This post was originally published on this site

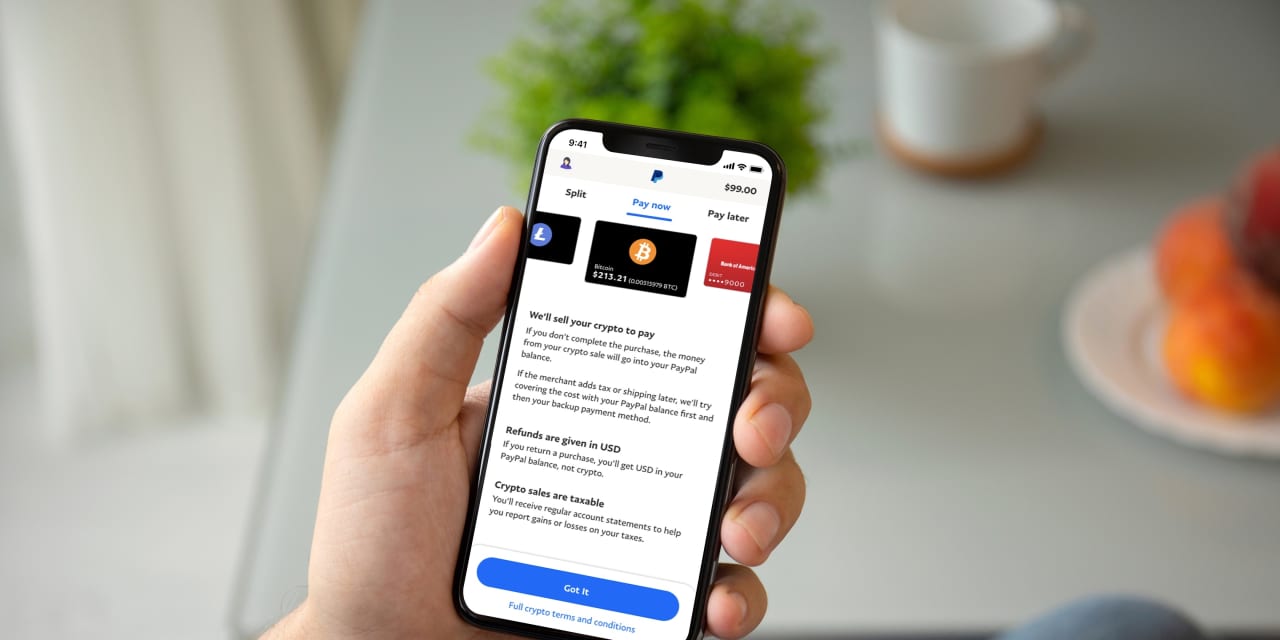

PayPal Holdings Inc. will start letting its U.S. customers purchase items with cryptocurrencies in the latest embrace of digital assets by a traditional payments player.

The company announced Tuesday that U.S. customers who hold cryptocurrencies in their PayPal

PYPL,

mobile wallets will be able to use those digital assets to buy goods from PayPal merchants beginning today. The feature will initially be available with millions of PayPal merchants, with plans to add more in the months to come.

Through the feature, called Checkout with Crypto, PayPal users will be able to choose from bitcoin

BTCUSD,

litecoin

LTCUSD,

ethereum

ETHUSD,

or bitcoin cash

BCHUSD,

the company said. They’ll have the ability to select their preferred cryptocurrency at checkout depending on the types of crypto holdings they have and whether they have enough to cover a given purchase.

PayPal said that it won’t charge a transaction fee for consumers checking out using cryptocurrencies and that a conversion spread will be built into the conversion from crypto to U.S. dollars.

“Enabling cryptocurrencies to make purchases at businesses around the world is the next chapter in driving the ubiquity and mass acceptance of digital currencies,” Chief Executive Dan Schulman said in a statement. The company previously teased its plans to roll out crypto checkout capabilities.

The company plans to settle all of the transactions in U.S. dollars and convert payments to the applicable currencies of its various merchants at its usual conversion rates.

PayPal previously rolled out the ability for users to buy, sell, and hold cryptocurrencies, working with Paxos Trust Company, a virtual-currency provider that maintains the crypto holdings of PayPal customers. PayPal itself doesn’t currently plan to purchase crypto for investment or cash-management purposes, a spokesperson told MarketWatch, and while the company may ultimately decide to hold some balance for operational purposes, it hasn’t yet deemed that necessary.

The company views cryptocurrencies as a way to get customers to engage further with its platform. Those who’ve purchased cryptocurrencies through PayPal thus far have logged into PayPal at twice the rate that they did before, the company shared at its recent investor-day presentation.

Other financial-services companies have moved to embrace cryptocurrencies in their own ways. Mastercard Inc.

MA,

plans to begin letting merchants directly accept some cryptocurrencies later this year, though the company plans to be selective, with a focus on digital assets that have some price stability and meet various standards for compliance. Square Inc.

SQ,

lets customers buy and sell bitcoin through its mobile wallet, and Visa Inc.

V,

recently announced a pilot program allowing crypto platforms to settle transactions made with their issued Visa cards without converting funds to fiat currency.

PayPal shares have gained 152% over the past 12 months as the S&P 500

SPX,

has risen 56%.