This post was originally published on this site

After a frenetic February, investors are probably hoping that March holds true to its proverb: In like a lion out like a lamb.

Indeed, February turned out to be a doozy, with benchmark bond yields, represented by the 10-year Treasury note TMUBMUSD10Y, 1.415% and the 30-year long bond TMUBMUSD10Y, 1.415%, ringing up their biggest monthly surges since 2016, according to Dow Jones Market Data.

The move was a stark reminder to investors that bonds, considered mundane and straight-laced by some investors, can wreak havoc on the market all the same.

A final flurry of trading, some $2.5 billion in sales near Friday’s close, created a major downside drag for stocks in the final few minutes of the session and may imply that there may be more air pockets ahead before the market steadies next week.

The Dow Jones Industrial Average DJIA, -1.50% and S&P 500 index SPX, -0.48% barely held above their 50-day moving averages, at 30,863.07 and 3,808.40, respectively, at Friday’s close.

‘An associated 10-20% sell-off in US equities would also focus minds. But before then, the pain currently being handed out to growth-tilted equity portfolios could get worse.’ Citigroup strategists

“The turmoil is probably not over,” wrote Independent market analyst Stephen Todd, who runs Todd Market Forecast, in a daily note.

Yet, for all the bellyaching about yields running hotter than expected, stocks in February still managed to bang out solid returns. For the month, the Dow finished up 3.2%, the S&P 500 notched a 2.6% gain in February, while the Nasdaq eked out a 0.9% return, despite a 4.9% weekly loss put in on Friday that marked the worst weekly skid since Oct.30.

Many have made the case that a selloff in the technology-heavy Nasdaq Composite was inevitable, especially with buzzy stocks like Tesla Inc. TSLA, -0.99% only getting frothier by some measures.

“But the market has been overbought and extended all year and arguably for several months in late-2020,” wrote Jeff Hirsch, editor of the Stock Trader’s Almanac, in a note dated Thursday.

“After the big run-up in the first half of February folks have been looking for an excuse to take profits,” he wrote, describing February as the weak link in what’s usually the best six-month period of gains for the stock market.

The beneficiaries of the recent move in yields so far appear to be banks, which are benefitting from a steeper yield curve as long dated Treasury yields rise, and the S&P 500 financials sector SP500.40, -1.97% XLF, -1.91% finished down 0.4%, which is, as it turns out, was the second-best weekly performance of the index’s 11 sectors behind energy SP500.10, -2.30%, which surged 4.3%.

Utilities SP500.55, -1.86% were the worst performer, down 5.1% on the week and consumer discretionary SP500.25, +0.58% was second-worst, off 4.9%.

In February, energy logged a 21.5% gain as crude oil prices rose, while financials rose 11.4% on the month, booking the best and second-best monthly performances.

So what’s in store for March?

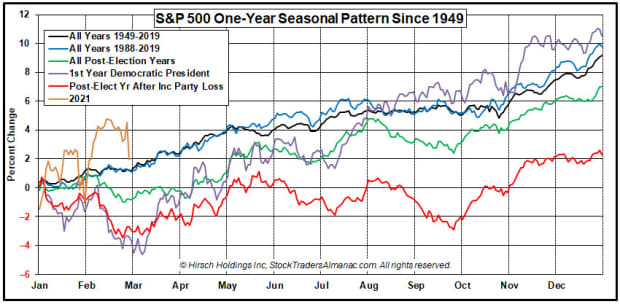

“Typical March trading comes in like a lion and out like a lamb with strength during the first few trading days followed by choppy to lower trading until mid-month when the market tends to rebound higher,” Hirsch writes.

March also sees “triple witching: occur on the third Friday, when stock options, stock-index futures and stock-index option contracts expire simultaneously.

Ultimately, seasonal trends suggest that March will be wobbly and could be used as an excuse for further selling, but on that downturn may be cathartic and give way to further gains in the spring.

“Further consolidation is likely in March, but we expect the market to find support shortly and subsequently challenge the recent highs again,” writes Hirsch, noting that April is statistically the best month of the year.

Stock Trader’s Almanac

Looking beyond seasonal trends, it isn’t certain how the rise in bond yields will play out and ultimately ripple through markets.

On Friday, the benchmark 10-year note closed at a yield of 1.459% based on 3 p.m. Eastern close, and hit an intraday peak at 1.558%, according to FactSet data. The dividend yield for S&P 500 companies in aggregate was at 1.5%, by comparison, while the Dow it is 2% and for the Nasdaq Composite is 0.7%.

As to the question of to what degree rising yields will pose a problem for equities, strategists at Citigroup make the case that yields are likely to continue to rise but the advance will be checked by the Federal Reserve at some point.

“It is unlikely that the Fed will let US real yields rise much above 0%, given high levels of public and private sector leverage,” analysts on Citi’s global strategy team wrote in a note dated Friday titled “Rising Real Yields: What to do.”

Real adjusted yields are typically associated with rates on Treasury inflation-protected securities, or TIPS, which compensate investors based on expectations for inflation.

Real yields have been running negative, which have been arguably encouraging risk taking but the coronavirus vaccine rollouts, with a Food and Drug Administration panel on Friday recommending approval for Johnson & Johnson’s JNJ, -2.64% one-jab vaccine and the prospects for further COVID aid from Congress, are raising the outlook for inflation.

Citi notes that the 10 year TIPS yields dropped below minus 1% as the Fed’s quantitative easing last year was kicked off to help ease stresses in financial markets created by the pandemic, but in the past few weeks the strategists note that TIPs had climbed to minus 0.6%.

Citi speculates that the Fed might not intervene to stem disruptions in the market until investors see more pain, with the 10-year potentially hitting 2% before alarm bells ring, which would bring real yields closer to 0%.

“An associated 10-20% sell-off in US equities would also focus minds. But before then, the pain currently being handed out to Growth-tilted equity portfolios could get worse,” the Citi analysts write.

Check out: Cracks in this multidecade relationship between stocks and bonds could roil Wall Street

Yikes!

The analysts don’t appear to be adopting a bearish posture per se but they do warn that a return to yields that are closer to the historically normal might be painful for investors heavily invested in growth stock names compared against assets, including energy and financials, that are considered value investments.

Meanwhile, markets will be looking for more clarity on the health of the labor market this coming Friday when nonfarm payrolls data for February are released. One big question about that key gauge of the health of U.S. employment, beyond how the market will react to good news in the face of rising yields, is the impact the colder than normal February weather have on the data.

In addition to jobs data, investors will be watching this week for manufacturing reports for February from the Institute for Supply Management and construction spending on Monday. Services sector data for the month are due on Wednesday, along with a private-sector payroll report from Automatic Data Processing.

Read: Current bond-market selloff worse than ‘taper tantrum’ in one key way, argues analyst

Also read: 3 reasons the rise in bond yields is gaining steam and rattling the stock market