This post was originally published on this site

Corporate insiders are aggressively selling with one hand what they’re buying with the other and that’s not a good sign for bullish investors.

That’s because insiders are selling from their own personal accounts, and when they’re betting with their own money they are more right than wrong. And, via share repurchases, they’re buying with other peoples’ money — their corporate cash. Companies historically have been wrong more than right in timing stock buybacks.

Earlier this year I wrote about insiders’ aggressive selling from their own accounts, and this has become even more pronounced in the weeks since. Winston Chua, a data analyst at EPFR, a division of Informa Financial Intelligence, reports that insider selling in the first quarter of this year was at a 14-year high.

At the same time that insider selling has jumped, companies have also accelerated the pace of repurchasing their shares. The total of stock buybacks in the first quarter, according to Chua, was the most in seven quarters.

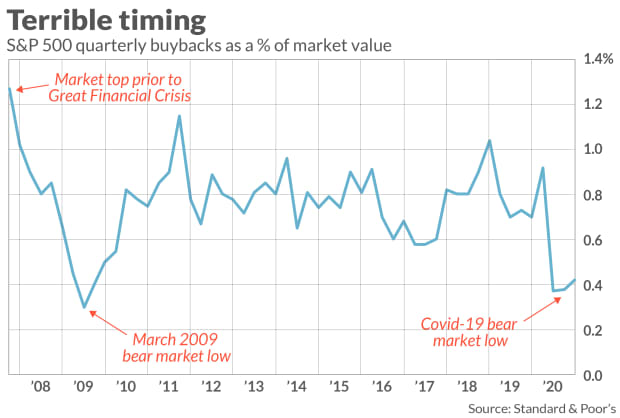

To appreciate how bad companies are at timing their share repurchases, take a look at the chart below. It plots the S&P 500’s

SPX,

so-called buyback yield: total repurchases of S&P 500 companies in a given quarter as a percentage of the S&P 500’s market capitalization. Notice that the lowest buyback yields over the past 15 years occurred at the two most significant bear market bottoms — March 2009 and March 2020.

If companies had good market-timing skills in deciding when to repurchase shares, of course, the buyback yield would have been highest at those bottoms, not lowest. Just the reverse would have been the case at the 2007 bull market high: If companies were good market timers, the buyback yield would have been lowest then, rather than at one of its highest levels in decades.

It’s probably not an accident that insider selling and share repurchases are trending higher at the same time. Rob Arnott, founder of Research Affiliates, explains why:

“Say you’re a CEO, and you have 10 million shares of stock options [that you want to redeem],” he told me a couple of months ago. “You’ll want to mitigate market impact by doing a stock buyback at the same time. So, noisily announce a 10 million share stock buyback for a certain date… Issue yourself 10 million shares of new stock at about the same time and promptly sell it. Change in the float of the stock? None. Perception in the marketplace? ‘They did another big buyback! Applause!’”

Arnott was speaking hypothetically, but if you have any doubt that the situation he describes is real, consider a study published in the November 2018 issue of Review of Financial Studies entitled “Strategic News Releases in Equity Vesting Months.” Its authors are Alex Edmans and Moqi Groen-Xu of the London Business School; Luis Gonclaves-Pinto of the Chinese University of Hong Kong; and Yanbo Wang of Sungkyunkwan University.

The researchers found strong evidence that the average CEO in the U.S. manipulates the flow of news about his company in his “vesting” months, increasing the frequency of positive news and delaying or killing neutral or negative stories. These vesting months represent the first opportunity the CEO has to sell shares or exercise options granted him in prior years. One way in which executives manipulate this flow of positive news is to strategically time the announcement of a new share repurchase program. The authors conclude that the CEO’s manipulation “generates a temporary increase in stock prices and market liquidity, which the CEO exploits by cashing out shortly afterwards.”

This research also helps us to understand why the stock market remains so strong despite aggressive insider selling from their own accounts: The increase in share repurchases softens the bearish impact of that selling. Be forewarned: History teaches us that share repurchases only temporarily postpone that impact.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.

More: Stocks’ short-term signals are bullish but Peter Lynch’s long-term investing advice still applies

Plus: Why consumers may be in no mood to help the economy or the stock market