This post was originally published on this site

There’s a “nuanced” but “real” connection between posts about Tesla Inc. on a popular social-media forum and the electric-car maker’s stock returns, analysts at Barclays said in a note Tuesday.

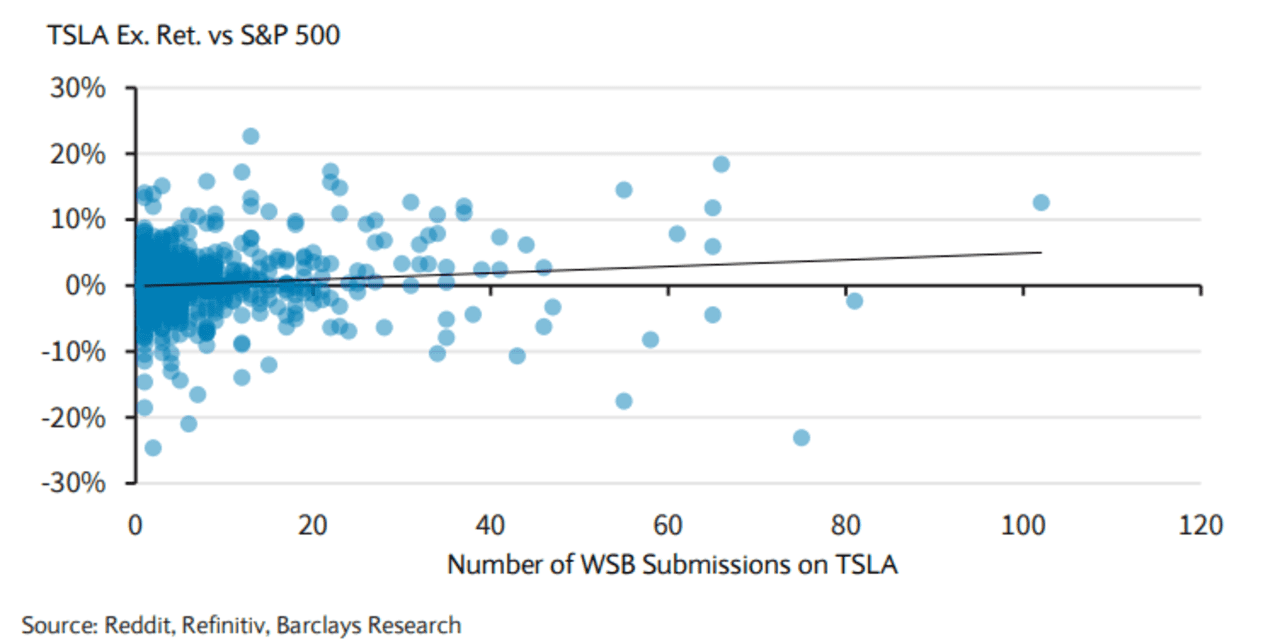

“Big upticks” in Tesla TSLA, -3.85% mentions on Reddit’s WallStreetBets (WSB) “have been predictive of stock returns a few days later,” according to the analysts, led by Ryan Preclaw and Brian Johnson.

Tesla is viewed by many investors as one of the original “meme stocks,” in the view of some driven not so much by the familiar financial acronyms that underscore stock fundamentals but FOMO, YOLO, and others, which is to say “fear of missing out” and “you only live once” applied to investment decisions.

Stocks of companies such as GameStop Corp. GME, -2.61%, AMC Entertainment Holdings Inc. AMC, +17.23% and other meme stocks boosted on WallStreetBets skyrocketed earlier this year, roiling the stock market and leading to congressional hearings and reportedly a securities probe.

Read also: Tesla stock’s drop likely related to bitcoin bet

The Barclays analysts found a “statistically significant” relationship between the number of returns and the absolute number of posts on the Reddit forum one and two days earlier, they said.

But that autocorrelation in the posts “also means that the measures of significance are less reliable than we would prefer to depend on,” they said.

They cautioned, however, that the situation has been “so dynamic that there are simply too few examples to be confident of a stable process between WSB posts and TSLA returns.”

And the old adage in prospectus and financial information everywhere appears to hold true in this case, regardless of meme power.

“Even more than usual, past results might not predict future performance,” the analysts said.