This post was originally published on this site

Getting a C-minus grade usually isn’t good news, but it promises to be just that for investors looking to capitalize on a boom in government spending on infrastructure.

The American Society of Civil Engineers assigned the U.S. an infrastructure grade of C-minus in its latest quadrennial report, a slight improvement from the previous D-plus rating.

The ASCE’s low grade for the U.S. underlines so many needs (you can read the 172-page report here), including bridge repair, road construction and maintenance, the continuing expansion and modernizing of the electric grid, and various water-quality initiatives.

Read: The U.S. needs to fill a hole this big, engineers say

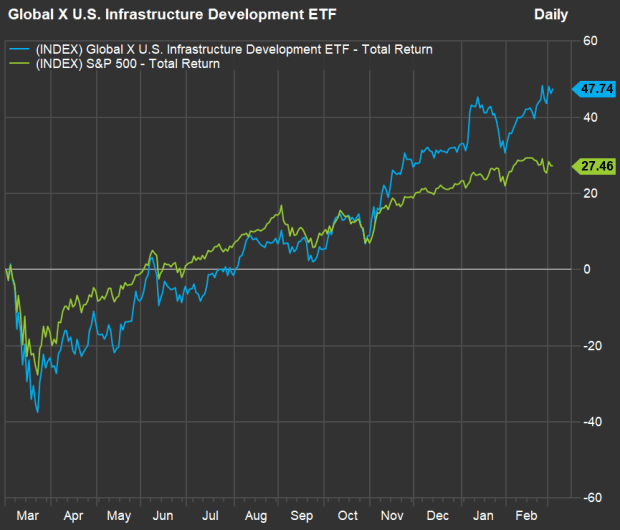

President Joe Biden has made it clear that once Congress passes another round of pandemic aid, he wants to move to a large infrastructure spending bill. Investors have already jumped on board, as you can see from this one-year chart comparing the performance of the Global X U.S. Infrastructure Development ETF PAVE, +2.94% to that of the S&P 500 SPX, +1.95% :

FactSet

PAVE holds 100 stocks, from small-cap to large-cap companies, that derive at least 50% of revenue from infrastructure construction, materials and equipment supply and related services in the U.S.

Unlike some infrastructure exchange-traded funds, PAVE doesn’t invest in utility companies. Half of the 100 stocks held by the iShares U.S. Infrastructure ETF IFRA, +3.08%, for example, are infrastructure asset owners and operators, including 20 electric utilities and four water utilities.

So PAVE might be your best way to take a broad approach at riding along with Biden’s infrastructure plan.

Then again, you might also be interested in the individual stocks held by the ETF.

Among the stocks held by PAVE, 73 are covered by at least five analysts polled by FactSet. Among that group, here are the 20 with majority “buy” or equivalent ratings that have the largest implied upside potential over the next 12 months based on consensus price targets:

Scroll the table to see all the data.

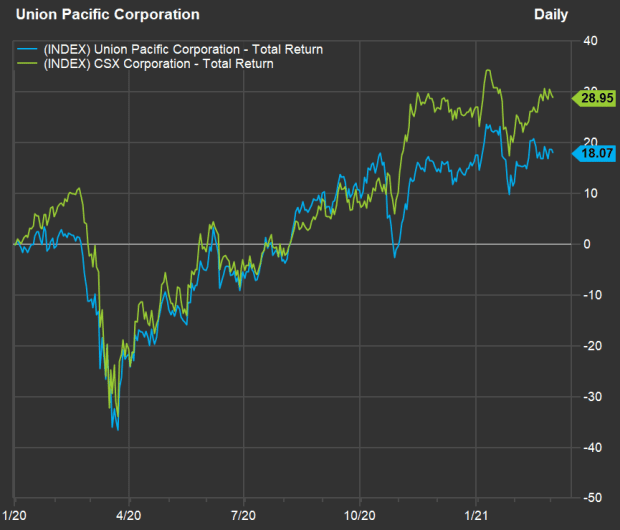

The largest companies on the list are railroad operators Union Pacific Corp. UNP, +4.29% and CSX Corp. CSX, +3.82%, both of which have surged this year:

FactSet

Analysts expect Union Pacific’s revenue to increase 7.6% in 2021 to $21.02 billion, while they expect CSX to see an 8.8% increase in revenue to $11.46 billion.

As always, if you see any stocks of interest, you need to do your own research to form your own opinion of companies’ long-term viability.

Don’t miss: These energy stocks could yield big gains while you’re getting paid high dividends