This post was originally published on this site

State and local governments have faced a cash crunch as a result of the COVID-19 pandemic. And they’re passing the pain on to homeowners in the form of higher property taxes, according to a new report.

A new analysis from real-estate data company Attom Data Solutions found that Americans who owned single-family homes paid $323 billion in property taxes in 2020, up more than 5% from 2019. The average property tax nationwide was $3,719 for a single-family home in 2020, up 4.4% from the year prior.

While the effective tax rate did drop slightly between 2019 and 2020, Americans last year were hit overall with the largest average property-tax hike in four years, Attom’s chief product officer, Todd Teta, said in the report. He called it “a sign that the cost of running local governments and public school systems rose well past the rate of inflation.”

Property taxes increased faster than average in 55% of the 220 metropolitan areas Attom studied for its report. Many of these counties included popular real-estate markets in the Sun Belt. Among the areas that saw the most notable increases in average property taxes were Salt Lake City (up 11.4%), San Francisco (up 11.1%), Seattle (up 10.3%) and Atlanta (up 10.2%).

Other cities that saw property taxes rise more than 10% between 2019 and 2020 included San Jose, Calif.; San Diego; and Tampa, Fla.

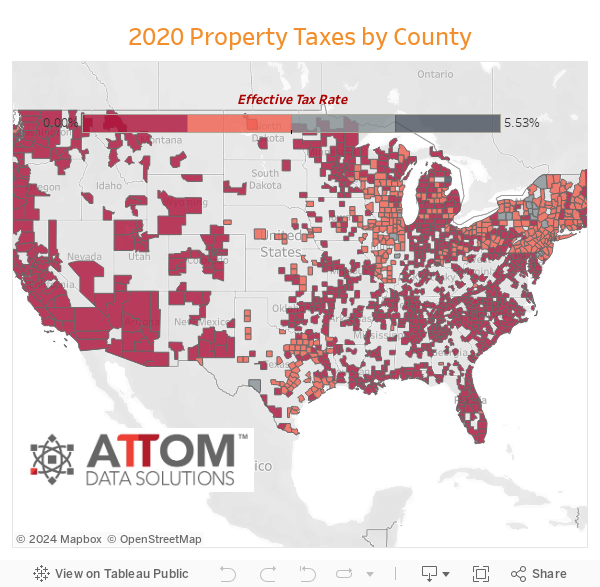

The states where property-tax rates are the highest didn’t change, despite the overall increase in property taxes nationwide. New Jersey had the highest effective property-tax rate at 2.2%, followed by Illinois (2.18%), Texas (2.15%), Vermont (1.97%) and Connecticut (1.92%). Hawaii had the lowest rate in the country at 0.37%, followed by Alabama at 0.44%.

There were 16 counties nationwide where homeowners paid more than $10,000 in property taxes last year on average. Twelve of those counties are located in the New York metropolitan area.