This post was originally published on this site

European stocks edged lower on Thursday, as the market seems to have severed its lockstep movement with bonds for the first time in months.

The Stoxx Europe 600

SXXP,

traded 0.1% lower, following weakness in the U.S. on Wednesday, in the technology-heavy Nasdaq Composite

COMP,

in particular. The drop came in a session with little movement in the bond market, with the yield on the 10-year Treasury

TMUBMUSD10Y,

at 1.62% on Thursday. Tech stocks of late have been pressured when bond yields climb, as it makes their relative valuation look worse.

U.S. stock futures

ES00,

NQ00,

rose, however, in early Thursday morning action.

The Suez Canal was blocked for a second day, idling at least 150 ships in the key shipping lane.

AstraZeneca

AZN,

AZN,

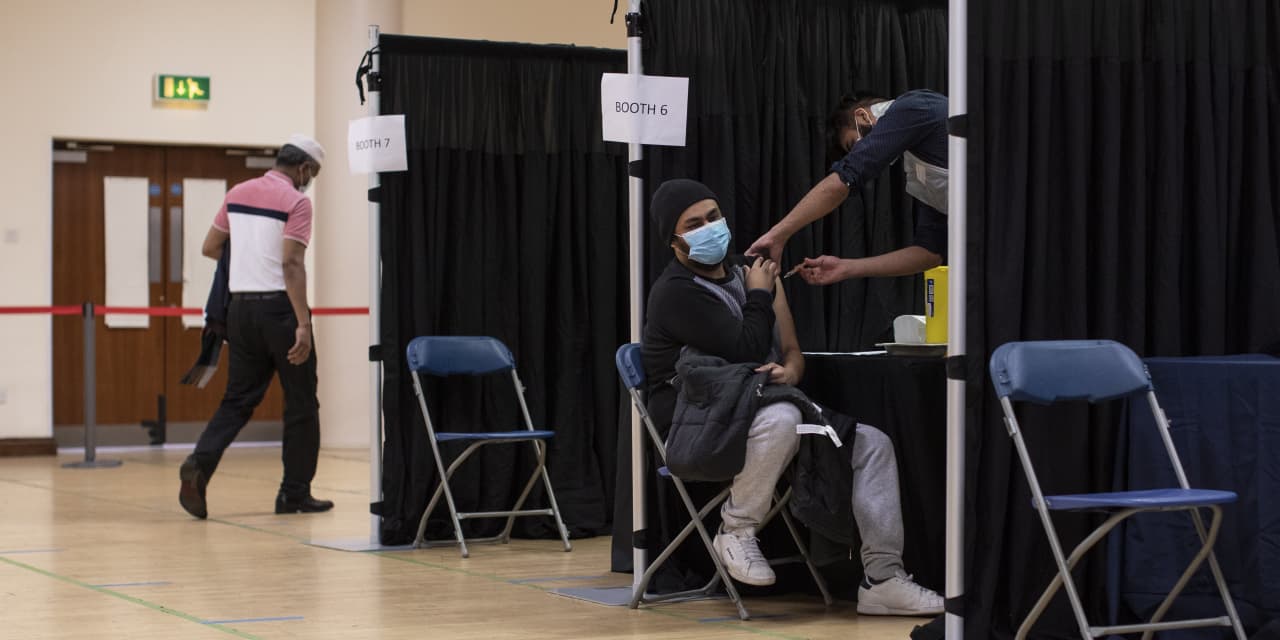

shares rose 0.9% after the drug company revised lower its estimate of its vaccine efficacy to 76% from 79% following a dispute with a U.S. regulator. AstraZeneca’s vaccine production is at the heart of a dispute between the U.K. and the European Union, and the two sides on Wednesday said they would look to expand vaccine supply for all.

Cineworld

CINE,

shares tumbled 9%, after the company said it is planning to issue a $213 million convertible bond at a 7.5% interest rate. The cinema operator recorded a $1.3 billion pretax loss in 2020 and said its base case is that its cinemas will reopen in May.

Aroundtown

AT1,

shares fell 5%, as the operator of commercial real estate in Germany and the Netherlands reported a sharper-than-forecast 29% drop in funds from operation per share in 2020 and guided for a weaker 2021 performance than analysts anticipated.