This post was originally published on this site

Pre-retirees want to talk investment returns and review how much they have saved as they debate just how soon they can retire.

Few of them (or their advisers) actually know how much they spend. A spending conversation is not as sexy as one about the stock market. Yet, as I have told many clients, knowing your spending is the secret ingredient that will carry you happily through retirement for decades.

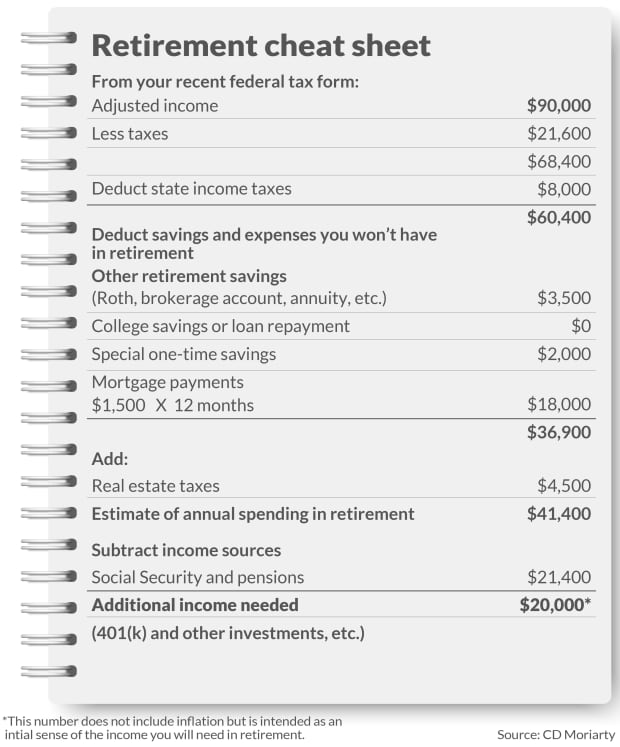

Here is a simple six-step process to figure out roughly what you spend now, how much income you need in retirement and whether you need to save more now so you can maintain your lifestyle.

If you are 10 years from retirement, you can use your current spending less the large savings you accumulate as your starting point.

Those more than 10 years from retirement need to be saving as much as they can, focusing on their asset and investment growth

1. Pull out your federal tax return. Look for the line described as “adjusted gross income” (line 11 in 2020 and line 8b in 2019, for example). It includes your salary (less any 401(k) contributions) as well as dividends, capital gains, alimony, and other income sources.

The rule of thumb is that you will spend 60% to 90% of your current income in retirement.

2. Now find the amount you paid in federal taxes, labeled “total tax” on your federal return. Do the same for the state and find the total tax. Deduct those amounts from your income.

You still will be paying taxes in retirement, but typically not as much. By calculating an amount you spend after taxes, we are focusing on the expenses you can control and change. Federal and state tax laws change, plus you may leave the state you are living in.

Now you know how much money you have available to spend every year after taxes. But we are not done.

3. You may be putting some of that money aside for retirement, a child’s college fund or for a special large expense, such as a once-in-a-lifetime trip, an anniversary party or a child’s wedding. You may also be repaying student loans. Subtract any of those expenses that you do not expect to have once you are retired, reducing the annual amount you will need in retirement.

Uncredited

4. If you own a home and intend to have your mortgage paid off by retirement, subtract that monthly amount times 12 from your ongoing number. If that payment includes your real estate taxes, add back those taxes.

Read: Should I refinance my mortgage? Here’s how to decide

What is the dollar amount you are left with?

This number is the starting point of understanding how much you spend and estimating what you will spend annually in retirement. This post-tax number will be your initial guide to view your retirement assets and how long they will sustain you.

5. Now you can look at the income side by looking up your Social Security estimate by going to your personal account on SocialSecurity.gov. Verify the information on your income is correct. It will show you how much you can expect to collect when you stop working (anywhere from 62 to 70) and claim your benefits. In general, it is best to wait until 70 or at least the latest date possible. You get to make the choice.

Deduct your estimated annual Social Security income as well as any income you expect from a defined-benefit pension plan and/or annuity.

Read: 37 states don’t tax your Social Security benefits — make that 38 in 2022

6. What’s left is the ballpark figure of any income you still need to match today’s spending in retirement. Now you can look at whether what you’ve saved in your 401(k) or similar retirement plan is enough to cover the difference for the rest of your life. Talk to the financial firm handling your 401(k) plan for help in estimating how much you can collect annually or use an outside calculator like this one.

When you get closer to retirement, you may fine-tune the number based on more specific information about where you will live, exact costs of health insurance or other factors. For example, you may have a better idea of the state you will live in and your income. Then, you can add to your expenses a realistic estimate of your income taxes.

Read: There is more to picking a place to retire than low taxes — avoid these 5 expensive mistakes

For example, if you have $500,000 saved in retirement today and you want to retire next year at age 67, knowing you spend $20,000 a year beyond your Social Security income means you could retire comfortably according to the 4% rule. If you spend $50,000 plus your future Social Security income, you must either work several more years to have a sustainable retirement or reduce your spending.

Your spending habits are crucial to your overall goal of retiring comfortably with income to cover your expenses. They have the biggest impact on what you will be spending in retirement. The less you are spending, the more you can save. Redo this exercise every year to discover your expenses after taxes. As much as we like to say our spending is consistent, it is not. Or while many folks say, “we do not spend much,” most people are surprised when they see the number in black and white.

Retirement, like the rest of life, has no guarantees. But by following this approach, you will be heading into retirement with less stress and uncertainty. You may even put yourself on track able to retire sooner than you thought.

CD Moriarty is a Certified Financial Planner, a columnist for MarketWatch and a personal-finance speaker. She blogs at MoneyPeace. Email your questions to MsMoneyPeaceQuestions@MoneyPeace.com

More on retirement finances

Should you use a Monte Carlo simulation to determine if your retirement savings will last?

Trying to figure out how much to save for retirement? Good luck with that

Barron’s: There Are 4 Types of Spenders in Retirement, and ‘the 4% Rule’ Doesn’t Factor In Habit Changes