This post was originally published on this site

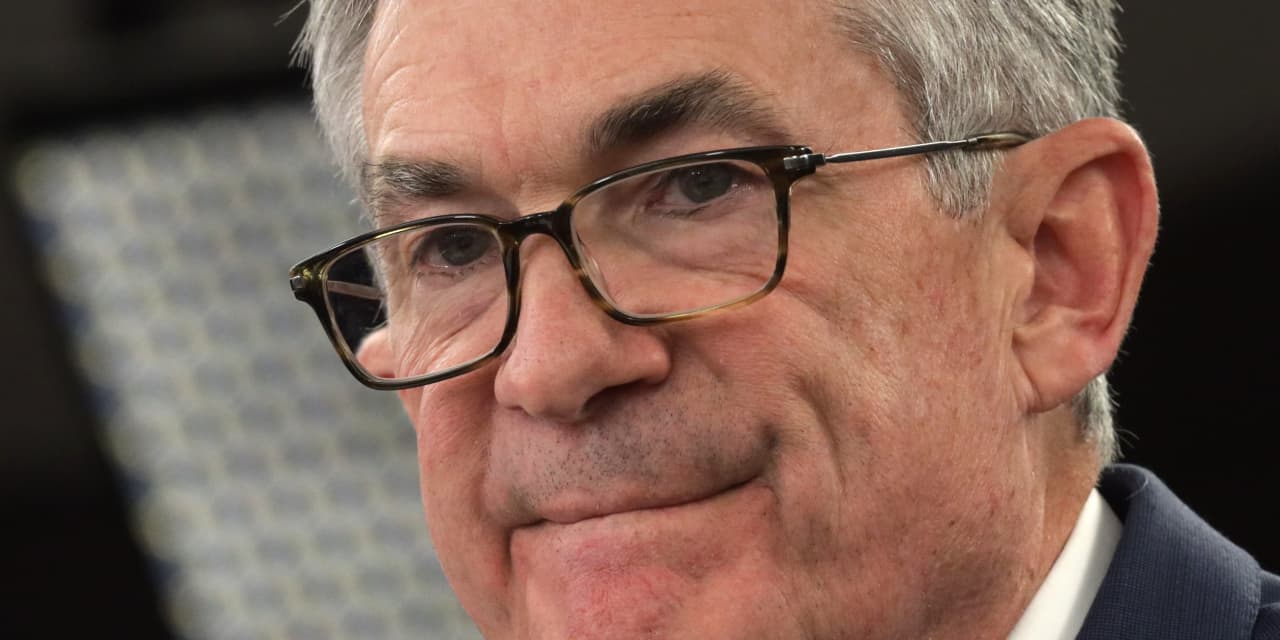

Federal Reserve Chairman Jerome Powell warned Thursday that the central bank would not sit back and let the financial market conditions tighten.

“I would be concerned by disorderly conditions in markets or persistent tightening in financial conditions that threatens the achievement of our goals,” Powell said during a Wall Street Journal webinar.

Powell stressed again that the Fed would be “patient” with higher inflation expected this year, saying it was likely to be a “one time” effect and not price gains that continue year-after-year.

Stocks were lower in choppy trade after Powell’s comments with the Dow Jones Industrial Average DJIA, -0.98% trading 101 points lower.

Yields on the 10-year Treasury note TMUBMUSD10Y, 1.533% rose 4 basis points to 1.529, around the highest level of the year. Yield have risen from under 1% this year.

Only last week, Powell welcomed rising long-term interest rates, saying they reflected confidence in the U.S. economic outlook.

Powell repeated that the Fed was a “long way” from its goals of maximum employment and stable 2% inflation.

Earlier this week, Fed Governor Lael Brainard was the first Fed official to express concern about rising bond yields.

Powell stressed a few times that he wasn’t watching one interest rate but was looking at financial conditions generally.