This post was originally published on this site

Investing great Charlie Munger thinks the world would be better off without SPACs, saying this week that “this kind of crazy speculation” is a sign of an “irritating bubble.”

That’s a little harsh. SPACs have a lot of pitfalls, as I wrote about here.

But in the right hands, they offer an easier path to market than the traditional IPO route for solid companies. They can make for good investments. The key is you have to know how to separate the wheat from the chaff.

Here is a guide to what to look for in SPACs, or special purpose acquisition companies, which are known as blank-check companies that come public with the intention of merging real companies into them.

SPAC tactic No. 1: Look for winners in the mix.

The SPAC EOS Energy Enterprises Inc. EOSE, +10.84% nearly doubled in the month after I mentioned it in my stock letter, Brush Up on Stocks (the link is in the bio below) on Dec. 10, and it is still up around 44%. I liked it at the time because of buying by Bryant Riley of B. Riley Financial Inc. RILY, +11.05%, an insider I like to follow for my stock letter.

EOS Energy is probably more of a hold now, but here’s a new SPAC that looks attractive.

In biotech, I always like to take a close look at what Perceptive Advisors is doing, because like Riley, they have a good record. Perceptive is sponsoring a new biotech SPAC called ARYA Sciences Acquisition IV ARYD, +11.30%, their fourth. I don’t know what they will do with it. But given their record, the odds are good it will pay off for investors.

It’s also a bullish sign that this SPAC has top-tier investment banks handling the initial public offering (IPO), in Goldman Sachs Group Inc. GS, -2.53% and Jefferies Financial Group Inc. JEF, -0.72%.

SPAC tactic No. 2: Look for SPAC sponsors that have good records.

This is a variation on the tactic above, but here you focus on a specific track record just in SPACs. One that stands out is FS Development Corp. II FSII, -0.09%, led by health-care investors at Foresite Capital. Their prior health-care sector SPAC Gemini Therapeutics Inc. GMTX, +1.33% is up nearly 50% in three months. Gemini is developing a potential treatment for age-related macular degeneration (AMD).

Also consider Alpha Healthcare Acquisition Corp. AHAC, +0.96%, led by Rajiv Shukla. His prior biotech SPAC, DermTech Inc. DMTK, -6.23%, was recently up 640% from when it was launched in 2019. Shukla’s Alpha Healthcare is merging with Humacyte, which develops bioengineered human tissues and organs that may not trigger rejection by the bodies of recipients. Its first products may be used in heart bypass surgery, pediatric heart surgery, and type 1 diabetes.

AHAC popped above $14 in February, but it’s now down close to $12. Alpha Healthcare will soon trade under the ticker HUMA.

That Perceptive Advisors SPAC ARYA Sciences Acquisition IV that I mentioned above also fits in here. Perceptive’s record in SPACs? Its Arya Sciences Acquisition Corp. III ARYA, -1.57% is up 60% to $16 after trading in the $10-$11 range for the second half of last year. This one is merging with a company called Nautilus that’s developing a platform that can better analyze proteins in the body. This should help researchers better understand diseases and potential therapies for them. Arya Sciences Acquisition Corp III will be changing its ticker to NAUT.

SPAC tactic No. 3: Favor SPACs sponsored by professional investors who manage a lot of money.

In their research paper “A Sober Look at SPACs,” SPAC experts Michael Klausner, Michael Ohlrogge and Emily Ruan at Stanford University and New York University School of Law define “quality” SPACs as those sponsored by investors who manage a lot of money. Their cut off is $1 billion, but any sizeable investment shop fits the bill. The assumption is that if sponsors have attracted a lot of money, they probably have a good investing track record and a respectable level of expertise in investing.

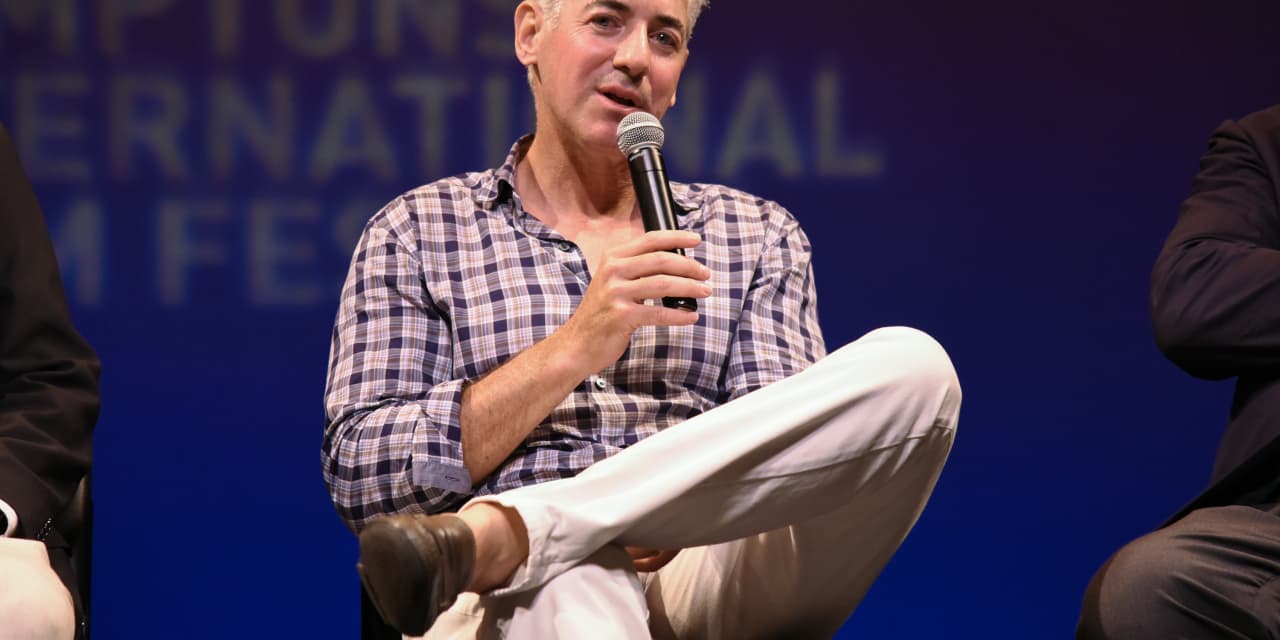

One example here is Pershing Square Tontine Holdings Ltd. PSTH, +1.66%, set up by Bill Ackman at Pershing Square, a huge investment fund that has made a lot of good calls over the years. Another is 23andMe coming public through VG Acquisition Corp. VGAC, +2.15%. It is being set up by Virgin Group’s Richard Branson.

SPAC tactic No. 4: Favor SPACs managed by former CEOs or top executives at successful companies.

The SPAC experts from Stanford and NYU mentioned above also define “quality” SPACs as those led by former CEOs or top executives at big companies.

A good example here is the telecom and tech SPAC Colicity Inc. COLIU, -0.96%. Colicity is led by Craig McCaw, from the telecom companies McCaw Cellular Communications, Nextel Communications and Clearwire. Colicity also scores well for the sponsor track record tactic, since another McCaw telecom and tech SPAC, Holicity Inc. HOL, -4.12%, is up over 60% from the $10 range it traded at during November-January.

Another one that checks the box here is Social Capital Hedosophia Holdings Corp. IV IPOD, -1.20%, set up by Chamath Palihapitiya, a former top exec at Facebook Inc. FB, +1.15%.

SPAC tactic No. 5: Dodge the flood of warrant dilution.

As I mentioned in my column on hidden risks in SPACs, an important problem with SPACs is that initial investors, such as hedge funds and Wall Street insiders, can get one warrant for each share they buy on the IPO. That creates big dilution if the stock does well. Warrants are a right to buy a share at a preset price — typically $11.50 for SPACs that come public at $10. When people exercise warrants, new shares are created, which means lots of dilution for other shareholders.

The simple way around this is to avoid SPACs that offer a warrant for each share in a 1:1 ratio. Not only do you avoid dilution, but to me, the use of few or zero warrants is a bullish investing signal. It suggests the SPAC sponsors have a decent reputation since they didn’t have to stretch to attract investors — by offering all those free warrants.

An example here is the telecom and tech SPAC Colicity mentioned above. It offered one-fifth a warrant exercisable at $11.50 when it launched its IPO this week, instead of one warrant per share of stock. Another one called FinTech Acquisition VI, which filed on Wednesday, offers one-fourth of a warrant exercisable at $11.50. (It will trade under the ticker FTVIU.)

Better yet, just go with SPACs that offer zero warrants. Two examples, already mentioned above because they checked the boxes for other tactics, are Foresite Capital’s FS Development Corp II and Perceptive Advisors’ SPAC ARYA Sciences Acquisition IV.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned EOSE and RILY. Brush has suggested EOSE RILY GS JEF FB in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.