This post was originally published on this site

Electric-vehicle stocks suffered a correction early in 2021, but still appear to be popular investment targets that retain much of their shocking 2020 increases in valuation while putting billions in funding to use.

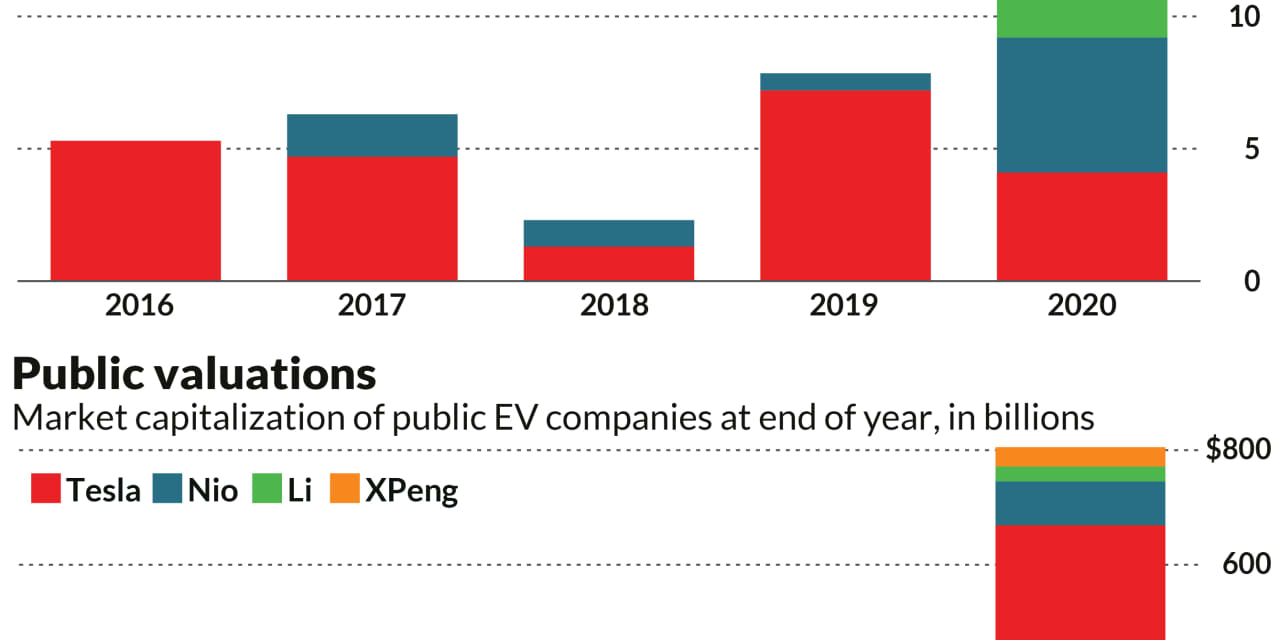

Two pure-play EV companies with autonomous ambitions, Tesla Inc. TSLA, +1.90% and Nio Inc. NIO, -0.78%, came into 2020 with a combined market cap just shy of $80 billion; by the end of the year, Nio was worth almost that much on its own, Tesla’s market capitalization had jumped to more than $650 billion, and two other Chinese EV companies — Li Auto Inc. LI, +0.95% and Xpeng Inc. XPEV, -0.06% — had joined the party with initial public offerings. In total, the four companies ended 2020 valued by the market at over $800 billion, more than 10 times their combined market cap at the beginning of the year, according to figures from Dow Jones Market Data Group.

The two IPOs joined with stock and debt offerings from Tesla and Nio to generate more than $15 billion in funding to those four public EV companies in 2020, but even more money went into other EV and autonomous-technology companies. CB Insights tracked more than $20 billion in funding to those two sectors in 2020 — $12.8 billion for EV companies and $7.3 billion for AV tech, both records.

Money also poured into special-purpose acquisition companies, or SPACs, which raise money and then seek to merge with startups to create a public company. CB Insights tracked 22 SPAC mergers in the autos and mobility sector in 2020, the majority focused on electric vehicles, and there are plenty more on the hunt in 2021. The most prominent SPAC deals have been for U.S. electric-vehicle manufacturers — like Fisker Inc. FSR, -1.60% and Lucid Motors, which is in the process of combining with SPAC Churchill Capital Corp. IV CCIV, +6.61% — but spread out to AV tech as well, including big bets on LiDAR such as Velodyne Lidar Inc. VLDR, +6.64%

As these SPAC deals multiply, Tesla and the other already public companies are losing some of their gains: As of Monday, Tesla stock was basically even in 2021 trading despite a sharp drop in late February and early March, while its Chinese competitors had not bounced back all the way: Nio had lost 7.3% so far this year, Li was 9.8% lower and XPeng had fallen 17.8%.

Trading volumes for these stocks have mostly continued at levels that ramped up tremendously in the second half of 2020, however, and they have even accelerated in some cases.

For example, the dollar value of Tesla shares traded averaged $20.02 billion a day in 2020, a near eightfold increase from the daily average of $2.55 billion in 2019. In comparison, the daily average of SPDR S&P 500 exchange-traded fund SPY, +0.25% shares traded a day rose 51.3% to $30.72 billion.

The difference, however, is that while the average daily value (ADV) of the ETF traded in the second half of 2020 was $23.73 billion, or down 37.4% from $37.89 billion in the first half when markets were more volatile as the COVID-19 pandemic took hold, the ADV of Tesla shares traded jumped 111.7% to $27.07 billion in the second half, from $12.79 billion in the first six months of the year.

So far in 2021, the ADV of Tesla shares traded was $31.34 billion in January and $21.85 billion in February, above the 2020 ADV, while the ADV of the ETF traded of $27.81 billion in January and $26.60 billion in February, both below the 2020 ADV traded.

Elsewhere in the EV space, the ADV of Nio stock traded was $2.57 billion in 2020, up from $133.9 million in 2019, while ADV for the second half of 2020 was $4.78 billion, or 149.0% higher than the first half of 2020 ADV of $300.7 million.

General Motors Co. GM, -2.13%, which announced in March 2020 that it was going all-in in electric vehicles, saw its ADV of shares traded rise 39.5% to $459.6 million in 2020 from $329.4 million in 2019, with 2H20 ADV of $499.3 million rising 19.2% above 1H20 ADV of $419.0 million.