This post was originally published on this site

U.S. stocks are starting the quarter in positive territory after President Joe Biden rolled out his $2.3 trillion infrastructure plan. Biden described it as a “once-in-a-generation investment in America” in a speech on Wednesday.

American manufacturers grew faster in March as the key ISM manufacturing index hit a 38-year high, providing further impetus for the stock market.

Investors will be closely the nonfarm payrolls report on Friday, when markets in the U.S. and Europe will be closed for the Good Friday holiday.

The U.S. dollar

DXY,

also remains in focus, as its recent rebound has raised concerns among stock-market bulls. However, in our call of the day, Citi strategists argued that U.S. stocks may even outperform as the dollar’s rally continues.

Citi foreign exchange strategists noted that the DXY benchmark — measuring the dollar’s value against a basket of currencies — is up 4% since mid-February and expected the U.S. dollar rally to continue, citing the rapid U.S. COVID-19 vaccine rollout in the near term and higher fiscal stimulus over the medium term.

But the bank’s global equity strategists said that didn’t necessarily mean stocks were set to fall, as history may suggest.

“A stronger dollar can be a brake on risk assets, although is not fatal if the global economic recovery continues,” they said.

Citi’s three-stage “dollar smile” model shows a rising dollar and a slowing global economy in March 2020 and then a falling dollar and expanding economy in the second half of last year. It said it was now time for stage 3, which would see the dollar rise and economy expand.

Stage 1 saw risk appetite drop as markets priced in a global slowdown, with the dollar becoming a safe haven currency, while in stage 2 risk appetite recovered as the economic outlook improved and the dollar dropped back.

“Next the U.S. dollar starts to move back up towards the right of the smile. The global economic recovery continues with the U.S. leading the way. Treasury yields rise further as markets contemplate potential rate hikes from the Fed,” it said. “This strategy is starting to work now,” the Citi team added.

Citi’s strategy for stage 3, which it said was happening now, advises investors to be overweight on U.S. stocks and Japanese equities, if the yen is hedged, but underweight on emerging market and U.K. stocks. When it comes to sectors, the team is overweight on industrials, financials and information technology and underweight on consumer staples, materials and communication services. Investors should also consider taking profits on commodities.

As the dollar keeps rising — to complete the ‘dollar smile’ — it will start to “prove a drag on risk assets,” the team said, adding that it was too early to call the next bear market but that investors should be more careful.

The team said this was a “simplistic strategy” based on previous periods when the dollar was rising alongside an global economic expansion and noted other themes, such as rising bond yields and value rotation that may deliver contradictory messages. “Nevertheless, our analysis should give a good feel for how investors might integrate a rising U.S. dollar into equity portfolios,” Citi said.

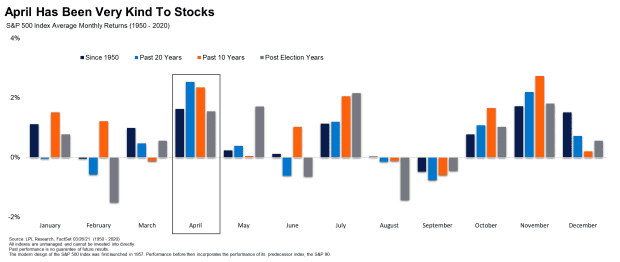

The chart

This chart from LPL Financial shows that April has historically been a great month for stocks, in fact it has been the best month over the past 20 years and the second best since 1950. Chief market strategist Ryan Detrick said stocks have closed higher in April in 14 of the past 15 years.

Source: LPL Research, FactSet

The markets

U.S. stocks

DJIA,

COMP,

moved higher early on Thursday in the aftermath of Biden’s infrastructure speech and better-than-expected manufacturing data. European and Asian stocks were also buoyed by the infrastructure spending proposal, with Asian indexes making modest gains overnight and the Stoxx 600

SXXP,

rising 0.4% in early trading.

The buzz

Tech giant Apple

AAPL,

will use electric-car maker Tesla’s

TSLA,

battery packs to store energy from a solar farm in North Carolina, according to a report by The Verge.

Chinese electric-vehicle makers Nio

NIO,

and XPeng

XPEV,

both reported big gains in first-quarter deliveries early on Thursday.

Frontier Group Holdings, the parent of low-cost carrier Frontier Airlines, said its initial public offering will price at $19 a share, the low end of its price range.

Pharmaceutical company Johnson & Johnson

JNJ,

acknowledged on Wednesday that a batch of its COVID-19 vaccine produced by one of its manufacturing partners “did not meet quality standards,” and said it will provide more experts to oversee production.

Miley Cyrus is giving away a total of $1 million worth of stock in partnership with Square Inc.’s

SQ,

Cash App, the singer tweeted on Wednesday.

Cannabis exchange-traded funds are benefiting from news that pot is now legal in New York state, with one breaking higher than the rest.

Netflix

NFLX,

has reached a deal for two sequels to director-screenwriter Rian Johnson’s “Knives Out,” with the streaming giant set to pay close to $450 million, according to reports.

Random reads

10 stories that look like April Fools’ Day pranks but aren’t.

So-called covidiot campers pitch tents just feet from the edge of a crumbling cliff.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.