This post was originally published on this site

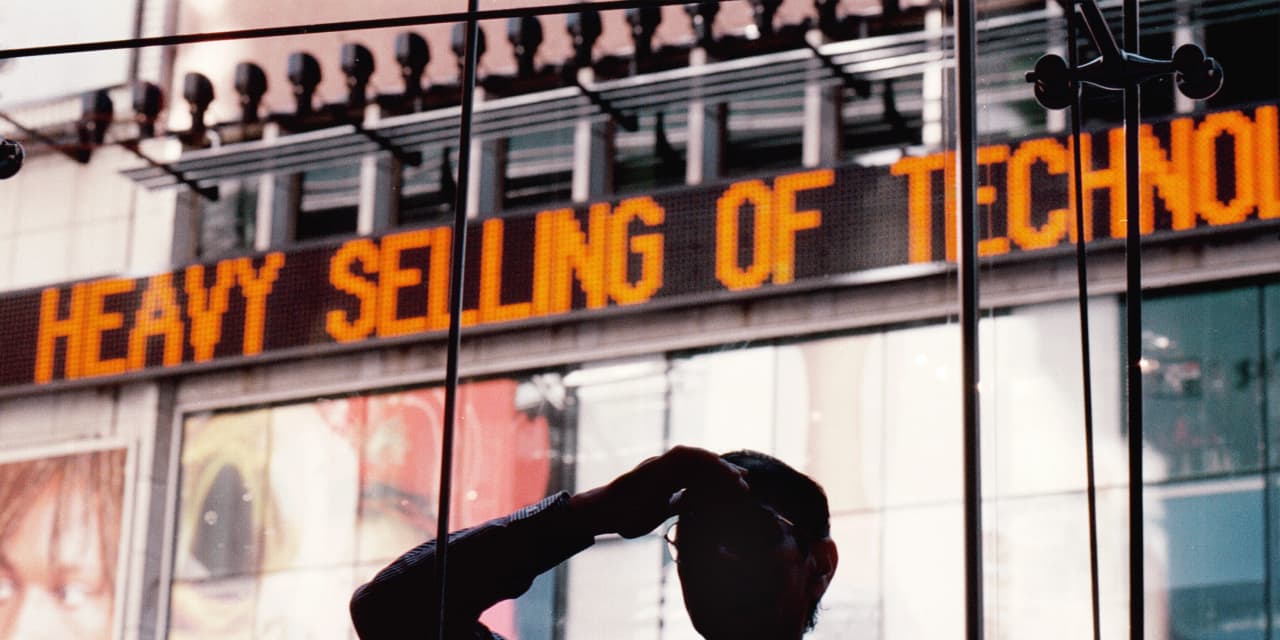

The Nasdaq Composite Index on Thursday was down nearly 10% from its recent peak, a move which is usually defined as market correction, reflecting a retreat from all-time highs for technology stocks as bond yields rise.

The technology-laden Nasdaq Composite COMP, -3.16% was down 9.75% Thursday afternoon after seeing a Feb 12 peak at 14,095.47.

The last time the Nasdaq Composite fell into a correction, defined as a fall from a recent peak of at least 10% but no more than 20%, was early September last year.

The slump in the Nasdaq reflects a rise in benchmark government debt yields that can make the tech-heavy look less attractive compared to fixed-income investments and other sectors of the stock market that have not done as well as the economy has begun to recover from the COVID pandemic. Tech stocks are particularly sensitive to rising bond yields because their value rests heavily on growth in future earnings which are discounted more deeply when bond yields go up.

On Thursday, comments from Federal Reserve Chairman Jerome Powell during a webinar hosted by The Wall Street Journal failed to placate fretful investors. Atlhough, Powell said that the central bank wouldn’t sit back and let the financial market conditions tighten, he seemed to refer to the moves as transitory.

“I would be concerned by disorderly conditions in markets or persistent tightening in financial conditions that threatens the achievement of our goals,” Powell said.

Yields on the 10-year Treasury note surged by around 7 basis points to 1.54, around the highest level of the year.

Investors are wagering that additional fiscal stimulus from Congress will boost the economic recovery in the U.S. but also push up inflation and force the Fed to raise interest rates sooner than they would prefer—an overall environment that is not felicitous for tech stocks.