This post was originally published on this site

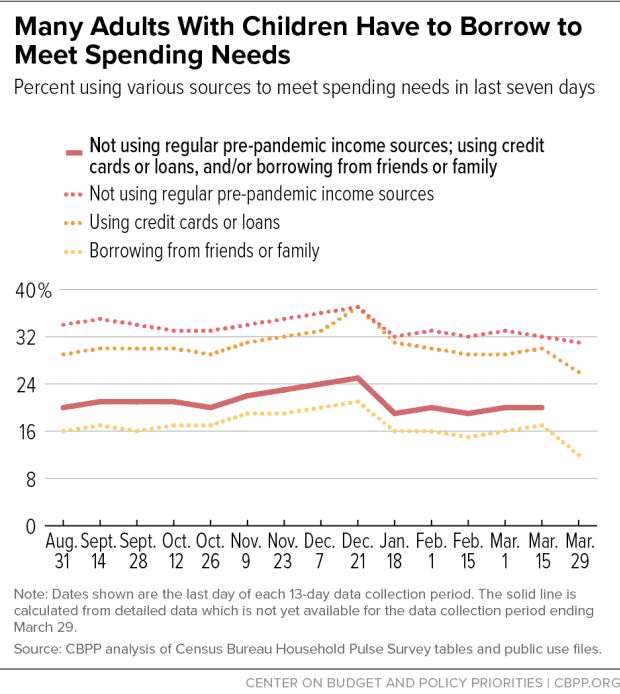

Americans are finding it easier to afford everyday expenses than they were at the height of the pandemic, but that’s primarily because they’ve been borrowing money to get by.

With interest rates at near-zero levels, some 50 million Americans are relying on loans or credit cards to finance their immediate expenses — and that does not even include cars or homes.

In addition, 20 million Americans are depending upon family and friends for money, according to data from the U.S. Census Bureau’s weekly Household Pulse Survey.

“

In the last week of March, some 18 million adults in households reported they didn’t have enough to eat over the course of a week

”

That has helped many Americans avoid food insecurity.

In the last week of March, some 18 million adults in households reported they didn’t have enough to eat over the course of a week, down from 24 million adults in the prior week of March, according to data from the survey.

What’s more, the 20 million Americans who are getting by primarily due to the generosity of friends and family members are more likely to be suffering from food insecurity.

That’s according to an analysis of the survey performed by Claire Zippel, a research analyst at the Center on Budget and Policy Priorities, a think-tank focused on the impact of budget and tax issues on inequality and poverty.

Zippel’s analysis also found that the share of adults “using some form of borrowing and not their regular pre-pandemic income sources in early March was higher among adults with children (20%) than those without children (14%).”

Adults with children obviously need to spend more money to cover daily necessities than adults without children, Zippel said.

“

Adults with children who are relying on borrowing are also more likely to be behind on rent

”

Additionally, adults with children who are relying on borrowing are also more likely to be behind on rent, despite housing aid from the $1.9 trillion American Rescue Plan.

Almost half (47%) of all adult renters with kids who aren’t caught up on rent said they were borrowing money to get by, and not relying regular pre-pandemic sources of income.

“Many may be falling even further behind on rent payments and may need time to fully pay off their rental arrearages even as the economy improves,” Zippel said.