This post was originally published on this site

The recent rise of bitcoin toward all-time highs is creating millionaires, on paper, at a fairly rapid clip, according to data from BitInfoCharts.

At last check, bitcoin was trading up by over 6.5% on CoinDesk BTCUSD, +2.02% at $49.141.23. But even with the asset down by about 12% for the week after a jaunt to a record high at $58,332.36 over the weekend, the digital currency’s ascent is helping mint a round of crypto millionaires.

Read: #LaserEyes meme campaign goes viral on Twitter in apparent bid to double bitcoin price to $100,000

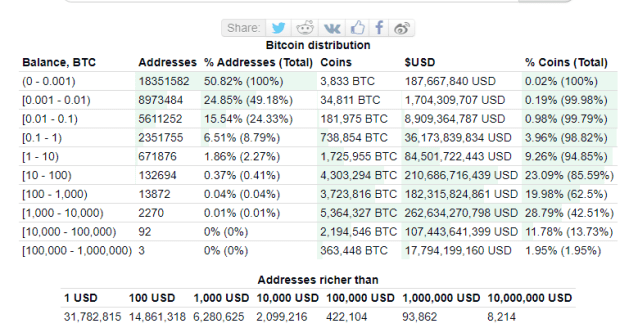

There are 93,862 accounts holding bitcoins worth at least $1 million and there are 8,214 that own bitcoins valued at more than $10 million, according to BitInfoCharts, as of Wednesday afternoon.

via BitInfoCharts.com

That is 102,076 bitcoin accounts that can call themselves diamond hands, in the parlance of Redditors who refer to investment outperformance in that way.

Read: Don’t fight the FUD: HODL onto this list of bitcoin terms you need in your vocabulary

Also, 422,104 accounts can boast bitcoin accounts valued at more than $100,000, the data show.

It is impossible to know where values for the crpyto asset created in 2009 are headed and whether a crypto winter, similar to the one that ensued after bitcoin surged to near $20,000 back in late 2017 only to slip to around $3,000 will take hold, but bitcoin’s climb has been widely attributed to greater institutional ownership.

Bitcoin’s price surpassed $50,000 this month after Tesla announced a $1.5 billion bitcoin investment. The leading cryptocurrency wasn’t finding lasting support from the campaign, with its price having fallen below the $50,000 mark in Tuesday action.

Still, bitcoin’s price is up nearly 70% so far in 2021. By comparison, gold GC00, -0.24%, bitcoin’s closest traditional rival asset, is down 5%. The Dow Jones Industrial Average DJIA, +1.35% and the S&P 500 index SPX, +1.14% are both up around 4.5% thus far this year, while the Nasdaq Composite Index COMP, +0.99% has gained 5.3% over the same period.

Last Friday, bitcoin hit a market cap above $1 trillion, a momentous occasion with a new crop of players dipping their toes into cryptos, including PayPal Holdings Inc. PYPL, which back in November opened up its cryptocurrency platform to all U.S. customers after conducting a more narrow rollout.

Meanwhile, a number of high-profile Wall Street investors, including Stanley Druckenmiller and Paul Tudor Jones, have embraced bitcoin. Famed investor Bill Miller, founder of Miller Value Partners, in a letter to clients earlier this month published on the firm’s website, reaffirmed his bullish outlook on bitcoin.

To be sure, investing in cryptos requires a steely constitution. Over the past 12 months bitcoin has registered 8 corrections, defined as a decline from a recent peak of at least 10% but not more than 20%, and two bear markets, which are defined as falls of 20% or more, according to Dow Jones Market Data.

By comparison, the S&P 500 and the Dow have had one correction that then fell further into a bear market over the past year.

On top of that, bitcoin and other cryptos are viewed as highly speculative and assets that could be written out of existence by stern global regulation.

That said, momentum has been on the side of bitcoin enthusiasts in recent days and even comments from regulators are peppered with references to the utility of digital assets and the blockchain technology that underpins most.