This post was originally published on this site

Well, here’s some cheerful news in this vale of tears.

About 12% of working baby boomers have responded to the catastrophe of the past year by saying they are going to retire earlier than they’d planned—and, happily, are in a financial position to do so.

So reports a new survey by insurance company MetLife

MET,

They spoke to 600 workers nearing retirement.

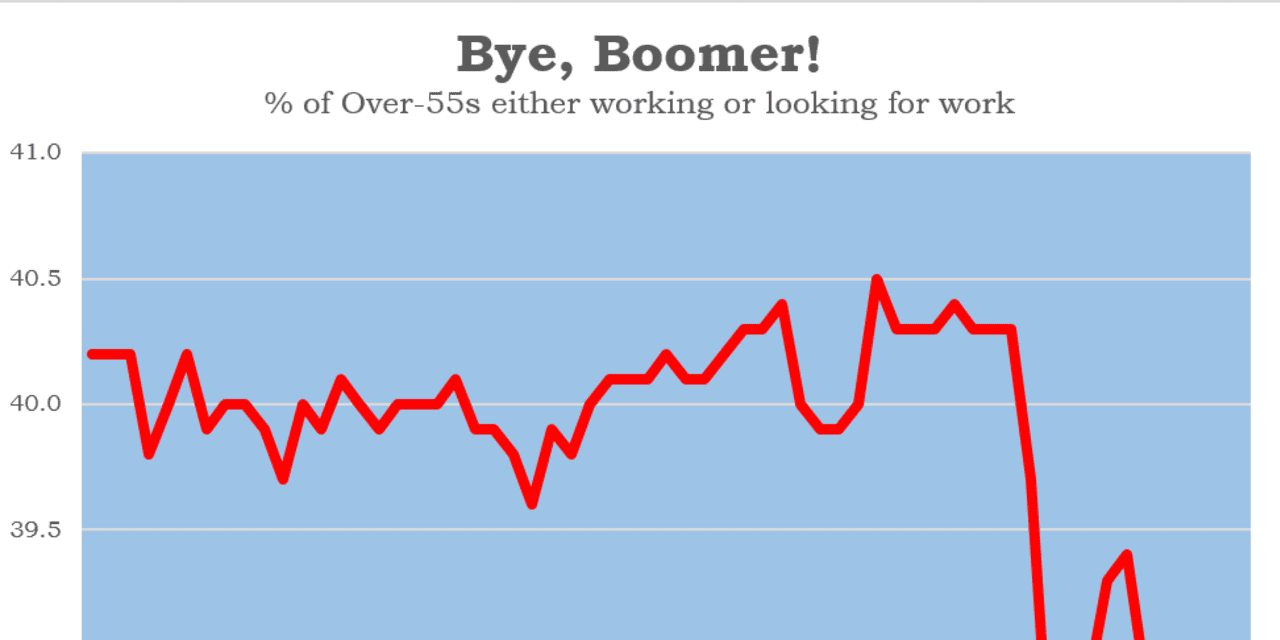

And their findings are confirmed when you look at the so-called “labor-force participation rate” published by the U.S. Department of Labor every month. The “participation rate,” far less well known than the official unemployment rate, looks at the percentage of the population who are either in work or who are looking for work.

In the past 12 months it has plummeted among the over 55s. And, noticeably, there has been no rebound lately.

“One in 10 boomers said the pandemic caused them to retire sooner than they expected,” Roberta Rafaloff, vice president at MetLife, tells me. “Their reason for retiring sooner is that ‘life is too short—take advantage of it while you can.’”

She adds that in MetLife’s surveys, “This idea that ‘I’m going to retire sooner because I want to live my best life (while) I still can, that’s something new.”

Many said also said they wanted to retire early to spend more time with their families.

Most of those planning to retire earlier than planned say they’re intending to pull the plug in the next two years.

It’s a refrain familiar to all those pounding the Financial Independence, Retire Early mantra for the past decade—though retiring at 55 or 60 is very different from trying to retire at 40.

The part of FIRE I am totally down with is making yourself financially independent as soon as you possibly can. And not just independent of your current employer, but independent of the economy.

Whether you want to retire early probably depends on how you feel about your job, as well as who you are. (An old family member who died recently, at a ripe old age, was retired for as long as he had worked. Thanks to some clever negotiating and a terrific pension, he quit work in his 50s and used to say retiring early, “was the best thing I ever did.”)

It may be too soon to call the end of the Age of the Boomers. Another 20% told MetLife they have been forced to delay their retirement after the past year, mainly for financial reasons. They said they need more income, or the crisis has hit their ability to save.

It is one of the many financial tragedies for working people that so many of them have been deprived of their ordinary income, and therefore the ability to save, precisely at the moment when the rewards for new investment have been so great. Even measured from the beginning of March last year, before the total market meltdown, the broad S&P 1500 stock market index

SP1500,

has earned you a fat 38% return. From the lows it’s nearly doubled.

As mentioned here a year ago, if you invest in stocks during the depths of a crisis and can hold on for a year you’re generally sitting pretty.

But the Investment Company Institute, the mutual-fund industry’s trade association, reports that individual investors sold down their stock market investments—through mutual funds and ETFs—in all but one month last year, even while the market rose.

It is an old saw that so-called retail or individual investors are generally the worst market-timers in practice. They tend to buy and sell at the wrong time. During the generally flat decade for U.S. stocks between 2000 and 2010, anyone lucky enough to buy when Main Street was selling and sell when Main Street was buying would have ended up making good money.

It’s why individual investors often end up making a fraction of the returns from stocks that they could do and should do.

And that, in turn, means fewer can retire early, and more have to work longer.

What theorists often forget is that it’s not simply a matter of psychology. People may sell because they need the money, and that happens at precisely the worst times: Like last year, or during 2008-9, or in previous recessions.

The smartest move in a crisis for those who have to liquidate stocks to live may be to transfer a small portion of the money into equity call options, which keep them exposed to any stock market recovery without committing all, or most, of their cash. I wonder how many Main Street investors know about this quite simple option or are advised on it.

Options are usually labeled “risky,“ but done right they are almost the opposite of risk: They put very little of your overall savings at risk of permanent loss.

Meanwhile, for anyone feeling cheerful, remember the rules about Main Street buying and selling at the wrong time, and consider this: With the US S&P 1500 already more than twice its 2000 and 2007 peaks, and stock market valuations far above historic averages, ICI reports that individual investors started buying stock market funds again last month.