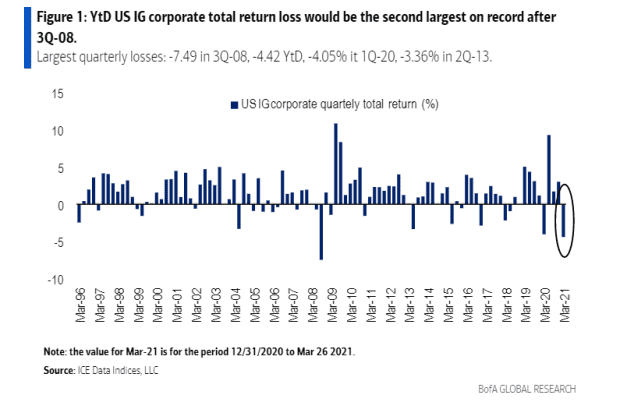

It has been a weird and wild past three months in financial markets, culminating in the worst quarterly loss for the biggest part of the $10.6 trillion U.S. corporate bond market since the 2008 global financial crisis.

The investment-grade tracking ICE BofA U.S. Corporate index on Wednesday booked a negative-4.495% total return for the first quarter of 2021.

That marked the wost three months for the benchmark since its historic 7.49% loss in the third quarter of 2008, during the global financial crisis, according to analysts led by Hans Mikkelsen at BofA Global Research, who flagged the looming milestone earlier in the week.

Worst loss for investment-grade corporate bonds since ’08.

BofA Global Research

Mikkelsen’s team noted the latest quarterly loss for the index exceeded the negative-4.05% return recorded during the liquidity crisis that erupted in the first quarter of 2020 at the onset of the coronavirus pandemic in the U.S.

It also surpassed the 3.36% loss booked in the second quarter of 2013 as a result of the “Taper Tantrum,” a volatile period sparked by then-Federal Reserve Chairman Ben Bernanke, who in late June of that year said the central bank planned to roll back its bond-buying program later in the year.

But bond-market pros said the recent rough patch for corporate bonds doesn’t necessarily mean red flags for the market.

“You can see these poorer returns when things are going well,” Collin Martin, fixed-income strategist at the Schwab Center for Financial Research, told MarketWatch. “I’m not panicking too much, because the outlook is positive.”

Martin pointed to the 10-year Treasury yield

TMUBMUSD10Y,

rising to a one-year high of 1.749% as of Wednesday as a catalyst for the rough quarter, but suggested that the spike in yields serves less of a warning shot than a nod to the economy’s continued recovery from the worst public-health emergency in a century, and that “we are getting closer to the exit of the pandemic.”

The benchmark Treasury yield has increased by about 1.24% from a historic low of 0.514% in August, according to Dow Jones Market Data.

“Fifty basis points on the 10-year Treasury might have made sense when half of the world was shut down and we didn’t know what the future looked like,” Martin said.

But even with rising benchmark rates, he still thinks it’s a “borrower’s market,” with overall yields hovering near historic lows.

Corporate bonds are priced at a spread, or premium, above the risk-free Treasury rate, which aims to compensate investors for the added risk of a company’s potential to default.

“It’s interesting, because credit spreads are tighter now than at the beginning of the year,” said John Luke Tyner, fixed-income analyst at Aptus Capital Advisors. “All of the pain has come from interest-rate risk.”

Tyner said many corporations this year “saw the writing on the wall,” and moved to lock in lower borrowing costs on the expectation that benchmark yields would continue to climb from the lows.

The yield on the ICE BofA US Corporate Index was last spotted at 2.28%, down from a pandemic high of about 3.68% a year ago.

The sector’s popular exchange-traded fund, the iShares iBoxx $ Investment Grade Corporate Bond ETF

LQD,

was down 5.9% on the year to date, according to FactSet.

“Moving forward, I’m a little nervous,” Tyner said, adding that “the rate risk is really high, but you are getting paid really nothing in terms of credit risk.”

Sunny Oh contributed reporting.