This post was originally published on this site

You might be cautious about investing in companies with lofty price-to-earnings ratios as some benchmark indexes are hitting up against all-time highs. But that type of thinking could cost you money.

Companies with high P/E valuations may be able to continue to grow sales quickly, boosting earnings in the process. And that could lead to higher share prices, even though the S&P 500

SPX,

hit a new intraday high April 6 and the Nasdaq

COMP,

reached a new high Feb. 19.

The time frame under discussion is a minimum of two to three years. This period is expected by economists and investment analysts to represent a return to growth in the economy and a rebound in corporate earnings. Meanwhile, the Federal Reserve has pledged to keep interest rates very low.

Below is a list of stocks whose P/E ratios (based on current share prices) will decline significantly over the next several years if analysts’ estimates are accurate.

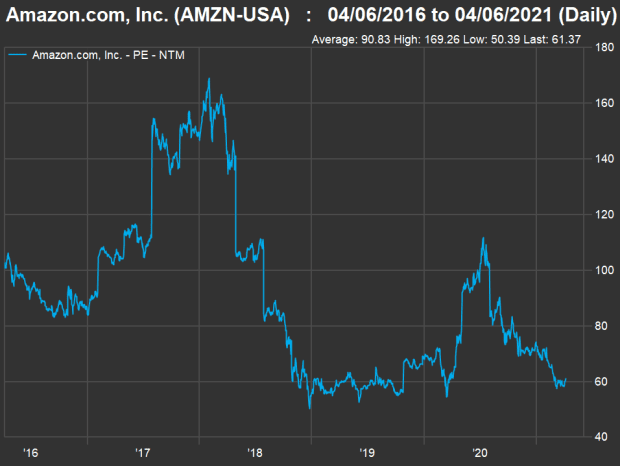

Amazon’s example

In the five years through April 5, shares of Amazon.com Inc.

AMZN,

have soared 451%. Look at how high the stock’s forward price-to-earnings ratios have been:

(FactSet)

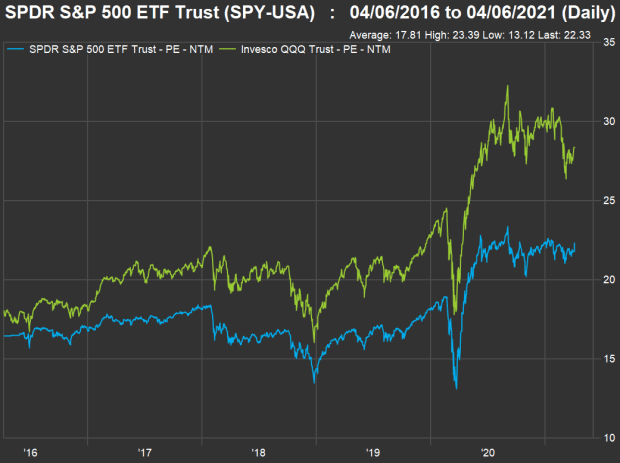

Those forward P/E ratios (based on rolling 12-month consensus estimates among analysts polled by FactSet) have always been high for Amazon, when compared with those for the SPDR S&P 500 ETF Trust

SPY,

and the Invesco QQQ Trust

QQQ,

(which tracks the Nasdaq-100):

(FactSet)

The two ETFs’ forward P/E valuations are much lower than Amazon’s, although they have moved sharply higher from two years ago.

You might have been warned to steer clear of Amazon’s stock at any time since the ecommerce company’s IPO in 1997. That would have been a mistake, as the stock market has been rewarding rapid sales growth with high P/E valuations.

As with Amazon, a company’s earnings may be misleading when conducting valuation research. Earnings can vary widely, especially if a company is emphasizing reinvesting in the business rather than showing profits. Amazon’s annual revenue increased at a compound annual growth rate of 29% from 2015 through 2020. The company booked annual profits during that periods, but as recently as 2014 reported a net loss of $241 million on net sales of $89 billion.

An investment screen of high P/E stocks

The Nasdaq-100 is made up of the 100 largest companies in the Nasdaq Composite Index by market capitalization, excluding financial companies. That means it’s weighted heavily toward technology companies and other rapid growers.

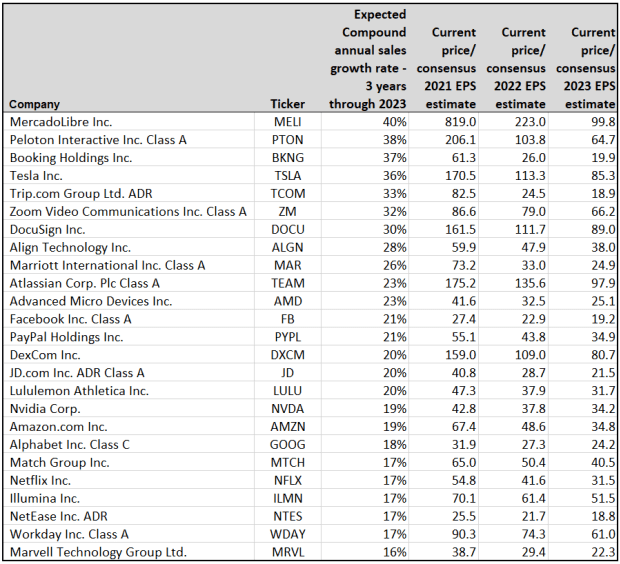

The following screen is based on consensus sales estimates among analysts polled by FactSet through calendar 2023, but it excludes 11 for which 2023 estimates aren’t available. The screen also excludes any companies expected to show declines in annual sales or net losses during 2021, 2022 or 2023.

That brings the initial list down to 77 companies. Here are the 25 expected to achieve the highest compound annual growth rates for sales over the next three calendar years, with their current forward P/E ratios and ratios of current prices to 2023 and 2023 earnings-per-share estimates:

(FactSet)

Continuing the Amazon discussion, you can see that the analysts expect the company’s sales growth rate to slow to an annual pace of 19% over the next three years, but that is still a very impressive growth rate if it holds. And the ratio of the company’s current stock price to estimatde 2023 EPS is 34.8, which isn’t outrageously high for a fast grower.

Taking the list from the top, for MercadoLibre Inc.

MELI,

and Peloton Interactive Inc.

PTON,

you can see that two years out the forward P/Es based on current prices still look very high, as do the ones for Zoom Video Communications Inc

ZM,

and Tesla Inc.

TSLA,

Potential bargains for patient long-term investors include Advanced Micro Devices Inc.

AMD,

Facebook Inc.

FB,

and even Netflix Inc.

NFLX,

which has been perennially expensive.

But that’s when you need to do your own research.

Don’t miss: This fund’s ‘long-short’ stock strategy helps investors navigate rocky times