This post was originally published on this site

JPMorgan Chase & Co. CEO Jamie Dimon took the leadership spot at the largest U.S. bank in December 2005. It has been an excellent run for the bank’s investors, as you can see below.

In his latest letter to shareholders April 7, Dimon wrote that over the long term, the performance of JPMorgan Chase’s

JPM,

stock reflects the bank’s “progress,” which he defined as “a function of continual investments in our people, systems and products, in good and bad times, to build our capabilities.”

Those are fine words, backed by outperformance against the S&P 500 Index

SPX,

during his tenure.

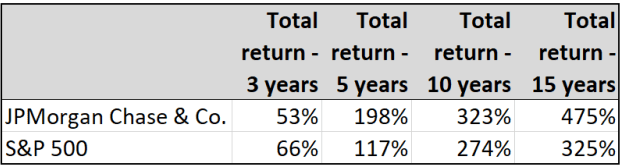

Check out these total returns for JPM and the index (both with dividends reinvested) for longer periods through April 6:

(FactSet)

So JPM has soundly beaten the S&P 500’s total return for five, 10 and 15 years. It has trailed for three years, but keep in mind what a remarkable run the index has had, led by rapidly growing tech-oriented companies. It’s also worth noting that bank stocks tend to trade at price-to-earnings ratios of about 60% to 70% of the index’s P/E.

As of the close April 6, the forward P/E ratio for the SPDR S&P 500 ETF Trust

SPY,

was 22.3, while the forward P/E for the Invesco KBW Bank ETF

KBWB,

was 13.4, according to FactSet. JPM’s forward P/E was 13.5. So the bank stocks still appear to be on the cheap side, relative to the S&P 500.

Bank earnings in the spotlight

Bank earnings season begins on April 14, when JPM, Wells Fargo & Co.

WFC,

and Goldman Sachs Group Inc.

GS,

report their first-quarter results. Bank of America Corp.

BAC,

and Citigroup Inc.

C,

will report April 15. Rounding out the big six U.S. banks (when ranked by total assets), Morgan Stanley

MS,

will report April 16.

Odeon Capital Group analyst Dick Bove advised clients in a note April 6 “to avoid making investment decisions based on first-quarter results.”

He expects that in the second half of 2021, “the economy will be growing so rapidly that when we reach that period, bank earnings will be soaring.” He has “buy” ratings on all of the big six U.S. banks listed above.

How the big bank stocks have performed

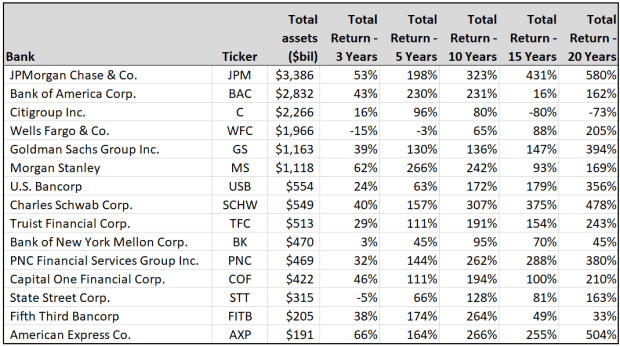

Here’s a ranking of the 15 largest U.S. banks by asset size, with long-term total returns through April 6:

(FactSet)

For the definition of “bank,” we have included bank and thrift holding companies. So Charles Schwab Corp.

SCHW,

is on the list, even though securities brokerage is its main business. Through its bank subsidiary, Schwab gathers deposits and makes loans.

Looking back at the 20-, 15- and 10-year periods, JPM has had the strongest total returns. For five years, Morgan Stanley has been the clear leader, followed by Bank of America, with JPM ranked third. For three years, American Express Co.

AXP,

takes the prize, followed by Morgan Stanley and then JPM.

Don’t miss: These stocks seem expensive now, but in two years you may wish you’d bought them at these prices