This post was originally published on this site

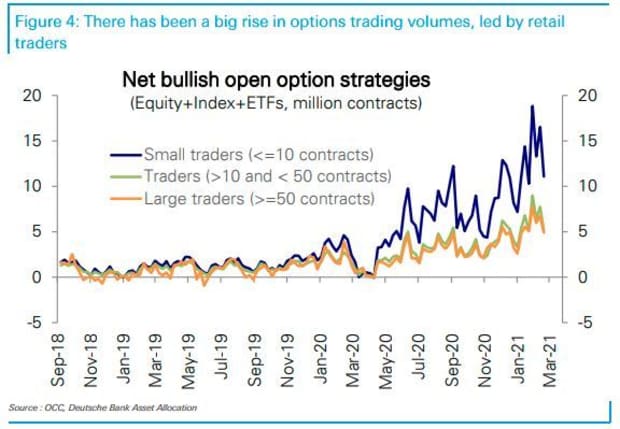

Driving the stock market from pandemic lows, a new crop of younger, aggressive retail investors are poised to place more bets on equities, including any future stimulus checks.

“With potential direct stimulus payments of $465 billion being planned, this

could represent a sizable inflow into equities ($170 billion),” said Deutsche Bank strategists Parag Thatte, Srineel Jalagani and Binky Chadha, in a note to clients on Wednesday.

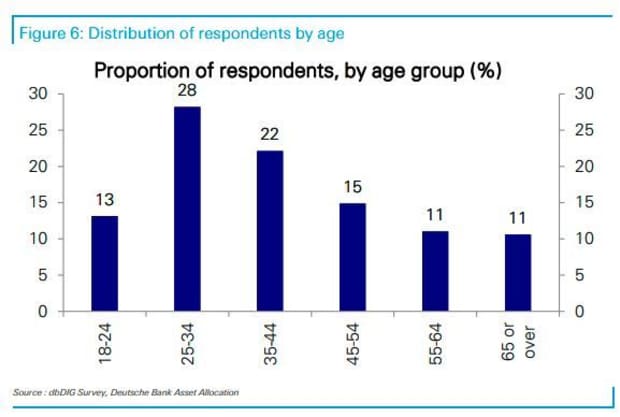

The strategists released a wide-ranging survey offering a glimpse into a fresh wave of stock market investors they credit for helping the S&P 500 SPX, -0.73% rally some 75% from last March’s COVID-19 pandemic lows. They surveyed 430 U.S. users of online broker platforms between Feb. 5 and 9 of this year, revealing 61% were under 34 years of age.

As for that possible big inflow of fresh money to stocks, 37% of respondents say they plan to use any future stimulus checks for that purpose. That is even as only a small part of stimulus funds were spent last year on stocks, as many made use of cash savings, reductions on spending, and rotations out of other assets classes.

Read: Individual investors are back — here’s what it means for the stock market

According to data from Barclays Bank, some $178.5 billion has already poured into global equities year to date. That is as Deutsche Bank revealed that this new wave of investors appears to be less fearful and even more savvy that past groups.

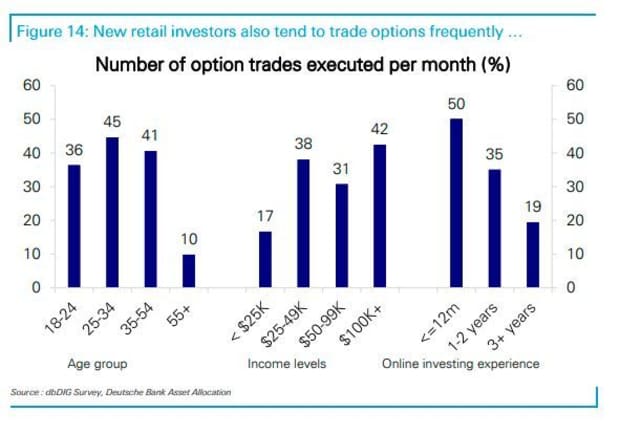

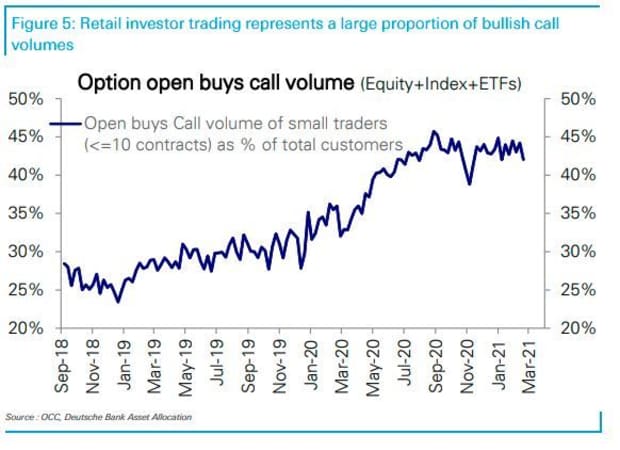

“The group of new individual investors exhibits several characteristics which are markedly different from those that have been trading for longer, and in particular show greater use of leverage, option trading and reliance on social media for investment advice,” said the Deutsche Bank team.

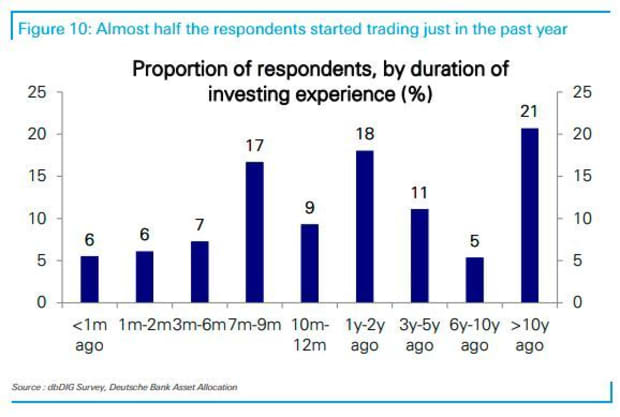

More than 50% frequently used options, with the same amount trading more than 10 times a month versus those with more than two years of experience — 19%. In addition, 26% say they have used some sort of leverage or borrowing to buy stocks, versus just 9% among those who have been investing one to two years. That number drops to 3% for even more seasoned investors.

Providing proof of just how new many of these traders are to stocks, 45% reported to be investing for the first time over the past year, and more than half increased their stock investments over the past year.

Behind the surge

The survey comes as the GameStop GME, +41.32% saga threatens to reboot. The videogames retailer and other stocks like movie-theater chain AMC AMC, +10.32% made headlines earlier this year, with huge stock-price swings that at times disrupted markets. They were driven, in part, by the WallStreetBets Reddit forum. GameStop jumped over 100% on Wednesday.

That January episode fueled views that the traders who jumped into GameStop and other popular names were undisciplined younger traders who made risky bets. But Vlad Tenev, the chief executive of the popular trading platform Robinhood, countered that recently, as he told a congressional hearing that most of their customers were investing for the long term.

So why pour more into stocks now, with some on Wall Street fretting over a market that seems unstoppable and possibly more volatile as a pandemic recovery inches forward?

Some 42% of respondents believe stocks offer good return on investment, while 35% say they had more cash to spend, and 38% cite more time to research and trade. The relative ease of trading from homes, with many locked down over the past year, was cited by 35%, while 28% said commission-free trades were key.

As for the look ahead, the vibe seems positive, as 62% believe stocks are currently a good investment, with just 25% neutral. “This positive take is widespread across all age and income groups, and regardless of when the investor began trading,” said the strategists.

Over the next three months, 53% expect stocks will keep rising, while over the next year, 68% have that rosy view. When asked what they would do in the case of a market selloff, new investors said they would reinvest unless any selloff reached 10%, in which case they would pull money out.

And as the economy reopens, younger respondents said they would maintain or keep adding to their stockholdings. “We note that this contrasts with respondents…saying they have had more time to research and trade and the ease of trading at home.”

The bank said the results were “broadly representative based on the U.S. Census for this population across gender, age, income, region, and race/ethnicity.” By age group, 41% of respondents were under 34, while 37% were in 34 to 54, with a smaller group in the over 55 range. Those earning $50,000 to $100,000 represented 34% of respondents, in line with the U.S. median of $69,000. Some 59% were employed full time, while 7% were part-time and 7% were self-employed or business owners.

Read: Here’s how every major asset has performed since the start of stock market’s COVID meltdown