This post was originally published on this site

Rising Treasury yields have contributed to a selloff by the stock market’s pandemic high-fliers, but probably won’t be enough to spoil the appeal of stocks over bonds in 2021, according to one analyst.

U.S. equity investors “have become focused on the recent increase in 10-year Treasury yields over the past week, which are all the way back to mid-February 2020 levels,” wrote Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, in a Tuesday note. Yields and bond prices have an inverse relationship.

The 10-year Treasury yield TMUBMUSD10Y, 1.349% is coming off its largest rise in six weeks, which has been blamed for sparking a pullback led by tech-oriented stocks that had benefited most from the stay-at-home dynamic created by the COVID-19 pandemic.

Related: Can the bull market in stocks survive rising inflation, bond yields? Here’s what history says

The relationship was on display in reverse Tuesday as the rise in yields relented following testimony by Federal Reserve Chairman Jerome Powell, allowing major benchmarks to erase or trim significant losses. The tech-heavy Nasdaq Composite COMP, -0.50%, which has led the way lower, trimmed a loss of nearly 4% to end down 0.5% as yields declined; the S&P 500 SPX, +0.13% eked out a gain to snap a five-day losing streak, while the more cyclically oriented Dow Jones Industrial Average DJIA, +0.05% erased a loss of more than 360 points to end slightly higher.

Meanwhile, Calvasina said a look at what stocks are offering in terms of dividend and earnings yield relative to bonds, as well as a reminder of what sort of bond moves have spelled trouble for equities, offers some reassurance that 2021 is unlikely to turn into a down year, she said.

Dividend yield

When it comes to dividend yield, RBC measured the percentage of companies that continue to exceed the 10-year Treasury yield. While that has fallen to 51.5% from 64% at the beginning of the year, it’s still within a range typically followed by a 17% gain for the S&P 500 over the following 12 months, she said.

Earnings yield

The S&P 500’s earnings yield has also deteriorated, moving to the low end of the range in place since the end of the financial crisis. It now stands near the level seen in 2017-’18, but remains in a range that’s been followed by 9.3% average gains by the S&P 500 over the next 12 months, Calvasina said.

“In other words, this analysis is acknowledging the case for a short-term pullback in the S&P 500, but isn’t necessarily signaling that longer-term investors should head for the exit,” she wrote.

Calvasina also highlighted an “important difference” between 2018, when the trade war posed a threat to the U.S. and global economies, and now, when gross domestic product forecasts are rising rapidly.

Treasury yields and stocks

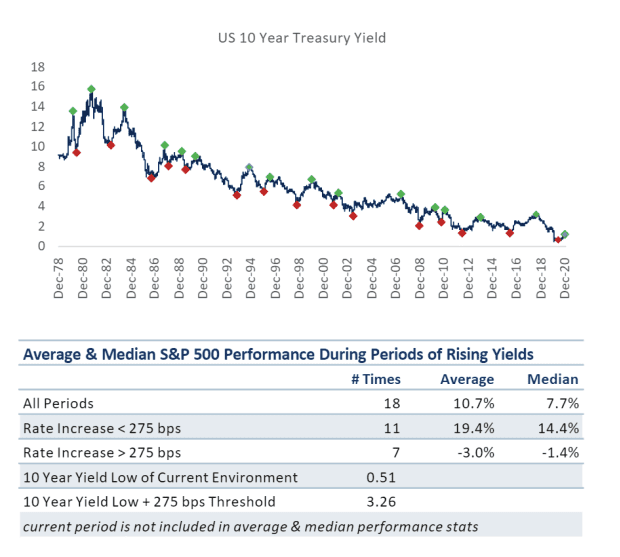

Finally, what about the rise in Treasury yields itself? After all, many market watchers have argued that while yields remain low by historical standards, it’s the size of the rise that may be most concerning for equities. Calvasina broke down the relationship between yield moves and stock-market performance in the chart below:

RBC Capital Markets

Calvasina said U.S. equities have tended to struggle when the 10-year yield rises more than 275 basis points, or 2.75 percentage points. Coming off its low of 0.51%, a 275-basis-point move would take the yield to around 3.26%. The 10-year ended Tuesday at 1.363%.