This post was originally published on this site

Composer Andrew Lloyd Webber has been popping up all over British television during lockdown. From documentaries to competitions, Lloyd Webber has been making the case that the devastated theater business needs to recover as COVID-19 restrictions are lifted.

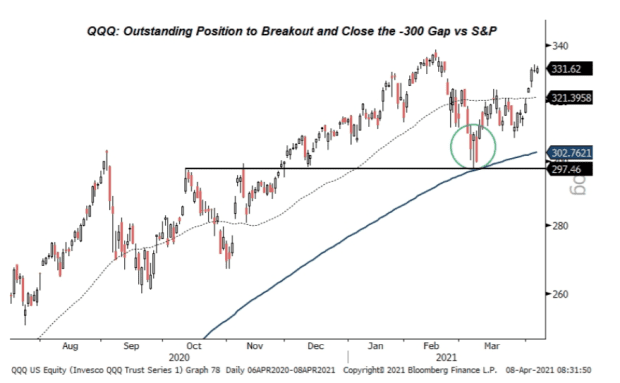

It helps to know some Lloyd Webber for the call of the day. Rich Ross, a technical analyst at Evercore ISI, says the megacap technology stocks are poised to break out. He calls the grouping FAAANTM (say it out loud — get it?), referring to Facebook

FB,

Alphabet

GOOGL,

Amazon

AMZN,

Apple

AAPL,

Netflix

NFLX,

Tesla

TSLA,

and Microsoft

MSFT,

“‘The Music of the Night’ has returned for Big Tech and ‘all I ask of you’ is that you overweight large cap tech when it is underloved and angry after months of consolidation with MSFT, GOOGL and FB all breaking out to all-time highs,” says Ross.

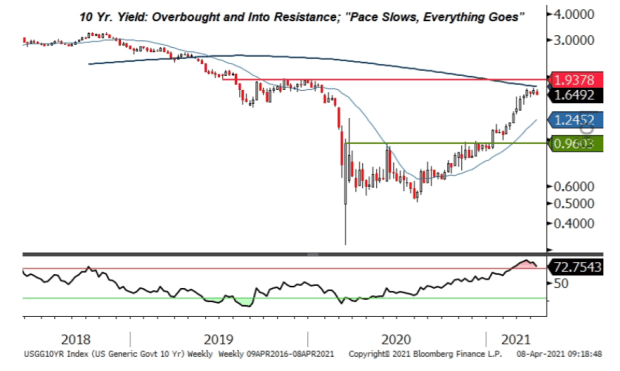

Seven months of consolidation and relative underperformance have left sentiment and positioning light, and set up for what he says will be a spring surge. In conjunction with a double bottom technical formation in the dollar, trillions of dollars in liquidity, and a slowing rise in interest rates and oil, he says the Nasdaq-100

QQQ,

exchange-traded fund will close the underperformance against the S&P 500

SPX,

and reach 450 by year-end.

A megatech breakout isn’t bad news for the S&P, however, given that they account for over 21% of the index.

Besides the FAANTM grouping — and he says Apple is poised to surge out of its base at the 200-day moving average, and that Amazon can reach $5,200 — he also highlights other tech stocks including graphics chip maker Nvidia

NVDA,

chip equipment maker Lam Research

LRCX,

communications chip maker Broadcom

AVGO,

and microchip maker Advanced Micro Devices

AMD,

Adobe

ADBE,

he adds, can get to $750 “PDF” — a reference to the software format it has popularized, which he says can also stand for “pretty darn fast” — after it takes out the $500 level.

Inflation and streaming in the spotlight

Producer price data — which was delayed due to a technical glitch on the Labor Department’s website — rose 1% in March, which was stronger than forecast. In an interview with Bloomberg News, Fed Vice Chair Richard Clarida emphasized that readings at the end of the year on inflation will be more important than any near-term rise.

China’s producer-price index rose by the highest in nearly three years in March.

Sony

SONY,

shares rose nearly 3% in Tokyo, after Sony Pictures said it will stream its movies exclusively on Netflix’s

NFLX,

platform.

FuboTV

FUBO,

shares may be active, as the sports steaming service acquired the rights for the South American qualifying matches ahead of the soccer World Cup.

Jeans maker Levi Strauss

LEVI,

raised its earnings and sales guidance and lifted its dividend.

Household products maker WD-40

WDFC,

may see pressure after reporting worse-than-expected results, with the company noting supply-chain constraints it expects to resolve in the second half of its fiscal year.

Naked Brand,

NAKD,

an apparel maker popular with retail traders, may gain after investment group Ault Global

DPW,

disclosed it has purchased a 6.4% stake.

Prince Philip has died aged 99, Kensington Palace announced. Here’s a look back at his dramatic life.

Yields edge higher

The yield on the benchmark 10-year Treasury

TMUBMUSD10Y,

rose to 1.67%. U.S. stock futures

ES00,

NQ00,

and in particular tech stock futures, dipped after the PPI data.

Random reads

Taiwan’s worst drought in 56 years led to a man recovering a phone he dropped in a lake a year earlier. The phone still works.

A software mistake led a flight to take off some 1,200 kilograms (2,646 pounds) heavier than expected, as all female passengers using the title “Miss” were classified as children. The flight’s operator, Tui

TUI,

was one of the worst-performing large-cap stocks in Europe after launching a €350 million convertible bond.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.