This post was originally published on this site

“Past performance is no guarantee of future results” is one of the most frequently uttered phrases by fund managers. It’s a way for financial-services companies to cover their butts while crowing about their track records, and it’s also a behavioral-finance axiom that warns investors not to get sucked in by the shiniest thing in the market right now.

But what if it’s not true?

In an analysis published in early March, Morningstar’s global head of research, Jeffrey Ptak, found that funds that have tended to outperform in recent years have been recent winners, while recent losers are the ones that have lagged.

“You heard that right: Past performance has been predictive lately,” Ptak wrote.

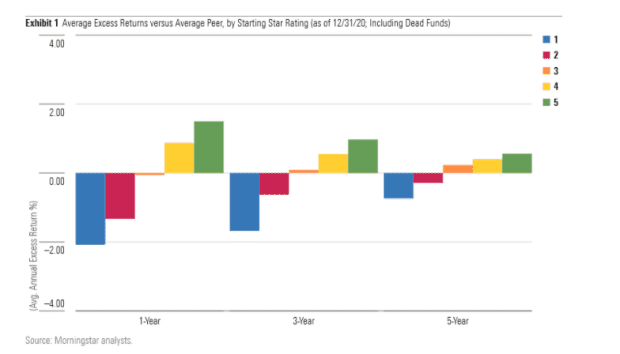

Ptak used funds’ Morningstar fund ratings to determine “past performance,” since they are based on risk-adjusted returns compared to peers.

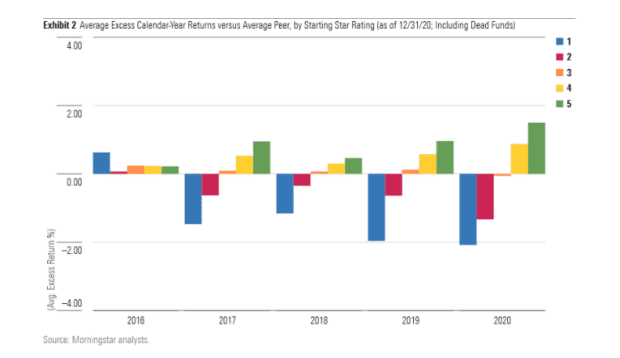

The chart above shows that the average highly-rated fund has outperformed its peers over one, three, and five year timeframes. And, as shown in the chart below, the gaps are getting bigger. “In fact, 2020 was one of the best years ever for chasing performance–if you plowed your money into the previous winners at the start of last year and avoided the past losers, that paid off,” Ptak writes.

It all comes down to what Ptak calls a “mundane” explanation: “performance trends persisted.”

That is, for several years in a row, investors rewarded the same investments, whether that was determined by asset class, style, size, or a variety of other classifications. “The trends that took shape from 2017 to 2019 were only accentuated in 2020,” he concludes.

That’s familiar to anyone who watched, week after week, as behemoth technology giants continued to grow sales and earnings, only to dominate in 2020, as global shelter-in-place orders forced many people to do more online than ever before.

It’s important to note that Ptak doesn’t think this period of past persistence will prevail. In fact, if the outsize market moves of the past couple of months are any indication, it may be a sign that everything – even persistence trends – revert to the mean.

See: Value stocks are so in favor they’ve become momentum stocks