This post was originally published on this site

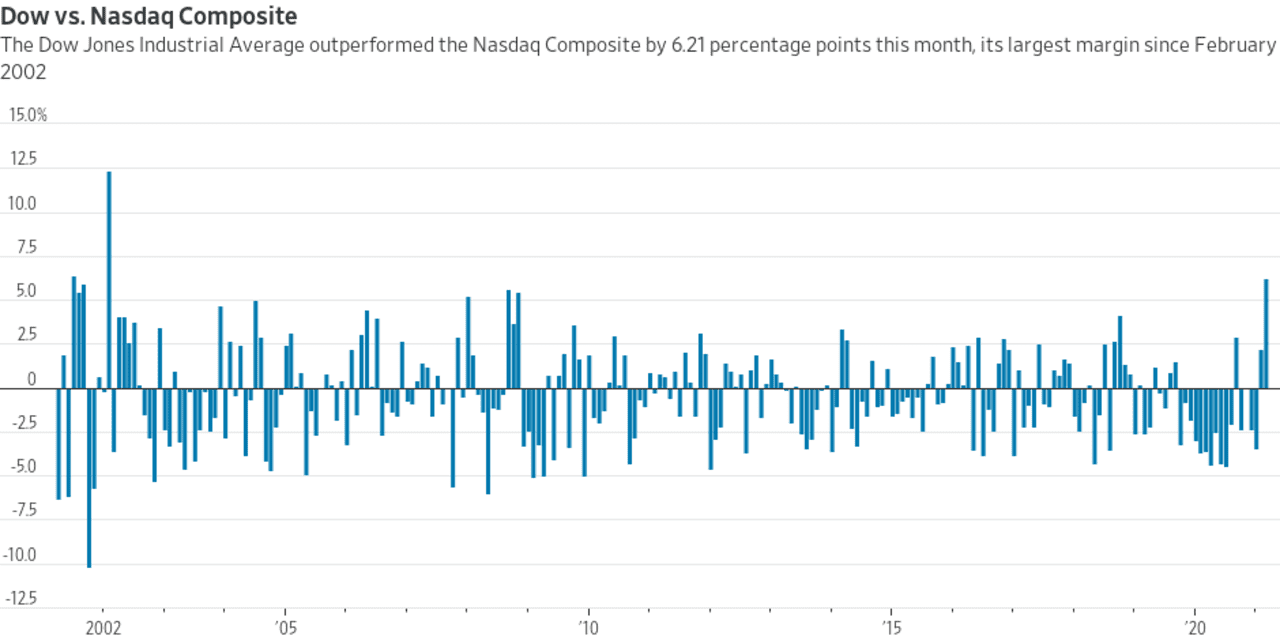

In like a lamb, out like a lion. That’s how the trading action appeared to conclude for the Dow Jones Industrial Average in March, with the blue-chip index booking its widest monthly outperformance against the Nasdaq Composite in nearly a decade.

The Dow

DJIA,

wrapped up trading in the final day of the month with a 6.62% return in March, compared with a measly 0.41% gain for the technology-laden Nasdaq

COMP,

over the same period. The S&P 500 index

SPX,

also put in a solid 6.6% gain in March.

The 6.21 percentage-point outperformance by the Dow over the Nasdaq represented the biggest monthly spread between the main equity indexes since February 2002, according to Dow Jones Market Data.

The nearly 125-year Dow has only outperformed the Nasdaq Composite by this great a margin in a month on 19 occasions, since the inception of the techy index in 1971.

It is notable, however, that on average the divergence in performance in the following month tends to continue, according to the Dow Jones data folks.

Following such outperformances, the Dow on average has returned 0.72%, while the Nasdaq Composite has averaged a decline of 0.72%.

The backpedaling for the Nasdaq Composite in March comes as benchmark bond yields have been on the rise, helping the Dow makeup ground, pushing it to a year-to-date gain of 7.8%, versus a 5.8% gain for the Nasdaq. However, the Nasdaq still holds on to a substantial edge over the past year, up 72% compared with the Dow’s 50% return.

Because the Nasdaq Composite maintains a heavy concentration of technology and tech-oriented companies, the index tends to be more vulnerable to the increase in borrowing costs that rising yields indicate.

Investors are being forced to reassess the risk/reward of speculating further on tech highfliers that enjoyed a major bounce during the height of the deadly pandemic. Some are considering putting money elsewhere, including in assets that could outperform in better economic times.

COVID vaccine rollouts and trillions of dollars in fiscal spending are expected to accelerate the economy’s rebound out of the depths of the public health crisis, which could further drive up rates and place additional pressures on techy names.

Meanwhile, it is worth noting that April has tended to be a strong month for stocks in recent history. LPL Financial Chief Market Strategist Ryan Detrick said that April has represented an incredible run for stocks, boasting gains in 14 out of the past 15 years. Over the past 20 years, April has been the greatest month for stocks and the second-best month since 1950, according to LPL analyst.

However, MarketWatch columnist Mark Hulbert warns that investors shouldn’t place too much emphasis on season trends. He notes that April’s performance before 2000 wasn’t always this good.

“In fact, when we analyze all years since the Dow was created in the late 1800s, we cannot conclude at the 95% confidence level that April’s performance is any different than the average.”

—Mike DeStefano contributed to this article