This post was originally published on this site

Mastercard Inc. is rolling out a tool that will allow consumers to gauge how their spending impacts the environment in what the company says is its latest attempt to become more sustainable in its business practices.

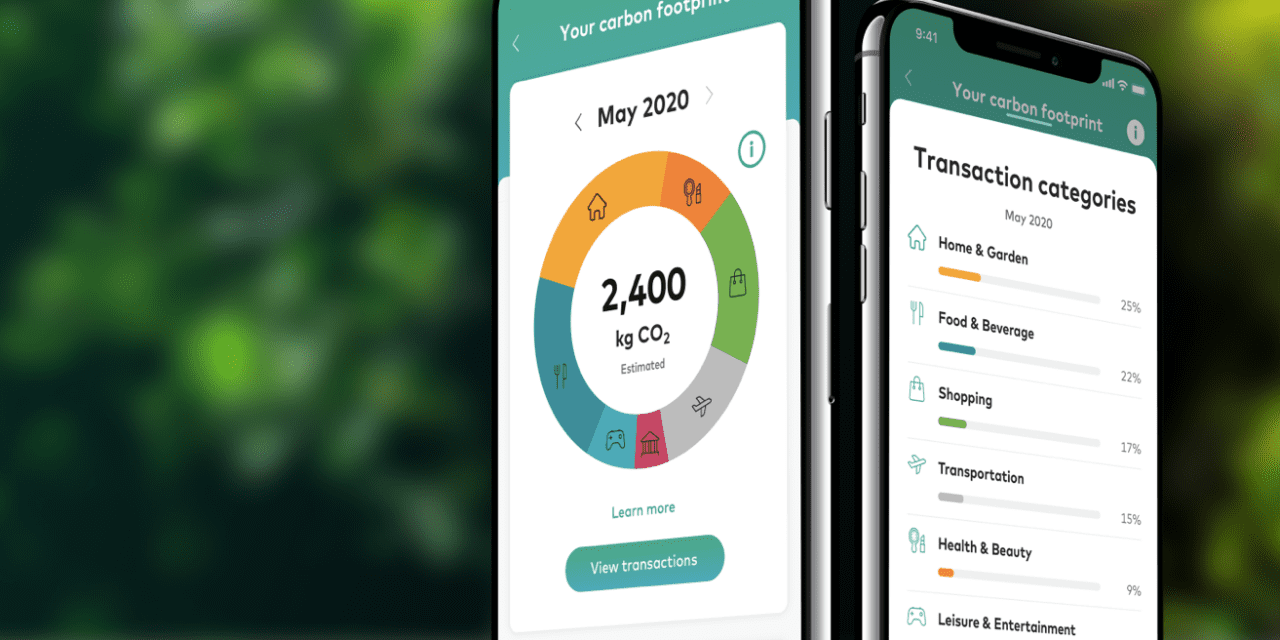

The payments giant is working with sustainably focused financial-technology company Doconomy to enable a carbon calculator that bank partners will be able to integrate into their consumer-facing apps. The company will also offer suggestions for ways to counteract these carbon impacts, such as donations toward planting trees.

Mastercard

MA,

is somewhat limited in the insights it can offer consumers due to the nature of credit-card data, which allow companies to see information like the amount that was spent at a given merchant, but not which individual items someone purchased. Instead of breaking down the carbon impact of a specific meal or laptop that a consumer bought, Mastercard’s tool will focus on spending categories to show people the environmental impact of a certain dollar value of spending in the grocery category, for instance.

Read: Mastercard to let merchants accept some cryptocurrencies directly later this year

Though there are some existing carbon calculators that let people track things like meal consumption and see the carbon impacts of those items, Mastercard argues that its tool will be valuable to consumers.

“You have to be really motivated to do that,” Chief Digital Officer John Lambert said of the process of logging recent purchases in third-party tools. “What we’re doing here is taking the calculator and embedding it inside the network so every transaction that moves through the network can be scored without the consumer having to do anything.”

The company isn’t creating the estimates itself but rather relying on the Åland Index, which measures carbon impacts.

Banks that embed Mastercard’s carbon calculator will also be able to provide access to a donation component for those looking to offset their carbon impacts by contributing to charities that plant trees. Lambert said that Mastercard “does not want to profit off” this initiative and is “not taking any fees” around these donations.

A spokesperson said that 100% of donations made to Mastercard’s Priceless Planet Coalition program go toward tree-planting efforts, with Mastercard covering any administrative costs.

There is also a push from some bank partners to incorporate sustainable donations into credit-card rewards programs. First Hawaiian Bank will let cardholders redeem rewards points toward planting trees, Mastercard said Monday, with other bank partners planning to follow.

Separately, a company called Aspiration has created a Mastercard credit card that lets cardholders plant trees to offset their spending and offers rewards for each month they reach carbon-zero status.

Read: Mastercard joins net-zero climate club with ambitious pledge to bring most of its customers on board

While people have been “enamored with air-mile points” lately when it comes to thinking about card rewards, Lambert said he expects that “in this decade, people will be interested in other things,” such as using their rewards points to make a sustainable impact.

At the same time, Lambert emphasized that “the purpose is really not to… spend more on your card and do this.” He noted that in the future, tools like carbon calculators could leverage open-banking options, pulling in other elements of people’s financial lives, such as utility bills that they don’t pay with their credit cards.

The carbon calculator for cardholders is one prong of the company’s ongoing push for sustainability, alongside efforts to reduce its emissions footprint as well as a move to tie executive compensation to milestones around carbon neutrality and other environmental, social, and governance (ESG) goals.

Mastercard is “relatively small in terms of an emitter,” Lambert said, given that the company isn’t a manufacturer, but the company works with a large range of banks and other partners, and it’s looking at its impact more broadly.

Lambert argued that Mastercard is “already in good shape” when considering Scope 1 emissions, which are direct greenhouse gases from a company’s own sources, and Scope 2 emissions, which are tied to the purchase of electricity and other utilities that produce greenhouse gases. “We need to solve our Scope 3,” he said, referring to emissions that are linked to a company’s supply chain.

Mastercard estimates that its supply chain accounts for more than 70% of its carbon footprint. It has been asking suppliers to make disclosures around their net-zero plans and will switch suppliers “if they cannot produce adequate answers,” Lambert said.