This post was originally published on this site

ARK Investment, one of the fastest-growing fund managers in 2020, just saw its flagship company enter a bear market, highlighting a brisk selloff in growthy, technology-related stocks amid a persistent rise in interest rates.

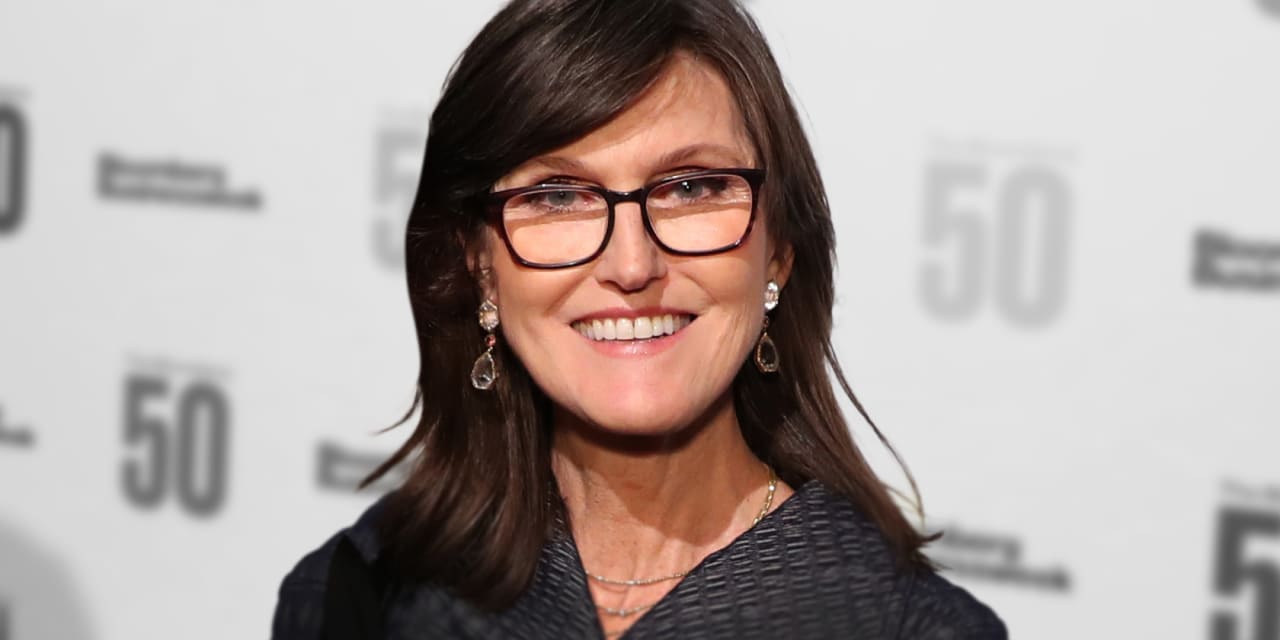

Led by the firm’s CEO and founder, Cathie Wood, the exchange-traded fund ARK Innovation ARKK, -6.29% fell 6.3% on Wednesday, leaving it down 20% from its peak at $156.58 put on Feb. 12, meeting the definition of a bear market commonly used by market technicians.

The ARK Innovation ETF boasts assets of $24.6 billion, but its focus on buzzy companies including Tesla Inc. TSLA, -4.84%, Square Inc. SQ, -7.14%, Teladoc Health Inc. TDOC, -6.76%, Zillow Group Z, -7.85% and Roku Inc. ROKU, -5.18% have proved a boon — and, of late, a bane — for the fund.

The decline for the fund comes as the Nasdaq Composite COMP, -2.70% tumbled 2.7% to register the worst two-day skid for the tech-laden index since Sept. 8, according to Dow Jones Market Data.

Investors have been eschewing tech in favor of so-called value stocks, those that are considered undervalued, against growth stocks, which have records of or prospects for outgrowing peers.

A rise in the 10-year Treasury note yield TMUBMUSD10Y, 1.486% to around 1.47% on Wednesday has underpinned the rotation out of tech and tech-related companies and into energy and financials, which are expected to perform better as the economy recovers from the COVID-19 pandemic.

Tech names are more vulnerable to a pullback in a higher-interest-rate regime because those stocks don’t tend to offer a yield and operate in areas considered overvalued by some measures.

Wood is known for targeting investments in growthy names and disruptive innovations. Over the past year, ARK has seen the assets in its seven exchange-traded funds explode more than tenfold.

But now investors are questioning how the highflying fund manager will respond to richer yields and a shift to underappreciated companies as vaccine rollouts and the expectation for COVID aid packages help drive bets to less-loved sectors of the market.

Wood told CNBC recently that she’s not perturbed by yields and is anticipating a pullback, vowing to double down on some bets, even as rates remain lofty, providing a “reality check” for her strategies. She reportedly upped her stake in Zoom Video Communications ZM, -8.37%, which has been a beneficiary of the work-from-home trend, of late.

See: Analysts say Zoom Video can continue to thrive in a vaccinated world

Reports also indicated that she’d bought more Tesla as the electric-vehicle maker’s shares slumped.

Ark Innovation’s shares are down 8.6% so far this week, hanging on to a less than 1% year-to-date gain. By comparison, the Dow Jones Industrial Average DJIA, -0.39% is up 2.2% so far in 2021, the S&P 500 index SPX, -1.31% is up 1.7% and the Nasdaq Composite Index COMP, -2.70% is up 0.8% after being hammered over the past few sessions.