This post was originally published on this site

GameStop Corp.’s stock appeared relaxed at the start of trading Friday compared with recent days, flipped between gains and losses during the session, and closed for their second best week of what has been a tumultuous year.

GameStop GME, -6.43% shares, which traded as much as 31% above and 21% below Thursday’s closing price, finished Friday down 6.4% at $101.74, for a gain of just over a 150% on the week. While that would be a hands-down record for many stocks, it falls short of GameStop’s record 400% weekly gain for the week ending Jan. 29.

In the first hour of Friday trading, more than 23 million shares had exchanged hands — tame compared with Thursday’s open and Wednesday’s close when trading volume shot through an already high roof. Trading volume pushed past 90 million shares following Friday’s close. The stock has an average daily volume of 33.1 million shares over the past 10 days, and 13.6 million shares over the past 52 weeks, according to FactSet data.

In comparison, the S&P 500 index SPX, -0.48% finished down 2.4% this week.

The stock’s notoriety in 2021 stems from a clash between tenacious retail investors called to arms through Reddit’s WallStreetBets forum and Wall Street firms that have bet against the videogame retailer to make it one of the most heavily shorted ever.

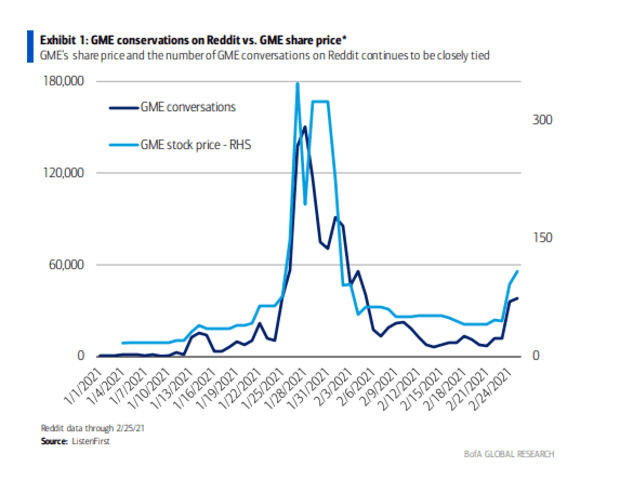

In a Friday note, B. of A. Securities analyst Curtis Nagle said there appeared to be a “very tight correlation between the number of conversations on Reddit related to GME and trading on platforms such as Robinhood as well as overall share volumes.”

“The most recent data suggest that retail investors seemingly are again driving GME shares,” Nagle said. “However, one distinction from the spike roughly a month ago is it appears that short covering is much less of a factor.”

Read: GameStop’s 104% jump on Wednesday led to a trading halt — here’s how the internet reacted

Meanwhile, other stocks that have been swept up in the clash took a back seat to GameStop.

AMC Entertainment Holdings Inc. AMC, -3.38% shares finished down 3.4%, for a 40.5% weekly gain. BlackBerry Ltd. BB, -5.01% fell 5%, for a 7.8% weekly decline. Naked Brand Group Ltd. NAKD, -8.77% shares fell 8.8% and are down nearly 15% for the week. Meanwhile, Koss Corp. KOSS, -22.39% shares dropped 22% Friday, for a 19% gain on the week.