This post was originally published on this site

Shares of Velodyne Lidar Inc. fell Friday after a wider-than-expected fourth-quarter loss, as the lidar sensor maker continued to lower prices to entice new customers.

The company reported late Thursday a net loss that widened to $111.5 million, 64 cents a share, from $27.7 million, or 21 cents a share, in the year-ago period.

Excluding nonrecurring items, such as stock-based compensation, the adjusted loss per share narrowed to 12 cents from 19 cents, but was wider than the FactSet consensus for a per-share loss of 11 cents.

Shares of the company VLDR, -10.44%, which bills itself as the “first public pure-play lidar company,” dropped 1.8% in premarket trading.

“Velodyne continues to focus on accelerating the adoption of sensors by lowering [average selling prices] and driving higher volumes,” the company stated. “As such, product units sold was higher year-over-year while revenue was impacted.

Revenue fell 5.9% to $17.85 million, but topped the FactSet consensus of $16.1 million, as a record 4,237 sensor units were shipped.

Product revenue declined 20.8% to $14.4 million, while license and services revenue soared more than fourfold to $3.4 million from $782,000.

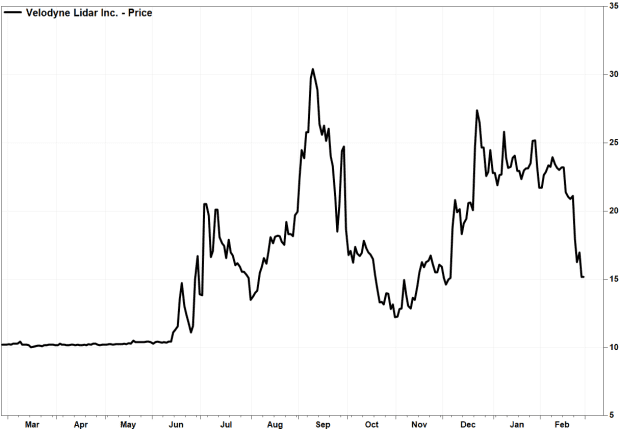

The stock has been on a roller-coaster ride since mid-2020. It nearly tripled in about three months to a record close of $30.43 on Sept. 9, then plunged 60% to $12.23 on Oct. 30. The stock then more than doubled to close at $27.38 on Dec. 22, before tumbling 44% from there through Thursday’s close of $15.19.

FactSet

Analyst Ruben Roy at Benchmark reiterated his buy rating, but cut his stock price target to $25 from $32. That target implied a 65% gain off Thursday’s close.

“We continue to view [Velodyne’s] longer-term opportunity positively despite ongoing COVID-related disruptions, as well as various customer-specific dynamics which are likely to limit near-term share price upside,” Roy wrote in a note to clients. “While we expect the issues related to manufacturing disruptions to persist during the first half of 2021, we expect a return to more normalized revenue run rates during the 2nd-half of the year.”

Velodyne said it estimates an opportunity for over $1.0 billion in revenue from signed and awarded projects from this year through 2025. The company also estimates a pipeline of projects through 2025 valued at $4.4 billion, that aren’t yet signed and awarded.

“[I]t is an incredibly exciting time for lidar and for Velodyne. We believe we have hit an inflection point in the lidar industry, which is evidencing itself by our record unit shipments in the fourth quarter and in our expanding pipeline,” said Chief Executive Anand Gopalan. “With a significantly enhanced balance sheet supporting this robust pipeline, our long-term outlook for growth remains strong.”

The stock has rallied 48.5% over the past 12 months through Thursday, while the S&P 500 index SPX, -2.45% has gained 22.9%.