continues, Fox says. “Sometimes we are hearing from consumers anywhere from nine to 18 months after they have received care,” he says.

Here’s how to get ahead of potential costs and handle a medical bill:

Ask for an itemized bill for COVID-19 treatments: This will help you spot errors like duplicate bill codes, Fox says. Compare the charges with your explanation of benefits to see if they are covered. By law, insurers must cover costs like a doctor’s visit fee that may have been added when you were tested. Medicare patients are mostly covered for COVID-19 treatments, but may have to pay deductibles, copays and coinsurance for hospital stays.

Negotiate: You can always negotiate medical bills, says Jan Stone, a medical billing advocate at Stoneworks Healthcare Advocates in Austin, Texas. If you don’t have insurance, ask your healthcare provider upfront what services you’ll be charged for.

Related: COVID-19 will change this about the way you get healthcare

If you are on an exchange plan and received treatments it doesn’t cover, you can negotiate that cost, Stone says. Drug costs are negotiable, too.

“If your doctor prescribed a single drug and you can take multiple less expensive options that would do the same thing, you should ask your physician,” she says. “People like the convenience of taking one pill.”

Ask for a payment plan: Talk to your healthcare provider about setting up a plan to pay over time. Also ask your provider or search online to see if your state has an assistance program to help with medical bills.

Get help: If you can, hire a medical billing advocate to negotiate complicated bills for you or seek claims assistance from professionals via Claims.org. If you have complaints about COVID-19 bills, contact the Department of Health and Human Services hotline at 800-HHS-TIPS or tips.hhs.gov. You can also file a complaint with your state attorney general or insurance commissioner.

More From NerdWallet

Amrita Jayakumar writes for NerdWallet. Email: ajayakumar@nerdwallet.com. Twitter: @ajbombay.