This post was originally published on this site

An upbeat start to the week is under threat, as stocks wobble on Tuesday. Some are pointing to a top regulatory official in China who warned of bubbles forming in the U.S. and European markets and elsewhere.

Whether you’re unsettled or at ease, our call of the day, from Julien Bittel, multiasset fund manager at Pictet Asset Management, offers one-size fits all advice right now: diversify that portfolio.

Bittel’s concerns stem in part from what he sees as no bad news being priced in anywhere right now. “We feel given the speculative extremes going on currently that there could be a race to the exit kind of similar to what we witnessed in 1987, where you know the market can quickly fall 30%…over a couple of months,” he told MarketWatch in an interview.

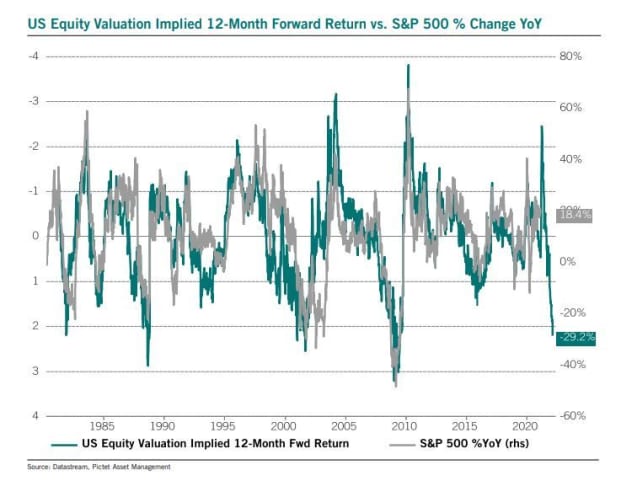

In a chartstorm, he walks through his view, starting with equity valuations, which he notes some brush aside on the view earnings “are about to explode higher.” His below chart encompasses a range of valuation metrics that have correlated closely with forward returns since the early 1980s.

“Now what you can see here is that at the current valuation extremes, this would suggest equity returns will be around minus 29% year on year, 12 months forward,” he said. Though by March, on an annual basis returns should be up around 55%.

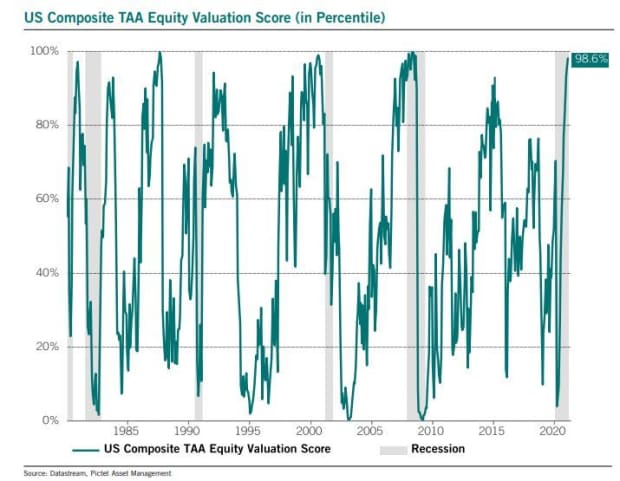

The next chart from Bittel shows a composite equity valuation score — currently in the 98th percentile. “So when it’s high, you know valuations are very expensive,” he said. Another way to look at it, “only 1.4% of the time over the last 40 years have equities been so expensive” based on this measure.

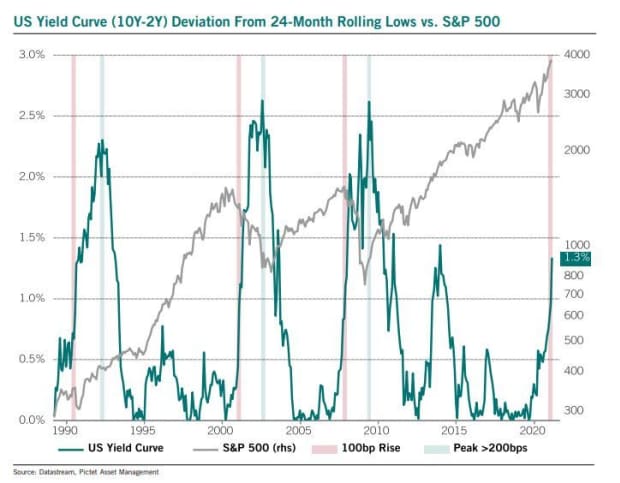

Rising bond yields, which have been roiling financial markets, are the topic of the next chart. “Here is the 10Y-2Y U.S. yield curve, it’s currently 130 basis points off curve inversion lows in August 2019,” said Bittel. An inversion refers to when longer-dated maturities yield less than shorter-dated ones.

The last three times this happened was in August 1990, February 2001 and November 2007, and “historically, this degree of steepening post yield curve inversion results in an inflection point for equity markets,” he said.

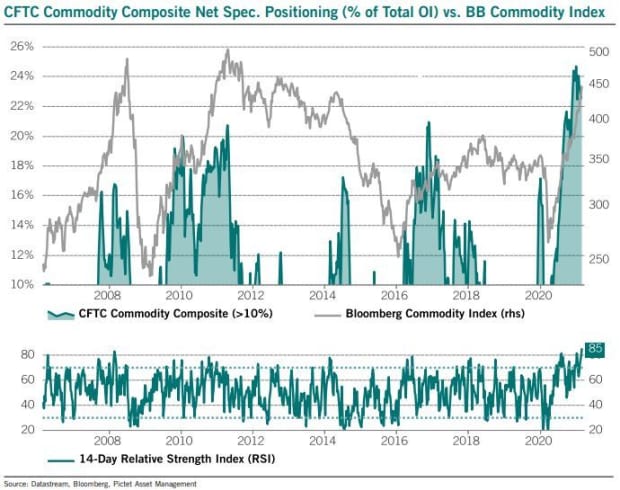

Squeezing in a couple more, the next shows commodities the most overbought since March 2008 (see 14-day relative strength index). For those assets to keep outperforming, the “dollar needs to weaken further and global growth momentum needs to surprise on the upside,” he said.

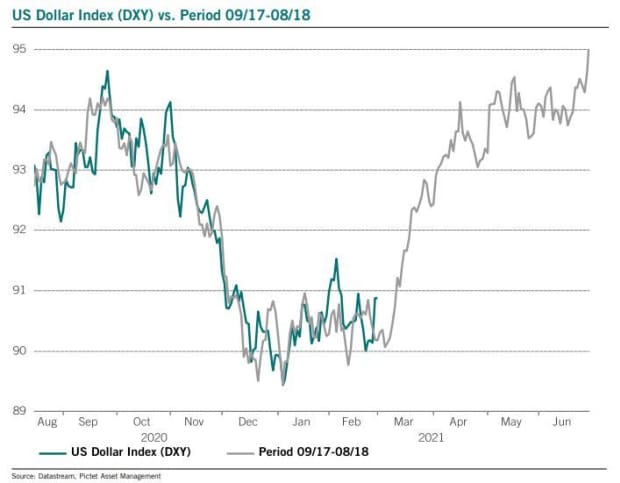

But he thinks a stronger dollar could be the big surprise for investors this year. The below chart tracks a late 2017 to 2018 analog and shows, “the train will officially leave the station in March.”

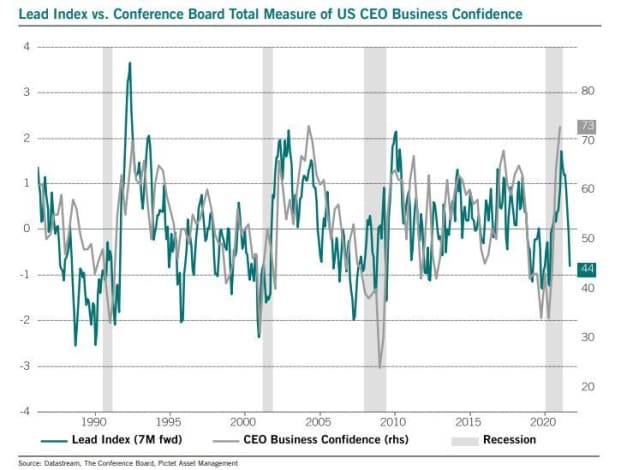

Finally, he’s worried about this chart showing company chief executive officers the most confident in 17 years. As in, they can’t get much more optimistic.

Two things he sees as likely that many investors don’t: a stronger dollar by the end of the second quarter and global growth momentum surprising on the downside in the second half of 2021. “The real blind spot for me is the impact this could have on the reflation trade,” he said.

Thus diversify is Bittel’s advice, via a multiasset product that offers up some equities and bonds, which will benefit in times of surprise growth but also hedge against the bad stuff happening.

The markets

Stocks DJIA, +0.01% SPX, -0.13% COMP, -0.77% are mixed after Monday’s bullish session. European stocks SXXP, +0.19% are up, while and Asian markets finished mostly lower, following that bubble warning from Guo Shuqing, head of the China Banking and Insurance Regulatory Commission. Oil prices CL00, -0.03% are lower, the dollar DXY, -0.31% is higher, and bitcoin BTCUSD, -2.28% prices are rising.

The buzz

Shares of retailer Target TGT, -5.20% are climbing after better-than-expected sales. In that same sector, shares of Kohl’s KSS, +1.40% are inching up after its results. Information technology group Hewlett Packard Enterprises HPE, -0.92% will report after the close.

Shares of Zoom ZM, -4.60% are surging, after the videocommunications group reported adjusted earnings nearly 10 times higher due to COVID-19 pandemic-related demand for its services.

All U.S. Apple AAPL, -1.44% stores are open for business, for the first time in nearly a year.

President Joe Biden is due to later Tuesday that Merck MRK, +0.73% will help make Johnson & Johnson’s JNJ, +0.04% one-shot COVID-19 vaccine in an rare agreement between competitors that could boost supply, the Washington Post reported Tuesday, citing unnamed senior administration officials.

A top World Health Organization official cautioned against declaring victory over the pandemic by the end of this year. That is as global coronavirus cases rose for the first time in seven weeks last week.

Random reads

Singer Taylor Swift is unhappy with Netflix’s NFLX, +0.37% “Ginny and Georgia.”

Two fruit, three vegetables daily = a longer life.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.