This post was originally published on this site

Hedge funds have been portrayed as helping the rich take outsized bets for profits — and occasionally suffering catastrophic losses.

But New York-based investment-management company Alger follows what the firm’s CEO, Dan Chung, describes as a “traditional conservative hedged-equity strategy” through a mutual fund. And it has achieved significant gains while reducing volatility, geared toward the average investor.

During an interview, Chung described the fund’s long-short strategy and how it has outperformed during the pandemic. He also gave examples of the fund’s investments.

With the U.S. economy in a recovery phase, stock valuations to earnings estimates are at historically high levels. So a hedged strategy may still be appropriate for investors who have difficulty being patient during big swings for the stock market.

“For any investor, the volatility of the markets can be really rattling. It often causes investors to make the worst investing decisions,” Chung said.

It is easy to point out that the stock market has always recovered after a crash. But some investors who try to time the market by moving to the sidelines during times of turmoil might sell for losses. They can also make the mistake of buying back in too late, after a significant portion of a recovery has taken place.

Fund performance

The Alger Dynamic Opportunities Fund’s Class A

SPEDX,

and Class Z

ADOZX,

shares are rated five stars (the highest) by research firm Morningstar.

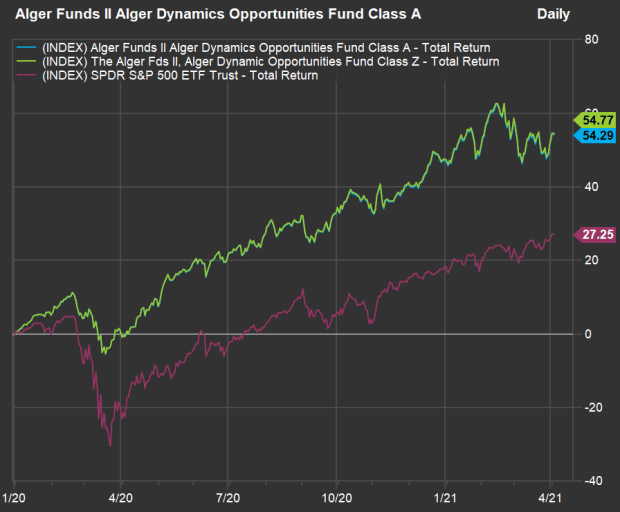

Here’s a chart showing the performance of both share classes and the SPDR S&P 500 ETF Trust

SPY,

from the end of 2019 through the close on April 2:

(FactSet)

The point of the chart isn’t only to show that the fund has outperformed the benchmark S&P 500 during the pandemic, but to show how its strategy led to a much smaller decline during the early days of the COVID-19 outbreak in the U.S.

From the close on Feb. 19, 2020 (the day the S&P 500 Index hit its pre-pandemic high) through the S&P 500’s bottom on March 23, 2020, SPY dropped 33.7%, while the Alger Dynamic Opportunities Fund (both Class A and Class Z) fell 13.2%.

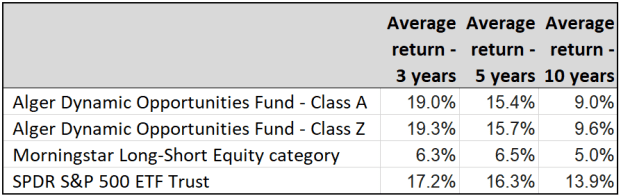

Here’s a comparison of average annual returns for longer periods through April 2, for the fund, the Morningstar Long-Short Equity category and SPY:

(Morningstar, FactSet)

Those returns are after expenses and exclude sales charges (if any) for the Class A shares. For the fund’s Class A shares, the investment minimum is $1,000, the maximum sales charge is 4.5% and annual expenses are 2% of assets under management. That’s a high management fee compared to most mutual funds. However, Morningstar considers it “below average” for its Long-Short Equity category. The Class Z shares have a $500,000 investment minimum and a 1.75% expense ratio. Sales charges and account minimums can vary depending on investment advisers’ relationships with Alger.

You can see that the outperformance during 2020 led to the fund beating its category and SPY for three years. It also trounced the category for five and 10 years. While it trailed SPY for those longer periods, this is in keeping with the lower-volatility strategy.

Navigating the pandemic

The Alger Dynamic Opportunities Fund doesn’t take concentrated positions in individual companies. It held 135 stocks (“long positions”) as of Dec. 31, with 74 short positions. Shorting a stock means borrowing shares and immediately selling them, hoping to repurchase them later at a lower price, returning them to the lender and pocketing the difference.

Chung said the fund’s strategy is to “invest in dynamic growth companies” rather than focus on riding the wave of price momentum. At the same time, the fund will short “companies with deteriorating fundamentals,” he said. But the short strategy also incorporates qualitative factors, including the threat from competition and a company’s strategy for retaining its market share.

While Chung was unable to discuss any short positions, he provided an example from many years back of a company he and his team decided to avoid. The fund had a large position in Research In Motion, the maker of BlackBerry phones, which were popular in the pre-iPhone/Android era because of their email capabilities. (RIM was renamed BlackBerry

BB,

in 2013.)

“We loved RIM/Blackberry as a growth stock,” Chung said. “But in this case we saw competition coming. [For] the early smartphones, the main thing they would do, which was new, was to be able to browse the web.” So Alger ended up selling the shares.

When discussing the fund’s outperformance during 2020, Chung said: “We didn’t predict COVID-19, but we were concerned about the levels the market had reached at the end of 2019.”

During 2019, the S&P 500 Index returned 31.5%. One way the fund hedged itself was by shorting exchange traded funds. Chung didn’t specifically say which ones the fund had shorted at the beginning of 2020, but he did say that at times it has shorted SPY and ETFs that track the Russell 1000 Index

RUI,

Russell 2000 Index

RUT,

or subsets of those indexes.

As of Dec. 31, 2020, the fund’s largest short position was the iShares Russell 2000 Growth ETF

IWO,

It had also shorted the iShares Russell Mid-Cap Growth ETF

IWP,

and the iShares Russell 1000 Growth ETF

IWF,

“It is not that we are particularly negative on the Russell 2000 or small growth stocks,” Chung said. “One of the things we to do be conservative, is that because we are long a lot of small-cap growth stocks, we also have a short position in an ETF that holds small growth stocks. We will often use ETFs to do that because they are efficient and cheap.”

Long positions — taking advantage of trends

When asked how the fund continued to outperform as the broad market recovered from its March 2020 low and then soared, Chung said the Alger team took advantage of trends that were accelerated by the pandemic. This meant increasing the size of its investments in ecommerce companies, including Amazon.com Inc.

AMZN,

and Chegg Inc.

CHGG,

which provides online education services. Chung also pointed to CrowdStrike Holdings Inc.

CRWD,

which develops cloud security software.

The Alger Dynamic Opportunities Fund also has long positions in Shopify Inc.

SHOP,

which provides an ecommerce platform to merchants, and Wayfair Inc.

W,

an ecommerce site that focuses on furniture and housewares.

One negative trend exacerbated by COVID-19 has been the difficulty for landlords holding brick-and-mortar retail properties.

“In this crisis, a lot of real estate in the shopping area will default and change hands,” Chung said. This expectation has led Alger to take a long position in Simon Property Group Inc.

SPG,

which Chung called “the best capitalized and best-positioned [of shopping-mall owners] to buy things on the cheap.”

Two companies with “high moats”

Chung named two more long positions — companies that suffered last year but that he believes “are very likely to benefit from the recovery,” in part because of “high moats” for competitors to cross:

Heico Corp.

HEI,

makes replacement parts for aircraft.

“They are the leading supplier of FAA-approved parts for aerospace engines and planes,” Chung said.

Going back to that peak-to-trough period of Feb. 19 through March 23 last year, the stock fell 49%. But it wound up gaining 16% for 2020 before pulling back 3% so far in 2021.

Chung said that during ordinary times for the airline industry, Heico grows its sales at an annual pace of 7%.

“We can all see that one of the biggest things consumers want to get back to is travel. The airlines will need to ramp up their flights and they have to maintain the planes,” he said. He called Heico a “high-margin business,” with operating margins of about 22% during normal times, with earnings and free cash flow growth “in the low-teens, long-term.”

The second company, CoStar Group Inc.

CSGP,

provides detailed information about commercial properties to real estate brokers. Chung said the company was “like Bloomberg,” in its niche, because its proprietary data is indispensable to brokers. He said that over the long term, CoStar tends to grow sales in the “mid-teens,” and earnings and free cash flow at annual rates of more than 20%.

Don’t miss: These infrastructure stocks could rise up to 41% in a year on Biden’s massive spending plan, analysts say