This post was originally published on this site

Another round of stimulus checks could provide a shot in the arm for stocks and, especially, bitcoin, according to a survey released Monday by Mizuho Securities.

The poll of 235 individuals who expect to receive checks courtesy of the latest round of COVID-19 relief signed into law by President Joe Biden found that two out of five recipients plan to invest at least some part of the proceeds into bitcoin and stocks. Based on the responses, around 10% of the total gross payments, or around $40 billion of the $380 billion in direct checks, could be allocated to the world’s most popular digital asset and stock purchases.

That’s in keeping with findings from other surveys and with a narrative that’s accompanied a surge in individual-investor activity over the course of the COVID-19 pandemic. Analysts and economists have speculated that boredom induced by the lockdowns coupled with earlier stimulus payments and a lack of activities to spend them on have sparked a surge in the opening of online brokerage accounts.

See: Individual investors are back — here’s what it means for the stock market

When it comes to the current round of payments, a Deutsche Bank survey late last month also found investors ready to use the money for trading. In fact, that poll found investors even more eager to push money into the market, estimating approximately $170 billion in potential stock-market inflows out of a then-estimated $465 billion in direct payments.

Drilling down, the Mizuho survey found around 20% of check recipients expected to allocate as much as 20% of their checks to bitcoin and/or stocks, while 13% expected to allocate 20% to 80%, and 2% expected to put 80% or more into the markets.

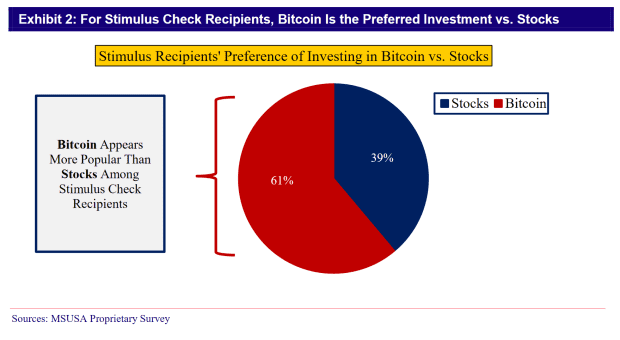

And between bitcoin and equities, the the cryptocurrency was by far the more popular choice.

Mizuho Securities

“Bitcoin is the preferred investment choice among check recipients. It comprises nearly 60% of the incremental spend, which may imply $25 billion of incremental spend on bitcoin from stimulus checks,” wrote Mizuho analysts Dan Dolev and Ryan Coyne, in a Monday note (see chart above). “This represents 2-3% of Bitcoin’s current$1.1 trillion market cap.”

Some Americans might already have received their money. The earliest batches of payments, coming in direct deposits, were due to hit accounts over the weekend. Paper checks and preloaded debit cards will start arriving in the coming weeks, according to IRS and Treasury Department officials. The IRS said it would not load the third round of payments on debit cards a person received in the first two rounds.

It all comes as bitcoin exhibits its trademark volatility, pulling back Monday after surging past the $60,000 milestone for the first time over the weekend. In recent dealings, bitcoin BTCUSD, -7.26% was down more than 6% at 56,337.

Stocks, meanwhile, were drifting lower after the Dow Jones Industrial Average DJIA, -0.19%, S&P 500 SPX, -0.19%, and the small-cap Russell 2000 RUT, -0.43% posted record finishes on Friday. Investors continue to monitor bond yields. The yield on the 10-year note TMUBMUSD10Y, 1.604% has risen for six straight weeks, sparking a rotation away from previously highflying large-cap growth stocks toward equities more sensitive to the economic cycle.

Also read: ‘There will be no peace’ until 10-year Treasury yield hits 2%, strategist says