This post was originally published on this site

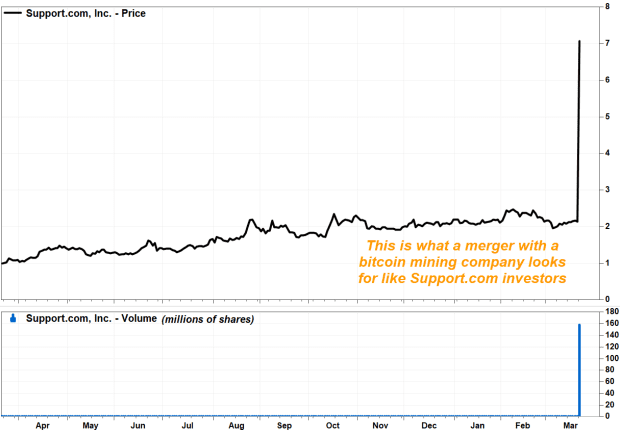

Shares of Support.com Inc. more than tripled on massive volume Monday, after the provider of technical support services and cloud-based software announced a deal to be acquired by bitcoin mining company Greenidge Generation Holdings Inc.

Support.com’s stock

SPRT,

skyrocketed 244.4% in morning trading, to put it on track for the highest close since August 2014. Trading volume exploded to 161.9 million shares, which already marks a one-day record for the stock, and is multiples of the full-day average of about 148,000 shares over the previous 30 days.

The stock is currently both the biggest percentage gainer and most actively traded on major U.S. exchanges.

Privately held Greenidge said it expects to be the deal would make it the first publicly traded bitcoin mining company with a wholly owned power plant.

Under terms of the deal, about 5% of Greenidge shares will be paid to Support.com shareholders for Support.com’s assets. In addition, about 3% of Greenidge shares will be paid for the estimated $33 million of cash expected to be on Support.com’s balance sheet.

As part of the deal, 210 Capital LLC acquired 3.9 million shares of Support.com in a private placement. Following the private placement, Support.com has about 23.6 million shares outstanding.

That means at current prices, Support.com’s market capitalization would be $173.9 million.

FactSet, MarketWatch

After the deal closes, which is expected to occur in the third quarter of 2021, Support.com shareholders will own about 8% of Greenidge’s shares outstanding.

“This transaction will build upon Greenidge’s successful business by providing them with additional cash funding and a public currency to fund their growth plans, as well as important new capabilities including customer interface, security software, and privacy expertise,” said Support.com Chief Executive Lance Rosenzweig.

Support.com’s stock has now run up 636.9% over the past 12 months, while the S&P 500 index

SPX,

has rallied 70.8%.

Greenidge started out in 1937 as a coal-fired plant commissioned by New York State Electric and Gas Corporation (NYSEG), until AES Corp.

AES,

bought the plant in 1999. Private funds managed by Atlas Holdings LLC acquired the plant in 2014. In 2020, Greenidge launched a data center for blockchain mining.