This post was originally published on this site

U.S. stocks fell at the open on Thursday following Wednesday’s technology selloff on Wall Street despite better-than-expected jobless claims data.

Overnight, Chinese tech stocks were hammered as the U.S. securities regulator said it has put into practice a new law that could lead to a delisting from U.S. markets.

U.S. jobless claims reached their lowest level of the pandemic last week, coming in at 684,000. Economists surveyed by Dow Jones had forecast new claims would fall to 735,000. U.S. GDP growth in the fourth quarter was revised upwards to 4.3% in further signs the economy is speeding up.

Despite the recent pressure on stocks, in our call of the day, Barclays said it was “all systems go” with the risk rally set to continue and global growth set for its fastest pace in four decades.

The bank, in its latest global outlook, said fears of the U.S. economy overheating wouldn’t derail the risk rally, urging investors to stay overweight on equities.

“Yes, equity multiples have expanded over the past year, but much of the rally has been due to the absolutely stunning recovery in earnings,” said head of macro research Ajay Rajadhyaksha.

He noted that S&P 500

SPX,

earnings weren’t expected to reach 2019 levels until at least 2021, but fourth-quarter 2020 earnings beat those of a year earlier. “A complete V-shaped recovery within a year despite the backdrop of continued pandemic-related restrictions,” he added.

The earnings outlook, a consensus for more than 21% growth between 2020 and 2021 was another reason to be bullish, Rajadhyaksha said.

Equity market valuations might look elevated relative to history, but the “scale of positive news expected in the coming quarters means that stocks still don’t look expensive to us,” Barclays added.

The bank maintained an S&P 500 year-end 2021 target of 4,000, and within U.S. stocks it was overweight on industrials and healthcare as well as hardware and semiconductors. The strategists added that valuations looked more attractive in the U.K. and euro area, despite the latter’s slow COVID-19 vaccination rollout.

In Europe, the bank is overweight value stocks such as financials and commodity-linked stocks, but more selective on cyclical sectors, and underweight defensive sectors.

Even the bond selloff in the first quarter, which threatened to halt the rally, merely reflected a brighter growth picture, but Barclays said it remained a risk.

“Admittedly, the fly in the ointment is the bond selloff and the fear that inflation will force the Fed into an aggressive hiking cycle that crushes the risk rally. We think these fears are overdone,” the bank said.

“The bond market took its best shot at derailing the risk rally in Q1. And failed.”

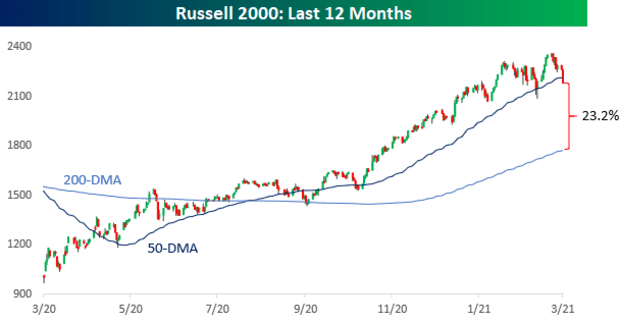

The chart

The Russell 2000

RUT,

closed below its 50-day moving average (DMA) but more than 20% above its 200-day moving average on Tuesday, for the first time in the index’s 42-year history, Bespoke Investment Group noted. The index’s worst day in nearly a month ended its longest streak of closes above its 50-day moving average in 10 years.

Bespoke Investment Group

Four out of the five times the index has closed below its 50-DMA and more than 15% above its 200-DMA occurred “early in multiyear bull markets,” Bespoke added.

The markets

U.S. stocks

DJIA,

COMP,

opened lower of the open, with the Nasdaq 0.7% down after falling 2% on Wednesday. European stocks edged lower as concerns over a third coronavirus wave on the continent remained in focus. Oil prices

BRN00,

CL.1,

fell back early on Thursday after shooting higher on Wednesday amid the continuing Suez Canal blockage.

The buzz

AstraZeneca

AZN,

announced updated Phase 3 trial data of its vaccine on Wednesday night, saying it is 76% effective at preventing symptomatic COVID-19. The U.K.-Swedish drug company originally said on Monday its vaccine had a 79% efficacy rate.

H&M

HM.B,

and other clothing and footwear brands, including Nike

NKE,

and Adidas

ADS,

are facing a backlash in China for raising concerns over forced labor in the Xinjiang region.

GameStop

GME,

stock suffered its worst day in seven weeks on Wednesday, after fourth-quarter profit and sales missed expectations. The videogames retailer’s stock was also downgraded by Wedbush analyst Michael Pachter.

The Suez Canal, one of the world’s most important trading routes, remained blocked by a large cargo ship as efforts to free the vessel entered a third day.

The European Union set out proposals for tougher controls of COVID-19 vaccine exports to the U.K. and other countries with better vaccination rates. The proposals will be debated on Thursday but tensions between the U.K. and EU may be eased by a reported deal to cooperate.

Random reads

The U.K.’s new £50 note honoring mathematician Alan Turing will feature GCHQ’s “toughest ever puzzle.”

Nice catch: Fisherman rescues boy stranded on ice.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.